GameStop 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

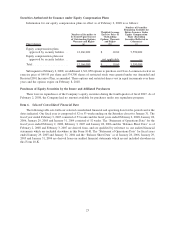

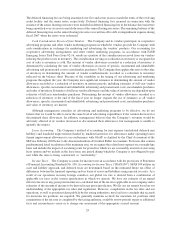

(1) Includes the results of operations of EB from October 9, 2005, the day after completion of the mergers, through

January 28, 2006. The addition of EB’s results affects the comparability of amounts from fiscal periods before

fiscal 2005.

(2) In the fiscal year ended January 29, 2005 (“fiscal 2004”), we revised our method of accounting for rent expense

to conform to GAAP, as clarified by the Chief Accountant of the SEC in a February 2005 letter to the American

Institute of Certified Public Accountants. A non-cash, after-tax adjustment of $3,312 was made in the fourth

quarter of fiscal 2004 to correct the method of accounting for rent expense (and related deferred rent liability) to

include the impact of escalating rents for periods in which we are reasonably assured of exercising lease options

and to include any “rent holiday” period (a period during which the Company is not obligated to pay rent) the

lease allows while the store is being constructed. We also corrected our calculation of depreciation expense for

leasehold improvements for those leases which do not include an option period. The impact of these corrections

on periods prior to fiscal 2004 was not material and the adjustment does not affect historical or future cash flows

or the timing of payments under related leases. See Note 1 of “Notes to Consolidated Financial Statements” of

the Company for additional information concerning lease accounting.

(3) On the first day of fiscal 2006, the Company adopted the provisions of Statement of Financial Accounting

Standards No. 123 (Revised 2004), Share-Based Payment, (“SFAS 123(R)”) which requires companies to

expense the estimated fair value of stock options and similar equity instruments issued to employees in its

financial statements. The implementation of SFAS 123(R) affects the comparability of amounts from fiscal

periods before fiscal 2006. The amount of stock-based compensation included was $26.9 million, $21.0 million

and $0.3 million for the fiscal years 2007, 2006 and 2005, respectively.

(4) The Company’s results of operations for fiscal 2006 and fiscal 2005 include expenses believed to be of a one-

time or short-term nature associated with the mergers, which included $6.8 million and $13.6 million,

respectively, considered in operating earnings and $7.5 million included in fiscal 2005 in interest expense.

The $6.8 million and $13.6 million included $1.9 million and $9.0 million, respectively, in charges associated

with assets of the Company considered to be impaired as a result of the mergers and $4.9 million and

$4.6 million, respectively, in costs associated with integrating the operations of GameStop and EB. Costs

related to the mergers included in interest expense in fiscal 2005 include a fee of $7.1 million for an unused

bridge financing facility which the Company obtained as financing insurance in connection with the mergers.

(5) Weighted average shares outstanding and earnings per common share have been adjusted to reflect the

Conversion and the Stock Split.

(6) Stores are included in our comparable store sales base beginning in the 13th month of operation.

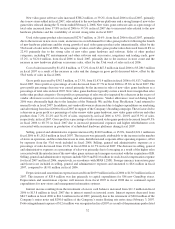

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in our consolidated

financial statements, including the notes thereto. Statements regarding future economic performance, manage-

ment’s plans and objectives, and any statements concerning assumptions related to the foregoing contained in

Management’s Discussion and Analysis of Financial Condition and Results of Operations constitute forward-

looking statements. Certain factors, which may cause actual results to vary materially from these forward-looking

statements, accompany such statements or appear elsewhere in this Form 10-K, including the factors disclosed

under “Item 1A. — Risk Factors.”

General

GameStop Corp. (“GameStop,” “we,” “us,” “our,” or the “Company”) is the world’s largest retailer of video

game products and PC entertainment software. We sell new and used video game hardware, video game software

and accessories, as well as PC entertainment software and related accessories and other merchandise. As of

February 2, 2008, we operated 5,264 stores, in the United States, Australia, Canada and Europe, primarily under the

names GameStop and EB Games. We also operate electronic commerce websites under the names

www.gamestop.com and www.ebgames.com and publish Game Informer, the industry’s largest multi-platform

video game magazine in the United States based on circulation.

25