Google 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOOGLE INC.

PART II

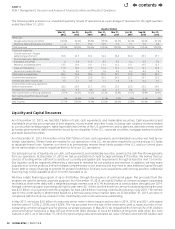

ITEM7.Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations

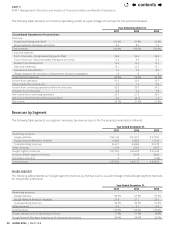

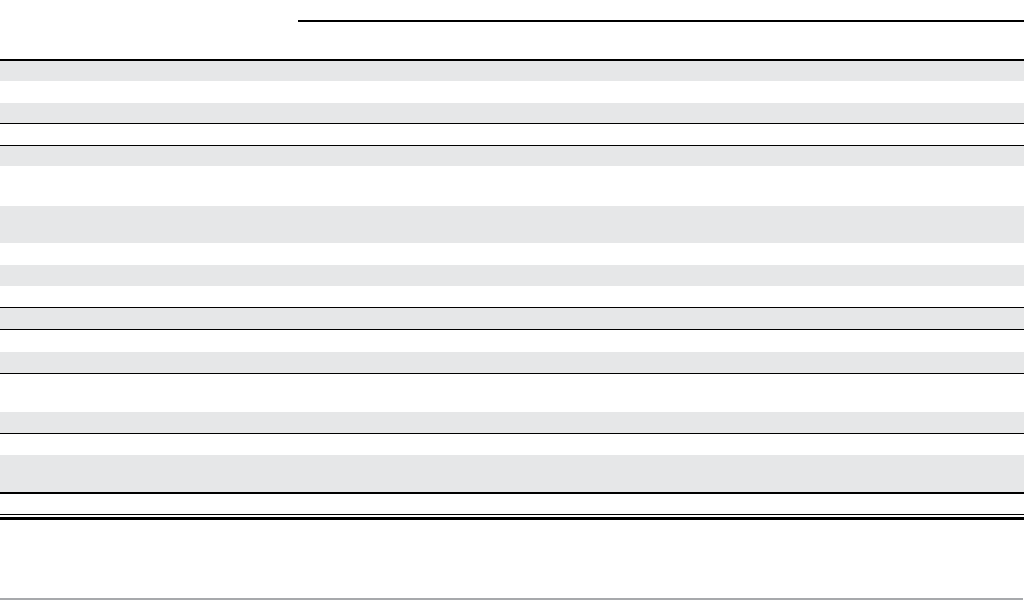

The following table presents our unaudited quarterly results of operations as a percentage of revenues for the eight quarters

ended December 31, 2013:

Quarter Ended

Mar31,

2012

Jun30,

2012

Sep30,

2012

Dec31,

2012

Mar31,

2013

Jun30,

2013

Sep30,

2013

Dec31,

2013

Revenues:

Google (advertising and other) 100.0%92.9%86.6%89.5%92.7%92.9%92.4%93.2%

Motorola Mobile (hardware and other) 0 7.1 13.4 10.5 7.3 7.1 7.6 6.8

Total revenues 100.0%100.0%100.0%100.0%100.0%100.0%100.0%100.0%

Costs and expenses:

