Google 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM8.Notes to Consolidated Financial Statements

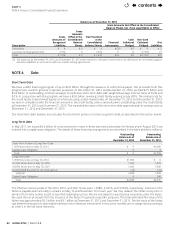

ThefollowingtablesummarizestheactivitiesforouroptionsfortheyearendedDecember31,2013:

Options Outstanding

Number

of Shares

Weighted-

Average

Exercise Price

Weighted-Average

Remaining Contractual

Term (in years)

Aggregate

Intrinsic Value

(in millions)(1)

BalanceatDecember31,2012 8,551,395 $405.98

Granted 1,571 $723.25

Exercised (3,299,276) $355.56

Forfeited/canceled (220,827) $595.92

BalanceatDecember31,2013 5,032,863 $431.00 5.0 $3,470

ExercisableasofDecember31,2013 3,795,911 $379.60 4.1 $2,813

ExercisableasofDecember31,2013andexpectedto

vestthereafter(2) 4,880,718 $426.33 5.0 $3,390

(1) Theaggregateintrinsicvalueiscalculatedasthedifferencebetweentheexercisepriceoftheunderlyingawardsandtheclosingstockprice

of$1,120.71ofourClassAcommonstockonDecember31,2013.

(2) Optionsexpectedtovestreflectanestimatedforfeiturerate.

Thefollowingtablesummarizesadditionalinformationregardingoutstanding,andvestedandexercisablestockoptionsasof

December31,2013:

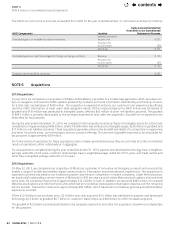

Range of

ExercisePrices

Options Outstanding Options Exercisable

Number

of Shares

Weighted-

Average

Remaining Life

(in years)

Weighted-Average

Exercise Price Number of Shares

Weighted-Average

Exercise Price

$3.75–$92.23 22,905 2.2 $68.89 22,905 $ 68.89

$117.84–$198.41 117,075 1.1 $181.44 117,075 $ 181.44

$205.96–$298.86 141,731 1.6 $276.29 141,731 $ 276.29

$300.97–$399.00 2,098,774 3.5 $309.82 2,066,572 $309.83

$401.78–$499.07 547,762 5.1 $442.23 516,010 $440.83

$501.27–$595.35 1,235,007 6.2 $538.95 755,917 $ 532.34

$601.17–$675.82 852,625 7.9 $628.88 172,006 $616.14

$723.25–$762.5 16,984 8.8 $758.87 3,695 $758.34

$3.75–$762.5 5,032,863 5.0 $431.00 3,795,911 $ 379.60

Theabovetablesinclude388,324warrantsheldbyselectednancialinstitutionsthatwereoptionspurchasedfrom

employeesunderourTSOprogram,withaweighted-averageexercisepriceof$431.76andaweighted-averageremaining

lifeof0.6years.

During2013,thenumberofsharesunderlyingTSOssoldtoselectednancialinstitutionsundertheTSOprogramwas671,190

atatotalvalueof$322million,oranaverageof$479.06pershare,includinganaveragepremiumof$2.35pershare.The

premiumiscalculatedasthedierencebetween(a)thesalepriceoftheTSOand(b)theintrinsicvalueoftheTSO,which

wedeneastheexcess,ifany,ofthepriceofourClassAcommonstockatthetimeofthesaleovertheexercisepriceof

theTSO.TheTSOprogramwasdiscontinuedasofNovember29,2013.Thisdidnothaveamaterialimpactonourconsolidated

nancialstatements.

Thetotalgrantdatefairvalueofstockoptionsvestedduring2011,2012,and2013was$561million,$489million,and$223million.

Theaggregateintrinsicvalueofalloptionsandwarrantsexercisedduring2011,2012,and2013was$674million,$827million,

and$1,793million.TheseamountsdonotincludetheaggregatesalespriceofoptionssoldunderourTSOprogram.

AsofDecember31,2013,therewas$188millionofunrecognizedcompensationcostrelatedtooutstandingemployeestock

options.Thisamountisexpectedtoberecognizedoveraweighted-averageperiodof1.9years.Totheextenttheactual

forfeiturerateisdierentfromwhatwehaveestimated,stock-basedcompensationrelatedtotheseawardswillbedierent

fromourexpectations.

contents