Google 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

PART II

ITEM7.Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations

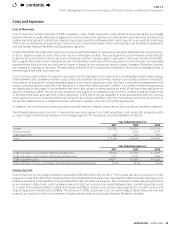

Stock-Based Compensation

Thefollowingtablepresentsourstock-basedcompensationfortheperiodspresented(dollarsinmillions):

Year Ended December31,

2011 2012 2013

Stock-basedcompensation(1) (2) $ 1,974 $ 2,523 $3,247

(1) These amounts are included in the previously discussed sections above, as unallocated items related to cost of revenues, research and

development,salesandmarketing,andgeneralandadministrativeexpenses.

(2) Stock-basedcompensationexpensesof$126millionand$21millionareincludedin“restructuringandrelatedcharges”abovefortheyears

endedDecember31,2012and2013.

Stock-basedcompensationincreased$724millionfrom2012to2013andasapercentageofconsolidatedrevenuesremained

atfrom2012to2013.Thisincreaseinexpenseswasprimarilyduetoanincreaseinheadcounttosupportourgrowingbusiness.

Stock-basedcompensationincreased$549millionfrom2011to2012andasapercentageofconsolidatedrevenuesremainedat

from2011to2012.Thisincreaseinexpenseswasprimarilyduetoadditionalstockawardsissuedtoexistingandnewemployees,

aswellasawardsissuedinconnectionwiththeacquisitionofMotorola.

Stock-basedcompensationexpensefortheMotorolaHomesegmentwasincludedinnetincome(loss)fromdiscontinuedoperations.

Weestimatestock-basedcompensationrelatedtoawardsgrantedthroughDecember31,2013tobeapproximately$3.1billion

in2014and$3.2billionthereafter.Thisestimatedoesnotincludeexpensestoberecognizedrelatedtoemployeestockawards

thataregrantedafterDecember31,2013ornon-employeestockawardsthathavebeenormaybegranted.Inaddition,tothe

extentforfeitureratesaredierentfromwhatwehaveanticipated,stock-basedcompensationrelatedtotheseawardswillbe

dierentfromourexpectations.

Interest and Other Income, Net

Interestandotherincome,net,decreased$96millionfrom2012to2013.Thisdecreasewasprimarilydrivenbyadecreaseinthe

gainondivestitureofbusinesses(otherthanMotorolaHome)of$245millionandadecreaseintherealizedgainoninvestments

of$81million,partiallyosetbyadecreaseinforeigncurrencyexchangelossof$152millionandanincreaseininterestincome

of$72million.

Interestandotherincome,net,increased$42millionfrom2011to2012.Thisincreasewasprimarilydrivenbyagainondivestiture

ofbusinessof$188millionin2012,animpairmentchargerelatedtoequityinvestmentsof$110millionin2011,partiallyoset

byanincreaseinforeigncurrencyexchangelossof$152millionandadecreaseininterestincomeof$99million.

Thecostsofourforeignexchangehedgingactivitiesthatwerecognizedtointerestandotherincome,net,areprimarilyafunction

of the notional amount of the option and forward contracts and their related duration, the movement of the foreign exchange

ratesrelativetothestrikepricesofthecontracts,aswellasthevolatilityoftheforeignexchangerates.

As we expand our international business, we believe costs related to hedging activities under our foreign exchange risk management

programmayincreaseindollaramountin2014andfutureperiods.

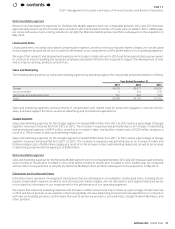

Provision for Income Taxes

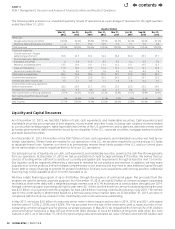

Thefollowingtablepresentsourprovisionforincometaxes,andeectivetaxratefortheperiodspresented(dollarsinmillions):

Year Ended December31,

2011 2012 2013

Provision for income taxes $2,589 $2,598 $2,282

Eectivetaxrate 21.0% 19.4% 15.7%

ThefederalresearchanddevelopmentcreditexpiredonDecember31,2011.OnJanuary2,2013,theAmericanTaxpayerReliefAct

of2012wassignedintolaw.Underthisact,thefederalresearchanddevelopmentcreditwasretroactivelyextendedforamounts

paidorincurredafterDecember31,2011andbeforeJanuary1,2014.Theeectsofthesechangesinthetaxlawhaveresulted

inataxbenetwhichwasrecognizedintherstquarterof2013,thequarterinwhichthelawwasenacted.

contents