Google 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 GOOGLE INC.

PART II

ITEM8.NotestoConsolidatedFinancialStatements

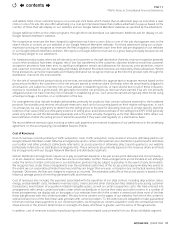

Financial Instruments

Fair Value Measurements

Wemeasureourcashequivalents,marketablesecurities,andforeigncurrencyandinterestratederivativecontractsatfairvalue

onarecurringbasis.Fairvalueisanexitprice,representingtheamountthatwouldbereceivedtosellanassetorpaidtotransfer

aliabilityinanorderlytransactionbetweenmarketparticipants.Assuch,fairvalueisamarket-basedmeasurementthatshould

bedeterminedbasedonassumptionsthatmarketparticipantswoulduseinpricinganassetoraliability.Assetsandliabilities

recordedatfairvaluearemeasuredandclassiedinaccordancewithathree-tierfairvaluehierarchybasedontheobservability

oftheinputsavailableinthemarketusedtomeasurefairvalue:

Level1—Observableinputsthatreectquotedprices(unadjusted)foridenticalassetsorliabilitiesinactivemarkets.

Level2—Includeotherinputsthatarebaseduponquotedpricesforsimilarinstrumentsinactivemarkets,quotedpricesfor

identicalorsimilarinstrumentsinmarketsthatarenotactive,andmodel-basedvaluationtechniquesforwhichallsignicant

inputsareobservableinthemarketorcanbederivedfromobservablemarketdata.Whereapplicable,thesemodelsproject

futurecashowsanddiscountthefutureamountstoapresentvalueusingmarket-basedobservableinputsincludinginterest

ratecurves,foreignexchangerates,andcreditratings.

Level3—Unobservableinputsthataresupportedbylittleornomarketactivities.

Thefairvaluehierarchyrequiresanentitytomaximizetheuseofobservableinputsandminimizetheuseofunobservableinputs

whenmeasuringfairvalue.

WeclassifyourcashequivalentsandmarketablesecuritieswithinLevel1orLevel2becauseweusequotedmarketpricesor

alternativepricingsourcesandmodelsutilizingmarketobservableinputstodeterminetheirfairvalue.Weclassifyourforeign

currencyandinterestratederivativecontractsprimarilywithinLevel2asthevaluationinputsarebasedonquotedpricesand

marketobservabledataofsimilarinstruments.

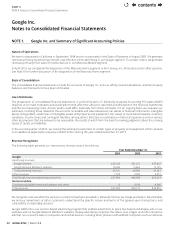

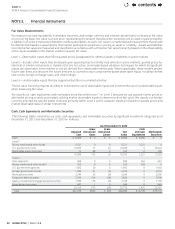

Cash, Cash Equivalents and Marketable Securities

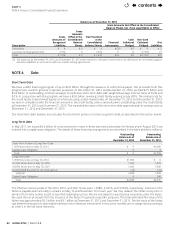

Thefollowingtablessummarizeourcash,cashequivalentsandmarketablesecuritiesbysignicantinvestmentcategoriesasof

December31,2012andDecember31,2013(inmillions):

As of December31, 2012

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Cash

and Cash

Equivalents

Marketable

Securities

Cash $8,066 $0$0$8,066 $8,066 $0

Level1:

Moneymarketandotherfunds 5,221 0 0 5,221 5,221 0

U.S.governmentnotes 10,853 77 (1) 10,929 0 10,929

Marketableequitysecurities 12 88 0 100 0 100

16,086 165 (1) 16,250 5,221 11,029

Level2:

Timedeposits(1) 984 0 0 984 562 422

Moneymarketandotherfunds(2) 929 0 0 929 929 0

U.S.governmentagencies 1,882 20 0 1,902 0 1,902

Foreigngovernmentbonds 1,996 81 (3) 2,074 0 2,074

Municipal securities 2,249 23 (6) 2,266 0 2,266

Corporatedebtsecurities 7,200 414 (14) 7,600 0 7,600

Agencyresidentialmortgage-backedsecurities 7,039 136 (6) 7,169 0 7,169

Asset-backedsecurities 847 1 0 848 0 848

23,126 675 (29) 23,772 1,491 22,281

Total $47,278 $840 $(30) $48,088 $14,778 $33,310

contents