GameStop 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

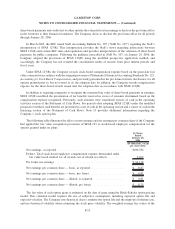

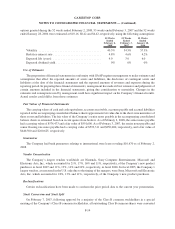

options granted during the 52 weeks ended February 2, 2008, 53 weeks ended February 3, 2007 and the 52 weeks

ended January 28, 2006 were estimated at $10.16, $8.42 and $4.42, respectively, using the following assumptions:

52 Weeks

Ended

February 2,

2008

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006

Volatility ....................................... 40.5% 54.5% 57.3%

Risk-free interest rate .............................. 4.8% 4.6% 4.2%

Expected life (years)............................... 4.0 3.0 6.0

Expected dividend yield ............................ 0% 0% 0%

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. In preparing these financial statements, management has made its best estimates and judgments of

certain amounts included in the financial statements, giving due consideration to materiality. Changes in the

estimates and assumptions used by management could have significant impact on the Company’s financial results.

Actual results could differ from those estimates.

Fair Values of Financial Instruments

The carrying values of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities

reported in the accompanying consolidated balance sheets approximate fair value due to the short-term maturities of

these assets and liabilities. The fair value of the Company’s senior notes payable in the accompanying consolidated

balance sheets is estimated based on recent quotes from brokers. As of February 2, 2008, the senior notes payable

had a carrying value of $574,473 and a fair value of $591,600. As of February 3, 2007, the senior notes payable and

senior floating rate notes payable had a carrying value of $593,311 and $250,000, respectively, and a fair value of

$640,500 and $260,625, respectively.

Guarantees

The Company had bank guarantees relating to international store leases totaling $10,670 as of February 2,

2008.

Vendor Concentration

The Company’s largest vendors worldwide are Nintendo, Sony Computer Entertainment, Microsoft and

Electronic Arts, Inc., which accounted for 21%, 17%, 16% and 11%, respectively, of the Company’s new product

purchases in fiscal 2007 and 11%, 13%, 14% and 10%, respectively, in fiscal 2006. In fiscal 2005, the Company’s

largest vendors, as measured in the U.S. only due to the timing of the mergers, were Sony, Microsoft and Electronic

Arts, Inc. which accounted for 18%, 13% and 11%, respectively, of the Company’s new product purchases.

Reclassifications

Certain reclassifications have been made to conform the prior period data to the current year presentation.

Stock Conversion and Stock Split

On February 7, 2007, following approval by a majority of the Class B common stockholders in a special

meeting of the Company’s Class B common stockholders, all outstanding Class B common shares were converted

F-14

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)