GameStop 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

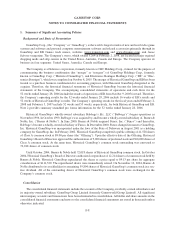

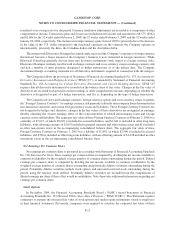

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Background and Basis of Presentation

GameStop Corp., (the “Company” or “GameStop”), is the world’s largest retailer of new and used video game

systems and software and personal computer entertainment software and related accessories primarily through its

GameStop and EB Games trade names, websites (www.gamestop.com and www.ebgames.com) and Game

Informer magazine. The Company’s stores, which totaled 5,264 at February 2, 2008, are located in major regional

shopping malls and strip centers in the United States, Australia, Canada and Europe. The Company operates its

business in four segments: United States, Australia, Canada and Europe.

The Company is a Delaware corporation, formerly known as GSC Holdings Corp., formed for the purpose of

consummating the business combination (the “merger” or “mergers”) of GameStop Holdings Corp., formerly

known as GameStop Corp. (“Historical GameStop”), and Electronics Boutique Holdings Corp. (“EB” or “Elec-

tronics Boutique”), which was completed on October 8, 2005. The merger of Historical GameStop and EB has been

treated as a purchase business combination for accounting purposes, with Historical GameStop designated as the

acquirer. Therefore, the historical financial statements of Historical GameStop became the historical financial

statements of the Company. The accompanying consolidated statements of operations and cash flows for the

52 weeks ended January 28, 2006 include the results of operations of EB from October 9, 2005 forward. Therefore,

the Company’s operating results for the 52 weeks ended January 28, 2006 include 16 weeks of EB’s results and

52 weeks of Historical GameStop’s results. The Company’s operating results for the fiscal years ended February 2,

2008 and February 3, 2007 include 52 weeks and 53 weeks, respectively, for both Historical GameStop and EB.

Note 2 provides summary unaudited pro forma information for the 52 weeks ended January 28, 2006.

Historical GameStop’s wholly-owned subsidiary Babbage’s Etc. LLC (“Babbage’s”) began operations in

November 1996. In October 1999, Babbage’s was acquired by, and became a wholly-owned subsidiary of, Barnes &

Noble, Inc. (“Barnes & Noble”). In June 2000, Barnes & Noble acquired Funco, Inc. (“Funco”) and thereafter,

Babbage’s became a wholly-owned subsidiary of Funco. In December 2000, Funco changed its name to GameStop,

Inc. Historical GameStop was incorporated under the laws of the State of Delaware in August 2001 as a holding

company for GameStop, Inc. In February 2002, Historical GameStop completed a public offering of 41,528 shares

of Class A common stock at $9.00 per share (the “Offering”). Upon the effective date of the Offering, Historical

GameStop’s Board of Directors approved the authorization of 5,000 shares of preferred stock and 300,000 shares of

Class A common stock. At the same time, Historical GameStop’s common stock outstanding was converted to

72,018 shares of common stock.

Until October 2004, Barnes & Noble held 72,018 shares of Historical GameStop common stock. In October

2004, Historical GameStop’s Board of Directors authorized a repurchase of 12,214 shares of common stock held by

Barnes & Noble. Historical GameStop repurchased the shares at a price equal to $9.13 per share for aggregate

consideration of $111,520. The repurchased shares were immediately retired. On November 12, 2004, Barnes &

Noble distributed to its stockholders its remaining 59,804 shares of Historical GameStop’s common stock in a tax-

free dividend. All of the outstanding shares of Historical GameStop’s common stock were exchanged for the

Company’s common stock.

Consolidation

The consolidated financial statements include the accounts of the Company, its wholly-owned subsidiaries and

its majority-owned subsidiary, GameStop Group Limited (formerly Gamesworld Group Limited). All significant

intercompany accounts and transactions have been eliminated in consolidation. All dollar and share amounts in the

consolidated financial statements and notes to the consolidated financial statements are stated in thousands unless

otherwise indicated.

F-8