GameStop 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

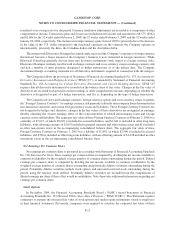

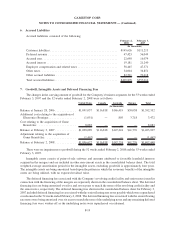

6. Accrued Liabilities

Accrued liabilities consisted of the following:

February 2,

2008

February 3,

2007

(In thousands)

Customer liabilities .......................................... $145,626 $111,213

Deferred revenue ........................................... 47,423 56,049

Accrued rent............................................... 22,698 16,074

Accrued interest ............................................ 19,181 21,240

Employee compensation and related taxes ......................... 58,445 47,371

Other taxes ................................................ 34,004 34,851

Other accrued liabilities ...................................... 82,501 70,218

Total accrued liabilities ....................................... $409,878 $357,016

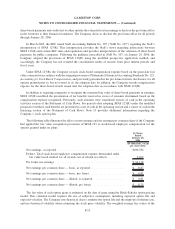

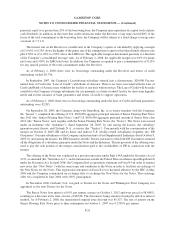

7. Goodwill, Intangible Assets and Deferred Financing Fees

The changes in the carrying amount of goodwill for the Company’s business segments for the 53 weeks ended

February 3, 2007 and the 52 weeks ended February 2, 2008 were as follows:

United States Canada Australia Europe Total

(In thousands)

Balance at January 28, 2006 ............. $1,091,057 $116,818 $146,419 $38,058 $1,392,352

Additional cost relating to the acquisition of

Electronics Boutique ................. (1,051) — 805 3,718 3,472

Cost relating to the acquisition of Game

Brands Inc. ....................... 8,083 — — — 8,083

Balance at February 3, 2007 ............. $1,098,089 $116,818 $147,224 $41,776 $1,403,907

Adjustment relating to the acquisition of

Game Brands Inc. .................. (1,467) — — — (1,467)

Balance at February 2, 2008 ............. $1,096,622 $116,818 $147,224 $41,776 $1,402,440

There were no impairments to goodwill during the 52 weeks ended February 2, 2008 and the 53 weeks ended

February 3, 2007.

Intangible assets consist of point-of-sale software and amounts attributed to favorable leasehold interests

acquired in the mergers and are included in other non-current assets in the consolidated balance sheet. The total

weighted-average amortization period for the intangible assets, excluding goodwill, is approximately four years.

The intangible assets are being amortized based upon the pattern in which the economic benefits of the intangible

assets are being utilized, with no expected residual value.

The deferred financing fees associated with the Company’s revolving credit facility and senior notes issued in

connection with the financing of the mergers are separately shown in the consolidated balance sheet. The deferred

financing fees are being amortized over five and seven years to match the terms of the revolving credit facility and

the senior notes, respectively. The deferred financing fees shown in the consolidated balance sheet for February 3,

2007 included deferred financing fees associated with the senior floating rate notes payable which were repurchased

or redeemed in the 52 weeks ended February 2, 2008. The deferred financing fees associated with the senior floating

rate notes were being amortized over six years to match the term of the underlying notes and any remaining deferred

financing fees were written-off as the underlying notes were repurchased or redeemed.

F-19

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)