Cost of revenues—Google

(advertising and other) 35.6 33.7 33.4 34.4 36.8 36.8 36.3 37.1

Cost of revenues—Motorola Mobile

(hardware and other) 0 5.9 11.3 8.7 5.7 6.2 6.7 7.0

Research and development 13.5 13.0 14.1 13.4 13.2 14.1 13.5 12.5

Sales and marketing 11.9 12.0 12.9 12.2 11.4 12.3 12.1 12.6

General and administrative 7.2 8.0 7.7 7.8 8.0 8.5 8.3 7.5

Total costs and expenses 68.2 72.6 79.4 76.5 75.1 77.9 76.9 76.7

Income from operations 31.8 27.4 20.6 23.5 24.9 22.1 23.1 23.3

Interest and other income, net 1.5 2.1 0.5 1.1 1.0 1.8 0.2 0.7

Income from continuing operations

before income taxes 33.3 29.5 21.1 24.6 25.9 23.9 23.3 24.0

Provision for income taxes 6.2 5.5 4.9 4.4 2.1 5.8 3.4 4.0

Net income from continuing operations 27.1%24.0%16.2%20.2%23.8%18.1%19.9%20.0%

Net income (loss) from discontinued

operations 0% (0.4)% 0.1%(0.2)% 0.2%4.8%0.1% 0%

Net income 27.1%23.6%16.3%20.0%24.0%22.9%20.0%20.0%

Liquidity and Capital Resources

AsofDecember31,2013,wehad$58.7billionofcash,cashequivalents,andmarketablesecurities.Cashequivalentsand

marketable securities are comprised of time deposits, money market and other funds, including cash collateral received related

tooursecuritieslendingprogram,highlyliquiddebtinstrumentsoftheU.S.governmentanditsagencies,debtinstrumentsissued

byforeigngovernments,debtinstrumentsissuedbymunicipalitiesintheU.S.,corporatesecurities,mortgage-backedsecurities

andasset-backedsecurities.

AsofDecember31,2013,$33.6billionofthe$58.7billionofcash,cashequivalents,andmarketablesecuritieswasheldbyour

foreignsubsidiaries.IfthesefundsareneededforouroperationsintheU.S.,wewouldberequiredtoaccrueandpayU.S.taxes

torepatriatethesefunds.However,ourintentistopermanentlyreinvestthesefundsoutsideoftheU.S.andourcurrentplans

donotdemonstrateaneedtorepatriatethemtofundourU.S.operations.

Ourprincipalsourcesofliquidityareourcash,cashequivalents,andmarketablesecurities,aswellasthecashowthatwegenerate

fromouroperations.AtDecember31,2013,wehadunusedlettersofcreditforapproximately$173million.Webelievethatour

sourcesoffundingwillbesucienttosatisfyourcurrentlyanticipatedcashrequirementsthroughatleastthenext12months.

Ourliquiditycouldbenegativelyaectedbyadecreaseindemandforourproductsandservices.Inaddition,wemaymake

acquisitions or license products and technologies complementary to our business and may need to raise additional capital through

futuredebtorequitynancingtoprovideforgreaterexibilitytofundanysuchacquisitionsandlicensingactivities.Additional

nancingmaynotbeavailableatallorontermsfavorabletous.

Wehaveadebtnancingprogramofupto$3.0billionthroughtheissuanceofcommercialpaper.Netproceedsfromthis

programareusedforgeneralcorporatepurposes.AsofDecember31,2013,wehad$2.0billionofcommercialpaperoutstanding

recordedasshort-termdebt,withaweighted-averageinterestrateof0.1%thatmatureatvariousdatesthroughJune2014.

Averagecommercialpaperborrowingsduringtheyearwere$2.1billionandthemaximumamountoutstandingduringtheyear

was$2.5billion.Inconjunctionwiththisprogram,wehavea$3.0billionrevolvingcreditfacilityexpiringinJuly2016.Theinterest

rateforthecreditfacilityisdeterminedbasedonaformulausingcertainmarketrates.AsofDecember31,2013,wewerein

compliancewiththenancialcovenantinthecreditfacilityandnoamountswereoutstanding.

InMay2011,weissued$3.0billionofunsecuredseniornotesinthreeequaltranches,duein2014,2016,and2021,withstated

interestratesof1.25%,2.125%,and3.625%.Thenetproceedsfromthesaleofthenoteswereusedtorepayaportionofour

outstandingcommercialpaperandforgeneralcorporatepurposes.InMay2013,wereclassiedthersttrancheof$1.0billion

unsecuredseniornotesdueinMay2014asshort-termdebt.Weplantoissue$1.0billionoflong-termdebtwhenthisnote

maturesin2014.AsofDecember31,2013,thetotalcarryingvalueandestimatedfairvalueofthesenoteswere$3.0billionand

contents