GameStop 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007),

Business Combinations, (“SFAS 141(R)”). SFAS 141(R) amends the principles and requirements for how an

acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed,

any noncontrolling interest in the acquiree and the goodwill acquired. SFAS 141(R) also establishes disclosure

requirements to enable the evaluation of the nature and financial effects of the business combination. SFAS 141(R)

is effective for the Company on February 1, 2009, and the Company will apply SFAS 141(R) prospectively to all

business combinations subsequent to the effective date.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, Noncontrolling

Interests in Consolidated Financial Statements — an amendment of Accounting Research Bulletin No. 51

(“SFAS 160”). SFAS 160 establishes accounting and reporting standards for the noncontrolling interest in a

subsidiary and for the deconsolidation of a subsidiary. SFAS 160 also establishes disclosure requirements that

clearly identify and distinguish between the controlling and noncontrolling interests and requires the separate

disclosure of income attributable to controlling and noncontrolling interests. SFAS 160 is effective for fiscal years

beginning after December 15, 2008. The Company is currently evaluating the impact that the adoption of SFAS 160

will have on its consolidated financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, The Fair Value

Option for Financial Assets and Financial Liabilities (“SFAS 159”). This statement permits entities the option to

measure many financial instruments and certain other items at fair value at specific election dates. Unrealized gains

and losses on items for which the fair value option has been elected are reported in earnings. SFAS 159 was effective

for our Company on February 3, 2008. The adoption of SFAS 159 did not have a material impact on our

consolidated financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, Fair Value

Measurements (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value, and

expands disclosures about fair value measurements. SFAS 157 applies to other accounting pronouncements that

require or permit fair value measurements. The Company adopted SFAS 157 on February 3, 2008 as required for its

financial assets and liabilities. However, in February 2008, the FASB released a FASB Staff Position, FSP

FAS 157-2, Effective Date of FASB Statement No. 157, which delayed the effective date of SFAS 157 for all non-

financial assets and non-financial liabilities, except those that are recognized or disclosed at fair value in the

financial statements on a recurring basis. The adoption of SFAS 157 for our financial assets and liabilities did not

have a material impact on the Company’s financial condition and results of operations. We do not believe the

adoption of SFAS 157 for our non-financial assets and liabilities, effective February 1, 2009, will have a material

impact on our consolidated financial statements.

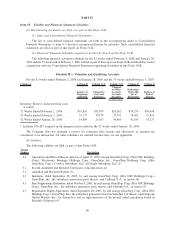

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit

realized during the fourth quarter which includes the holiday selling season. Results for any quarter are not

necessarily indicative of the results that may be achieved for a full fiscal year. Quarterly results may fluctuate

materially depending upon, among other factors, the timing of new product introductions and new store openings,

sales contributed by new stores, increases or decreases in comparable store sales, adverse weather conditions, shifts

in the timing of certain holidays or promotions and changes in our merchandise mix.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Exposure

We do not use derivative financial instruments to hedge interest rate exposure. We limit our interest rate risks

by investing our excess cash balances in short-term, highly-liquid instruments with a maturity of one year or less. In

addition, the Senior Notes outstanding issued in connection with the mergers carry a fixed interest rate. We do not

expect any material losses from our invested cash balances, and we believe that our interest rate exposure is modest.

43