Google 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52 GOOGLE INC.

PART II

ITEM8.NotestoConsolidatedFinancialStatements

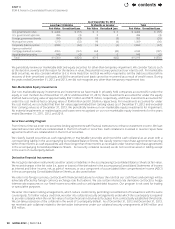

Stock-based Compensation

WehaveelectedtousetheBlack-Scholes-Merton(BSM)optionpricingmodeltodeterminethefairvalueofstockoptionsonthe

datesofgrant.Restrictedstockunits(RSUs)aremeasuredbasedonthefairmarketvaluesoftheunderlyingstockonthedates

ofgrant.Sharesareissuedonthevestingdatesnetoftheminimumstatutorytaxwithholdingrequirementstobepaidbyuson

behalfofouremployees.Asaresult,theactualnumberofsharesissuedwillbefewerthantheactualnumberofRSUsoutstanding.

Furthermore,werecordtheliabilityforwithholdingamountstobepaidbyusasareductiontoadditionalpaid-incapitalwhen

paid.Also,werecognizestock-basedcompensationusingthestraight-linemethod.

Weincludeaspartofcashowsfromnancingactivitiesthebenetsoftaxdeductionsinexcessofthetax-eectedcompensation

oftherelatedstock-basedawardsforoptionsexercisedandRSUsvestedduringtheperiod.DuringtheyearsendedDecember31,

2011,December31,2012,andDecember31,2013,theamountofcashreceivedfromtheexerciseofstockoptionswas$621million,

$736million,and$1,174million,andthetotaldirecttaxbenetrealized,includingtheexcesstaxbenet,fromstock-basedaward

activitieswas$451million,$747million,and$1,195million.Wehaveelectedtoaccountfortheindirecteectsofstock-based

awards-primarilytheresearchanddevelopmenttaxcredit-throughtheConsolidatedStatementsofIncome.

FortheyearsendedDecember31,2011,December31,2012,andDecember31,2013,werecognizedstock-basedcompensation

expenseandrelatedtaxbenetsof$1,974millionand$413million,$2,649millionand$591million,and$3,268millionand

$720million.Additionally,netincome(loss)fromdiscontinuedoperationsfortheyearendedDecember31,2012andDecember31,

2013includesstock-basedcompensationexpenseandrelatedtaxbenetsof$43millionand$11million,and$75millionand

$24million,respectively.

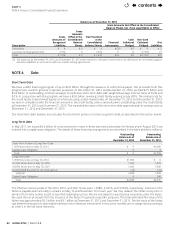

Certain Risks and Concentrations

Ourrevenuesareprimarilyderivedfromonlineadvertising,themarketforwhichishighlycompetitiveandrapidlychanging.In

addition,ourrevenuesaregeneratedfromamultitudeofverticalmarketsegmentsincountriesaroundtheworld.Signicant

changesinthisindustryorchangesincustomerbuyingoradvertiserspendingbehaviorcouldadverselyaectouroperating

results.Inaddition,forourMotorolaMobilesegment,thevastmajorityofourMotorolaproducts(otherthansomeprototypes)

aremanufacturedoutsidetheU.S.,primarilyinChinaandBrazil.

Financialinstrumentsthatpotentiallysubjectustoconcentrationsofcreditriskconsistprincipallyofcashequivalents,marketable

securities,foreignexchangecontracts,andaccountsreceivable.Cashequivalentsandmarketablesecuritiesconsistprimarilyoftime

deposits,moneymarketandotherfunds,includingcashcollateralreceivedrelatedtooursecuritieslendingprogram,highlyliquid

debtinstrumentsoftheU.S.governmentanditsagencies,debtinstrumentsissuedbyforeigngovernmentsandmunicipalitiesin

theU.S.,corporatesecurities,mortgage-backedsecurities,andasset-backedsecurities.Foreignexchangecontractsaretransacted

withvariousnancialinstitutionswithhighcreditstanding.Accountsreceivablearetypicallyunsecuredandarederivedfrom

revenuesearnedfromcustomerslocatedaroundtheworld.In2011,2012,and2013,wegeneratedapproximately46%,47%,

and45%ofourrevenuesfromcustomersbasedintheU.S.,withthemajorityofcustomersoutsideoftheU.S.locatedinEurope

andJapan.ManyofourGoogleNetworkMembersareintheinternetindustry.Weperformongoingevaluationstodetermine

customercreditandwelimittheamountofcreditweextend,butgenerallywedonotrequirecollateralfromourcustomers.

Wemaintainreservesforestimatedcreditlossesandtheselosseshavegenerallybeenwithinourexpectations.

Noindividualcustomerorgroupsofaliatedcustomersrepresentedmorethan10%ofourrevenuesin2011,2012,and2013.

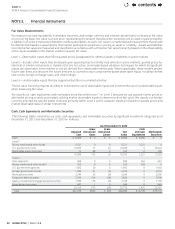

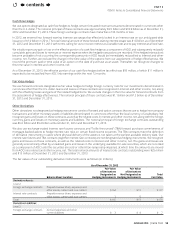

Fair Value of Financial Instruments

Ournancialassetsandnancialliabilitiesthatincludecashequivalents,marketablesecurities,andforeigncurrencyandinterest

ratederivativecontractsaremeasuredandrecordedatfairvalueonarecurringbasis.Wemeasurecertainotherassetsincluding

ournon-marketableequitysecuritiesatfairvalueonanonrecurringbasiswhentheyaredeemedtobeother-than-temporarily

impaired.Ourothercurrentnancialassetsandourothercurrentnancialliabilitieshavefairvaluesthatapproximatetheir

carryingvalueandarethereforenotrecordedatfairvalue.

Cash, Cash Equivalents, and Marketable Securities

Weinvestourexcesscashprimarilyintimedeposits,moneymarketandotherfunds,includingcashcollateralreceivedrelatedto

oursecuritieslendingprogram,highlyliquiddebtinstrumentsoftheU.S.governmentanditsagencies,debtinstrumentsissuedby

foreigngovernmentsandmunicipalitiesintheU.S.,corporatesecurities,mortgage-backedsecurities,andasset-backedsecurities.

Weclassifyallhighlyliquidinvestmentswithstatedmaturitiesofthreemonthsorlessfromdateofpurchaseascashequivalents

andallhighlyliquidinvestmentswithstatedmaturitiesofgreaterthanthreemonthsasmarketablesecurities.

Wedeterminetheappropriateclassicationofourinvestmentsinmarketablesecuritiesatthetimeofpurchaseandreevaluate

suchdesignationateachbalancesheetdate.Wehaveclassiedandaccountedforourmarketablesecuritiesasavailable-for-sale.

contents