GameStop 2007 Annual Report Download - page 89

Download and view the complete annual report

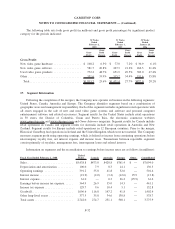

Please find page 89 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Issuers pay interest on the Senior Notes semi-annually, in arrears, every April 1 and October 1, to holders

of record on the immediately preceding March 15 and September 15, and at maturity.

The Indenture contains affirmative and negative covenants customary for such financings, including, among

other things, limitations on (1) the incurrence of additional debt, (2) restricted payments, (3) liens, (4) sale and

leaseback transactions and (5) asset sales. Events of default provided for in the Indenture include, among other

things, failure to pay interest or principal on the Notes, other breaches of covenants in the Indenture, and certain

events of bankruptcy and insolvency.

As of February 2, 2008, the Company was in compliance with all covenants associated with the Revolver and

the Indenture.

Under certain conditions, the Issuers may on any one or more occasions prior to maturity redeem up to 100% of

the aggregate principal amount of the Notes issued under the Indenture at redemption prices at or in excess of 100%

of the principal amount thereof plus accrued and unpaid interest, if any, to the redemption date. The circumstances

which would limit the percentage of the Notes which may be redeemed or which would require the Company to pay

a premium in excess of 100% of the principal amount are defined in the Indenture. Upon a Change of Control (as

defined in the Indenture), the Issuers are required to offer to purchase all of the Notes then outstanding at 101% of

the principal amount thereof plus accrued and unpaid interest, if any, to the date of purchase.

The Issuers may acquire the Notes by means other than redemption, whether by tender offer, open market

purchases, negotiated transactions or otherwise, in accordance with applicable securities laws, so long as such

acquisitions do not otherwise violate the terms of the Indenture.

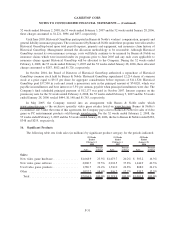

In May 2006, the Company announced that its Board of Directors authorized the buyback of up to an aggregate

of $100,000 of its Senior Floating Rate Notes and Senior Notes. As of February 3, 2007, the Company had

repurchased the maximum authorized amount, having acquired $50,000 of its Senior Notes and $50,000 of its

Senior Floating Rate Notes, and delivered the Notes to the Trustee for cancellation. The associated loss on

retirement of debt was $6,059, which consists of the premium paid to retire the Notes and the write-off of the

deferred financing fees and the original issue discount on the Notes.

On February 9, 2007, the Company announced that its Board of Directors authorized the buyback of up to an

aggregate of an additional $150,000 of its Senior Notes and Senior Floating Rate Notes. The timing and amount of

the repurchases were determined by the Company’s management based on their evaluation of market conditions and

other factors. As of February 2, 2008, the Company had repurchased the additional $150,000 of the Notes, having

acquired $20,000 of its Senior Notes and $130,000 of its Senior Floating Rate Notes, and delivered the Notes to the

Trustee for cancellation. The associated loss on retirement of this debt was $8,751, which consists of the premium

paid to retire the Notes and the write-off of the deferred financing fees and the original issue discount on the Notes.

On June 28, 2007, the Company announced that its Board of Directors authorized the redemption of the

remaining $120,000 of Senior Floating Rate Notes outstanding. The Company redeemed the Senior Floating Rate

Notes on October 1, 2007 at the redemption price specified by the Senior Floating Rate Notes of 102.0%, plus all

accrued and unpaid interest through the redemption date. The Company incurred a one-time pre-tax charge of

$3,840 associated with the redemption, which represents a $2,400 redemption premium and $1,440 to recognize

unamortized deferred financing costs.

Subsequently, on February 7, 2008, the Company announced that its Board of Directors authorized the

buyback of up to an aggregate of an additional $130,000 of its Senior Notes. The timing and amount of the

repurchases will be determined by the Company’s management based on their evaluation of market conditions and

other factors. In addition, the repurchases may be suspended or discontinued at any time. At the time of filing, the

Company had repurchased $24,697 of its Senior Notes pursuant to this new authorization and delivered the Senior

Notes to the Trustee for cancellation. The associated loss on retirement of debt is $1,867, which consists of the

F-22

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)