Google 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GOOGLE INC.

PART II

ITEM8.Notes to Consolidated Financial Statements

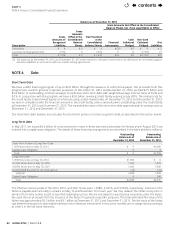

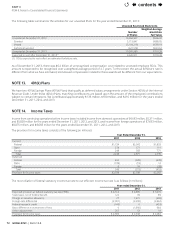

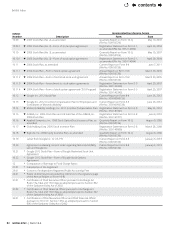

ThefollowingtablesummarizestheactivitiesforourunvestedRSUsfortheyearendedDecember31,2013:

Unvested Restricted Stock Units

Number

of Shares

Weighted-Average

Grant-Date

Fair Value

Unvested at December 31, 2012 10,994,927 $566.32

Granted 5,713,847 $888.05

Vested (5,104,216) $593.19

Forfeited/canceled (627,578) $623.62

UnvestedatDecember31,2013 10,976,980 $718.39

ExpectedtovestafterDecember31,2013(1) 9,626,811 $718.39

(1) RSUsexpectedtovestreflectanestimatedforfeiturerate.

AsofDecember31,2013,therewas$6.2billionofunrecognizedcompensationcostrelatedtounvestedemployeeRSUs.This

amountisexpectedtoberecognizedoveraweighted-averageperiodof2.7years.Totheextenttheactualforfeiturerateis

dierentfromwhatwehaveestimated,stock-basedcompensationrelatedtotheseawardswillbedierentfromourexpectations.

Wehavetwo401(k)SavingsPlans(401(k)Plans)thatqualifyasdeferredsalaryarrangementsunderSection401(k)oftheInternal

RevenueCode.Underthese401(k)Plans,matchingcontributionsarebasedupontheamountoftheemployees’contributions

subjecttocertainlimitations.Wecontributedapproximately$136million,$180million,and$216millionfortheyearsended

December31,2011,2012,and2013.

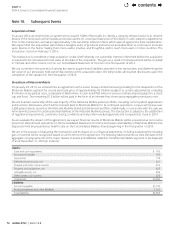

Income Taxes

Incomefromcontinuingoperationsbeforeincometaxesincludedincomefromdomesticoperationsof$4,693million,$5,311million,

and$5,828millionfortheyearsendedDecember31,2011,2012,and2013,andincomefromforeignoperationsof$7,633million,

$8,075million,and$8,668millionfortheyearsendedDecember31,2011,2012,and2013.

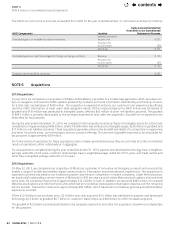

Theprovisionforincometaxesconsistsofthefollowing(inmillions):

Year Ended December31,

2011 2012 2013

Current:

Federal $1,724 $2,342 $1,853

State 274 171 111

Foreign 248 358 771

Total 2,246 2,871 2,735

Deferred:

Federal 452 (328) (439)

State (109) (19) 14

Foreign 0 74 (28)

Total 343 (273) (453)

Provisionforincometaxes $2,589 $2,598 $2,282

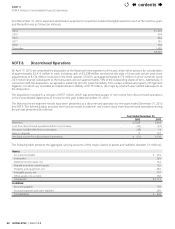

Thereconciliationoffederalstatutoryincometaxratetooureectiveincometaxrateisasfollows(inmillions):

Year ended December31,

2011 2012 2013

Expectedprovisionatfederalstatutorytaxrate(35%) $ 4,314 $ 4,685 $ 5,076

Statetaxes,netoffederalbenet 122 99 89

Change in valuation allowance 27 1,921 (598)

Foreignratedierential (2,001) (2,200) (2,494)

Federal research credit (140) 0 (453)

BasisdierenceininvestmentofArris 0 (1,960) 644

Otheradjustments 267 53 18

Provisionforincometaxes $2,589 $ 2,598 $ 2,282

contents