Google 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

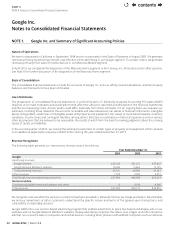

41

PART II

ITEM7A.QuantitativeandQualitativeDisclosuresAboutMarketRisk

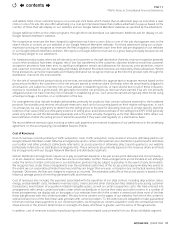

We considered the historical trends in currency exchange rates and determined that it was reasonably possible that changes

inexchangeratesof20%couldbeexperiencedinthenearterm.IftheU.S.dollarweakenedby20%,theamountrecordedin

AOCIrelatedtoourforeignexchangeoptionsbeforetaxeectwouldhavebeenapproximately$9millionand$4millionlowerat

December 31, 2012 and December 31, 2013, and the total amount of expense recorded as interest and other income, net, would

havebeenapproximately$140millionand$123millionhigherintheyearsendedDecember31,2012andDecember31,2013.If

theU.S.dollarstrengthenedby20%,theamountrecordedinaccumulatedAOCIrelatedtoourforeignexchangeoptionsbefore

taxeectwouldhavebeenapproximately$1.7billionhigherbothatDecember31,2012andDecember31,2013,andthetotal

amountofexpenserecordedasinterestandotherincome,net,wouldhavebeenapproximately$159millionand$120million

higherintheyearsendedDecember31,2012andDecember31,2013.

Inaddition,weuseforeignexchangeforwardcontractstoosettheforeignexchangeriskonourassetsandliabilitiesdenominated

incurrenciesotherthanthelocalcurrencyofthesubsidiary.Theseforwardcontractsreduce,butdonotentirelyeliminatethe

impactofcurrencyexchangeratemovementsonourassetsandliabilities.Theforeigncurrencygainsandlossesontheassets

andliabilitiesarerecordedininterestandotherincome,net,whichareosetbythegainsandlossesontheforwardcontracts.

We considered the historical trends in currency exchange rates and determined that it was reasonably possible that adverse

changesinexchangeratesof20%forallcurrenciescouldbeexperiencedinthenearterm.Thesechangeswouldhaveresulted

inanadverseimpactonincomebeforeincometaxesofapproximately$9millionand$52millionatDecember31,2012and

December31,2013.TheadverseimpactatDecember31,2012andDecember31,2013isafterconsiderationoftheosetting

eectofapproximately$731millionand$853millionfromforeignexchangecontractsinplaceforthemonthsofDecember31,

2012andDecember31,2013.Thesereasonablypossibleadversechangesinexchangeratesof20%wereappliedtototal

monetary assets and liabilities denominated in currencies other than the local currencies at the balance sheet dates to compute

theadverseimpactthesechangeswouldhavehadonourincomebeforeincometaxesinthenearterm.

Interest Rate Risk

Ourinvestmentstrategyistoachieveareturnthatwillallowustopreservecapitalandmaintainliquidityrequirements.Weinvest

primarilyinU.S.governmentanditsagencysecurities,moneymarketandotherfunds,corporatedebtsecurities,mortgage-backed

securities,debtinstrumentsissuedbyforeigngovernments,municipalsecurities,timedeposits,andassetbackedsecurities.By

policy,welimittheamountofcreditexposuretoanyoneissuer.Ourinvestmentsinbothxedrateandoatingrateinterest

earningsecuritiescarryadegreeofinterestraterisk.Fixedratesecuritiesmayhavetheirfairmarketvalueadverselyimpacted

duetoariseininterestrates,whileoatingratesecuritiesmayproducelessincomethanpredictedifinterestratesfall.Asof

December31,2012andDecember31,2013,unrealizedlossesonourmarketabledebtsecuritieswereprimarilyduetotemporary

interestrateuctuationsasaresultofhighermarketinterestratescomparedtothexedinterestratesonourdebtsecurities.

WeaccountforbothxedandvariableratesecuritiesatfairvaluewithchangesongainsandlossesrecordedinAOCIuntilthe

securitiesaresold.Weuseinterestratederivativecontractstohedgerealizedgainsandlossesonoursecurities.Thesederivative

contractsareaccountedforatfairvaluewithchangesinfairvaluerecordedinInterestandotherincome,net.

Weconsideredthehistoricalvolatilityofshort-terminterestratesanddeterminedthatitwasreasonablypossiblethatanadverse

changeof100basispointscouldbeexperiencedinthenearterm.Ahypothetical1.00%(100basispoints)increaseininterest

rateswouldhaveresultedinadecreaseinthefairvaluesofourmarketablesecuritiesofapproximately$1.1billionand$1.0billion

atDecember31,2012andDecember31,2013,aftertakingintoconsiderationtheosettingeectfrominterestratederivative

contractsoutstandingasofDecember31,2012andDecember31,2013.Ahypothetical1.00%(100basispoints)decrease

ininterestrateswouldhaveresultedinadecreaseinthefairvaluesofourforward-startinginterestswapsofapproximately

$107millionand$92millionatDecember31,2012andDecember31,2013.

contents