GameStop 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

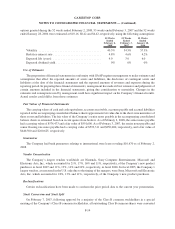

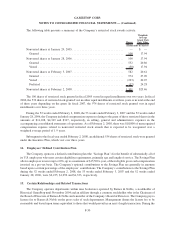

Approximate rental expenses under operating leases were as follows:

52 Weeks

Ended

February 2,

2008

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006

(In thousands)

Minimum ....................................... $255,259 $226,974 $126,562

Percentage rentals. ................................ 19,968 13,819 8,620

$275,227 $240,793 $135,182

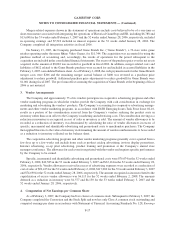

Future minimum annual rentals, excluding percentage rentals, required under leases that had initial, non-

cancelable lease terms greater than one year, as of February 2, 2008 are approximately:

Year Ended Amount

(In thousands)

January 2009 ....................................................... $ 261,433

January 2010 ....................................................... 221,360

January 2011 ....................................................... 172,656

January 2012 ....................................................... 132,407

January 2013 ....................................................... 94,014

Thereafter ......................................................... 136,402

$1,018,272

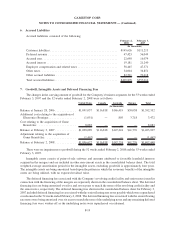

11. Commitments and Contingencies

Contingencies

On February 14, 2005, and as amended, Steve Strickland, as personal representative of the Estate of Arnold

Strickland, deceased, Henry Mealer, as personal representative of the Estate of Ace Mealer, deceased, and Willie

Crump, as personal representative of the Estate of James Crump, deceased, filed a wrongful death lawsuit against

GameStop, Sony, Take-Two Interactive, Rock Star Games and Wal-Mart (collectively, the “Defendants”) and Devin

Moore, alleging that Defendants’ actions in designing, manufacturing, marketing and supplying Defendant Moore

with violent video games were negligent and contributed to Defendant Moore killing Arnold Strickland, Ace

Mealer and James Crump. Moore was found guilty of capital murder in a criminal trial and was sentenced to death in

August 2005.

The Defendants filed a motion to dismiss the case on various grounds, which was heard in November 2005 and

was denied. The Alabama Supreme Court denied the Defendants’ request to appeal and discovery was ordered to

proceed. The Court’s scheduling order anticipated a Frye hearing on April 6, 2007, at which plaintiffs’ causation

theory and experts’ credentials were to be challenged. However, that hearing did not take place and plaintiffs’

Alabama and Florida counsel withdrew. New Alabama counsel has entered their appearance for plaintiffs and a new

scheduling order is expected to be entered by the Court, which we believe will set a new Frye hearing date, a new

close of discovery date and a new trial date. The Company does not believe there is sufficient information to

estimate the amount of the possible loss, if any, resulting from the lawsuit.

In the ordinary course of the Company’s business, the Company is, from time to time, subject to various other

legal proceedings. Management does not believe that any such other legal proceedings, individually or in the

aggregate, will have a material adverse effect on the Company’s financial condition or results of operations.

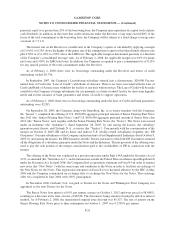

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited. Under the terms of

the purchase agreement, the individual owners of the remaining 49% interest have the ability to require the

F-24

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)