GameStop 2007 Annual Report Download - page 77

Download and view the complete annual report

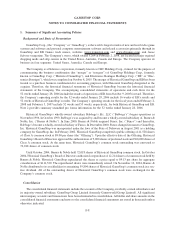

Please find page 77 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Bulletin No. 54 (“SAB 54”) in connection with the acquisition of Babbage’s in 1999 by a subsidiary of Barnes &

Noble. Goodwill in the amount of $2,931 was recorded in connection with the acquisition of GameStop Group

Limited in 2003. Goodwill in the amount of $1,074,937 was recorded in connection with the mergers. Goodwill in

the amount of $6,616 was recorded in connection with the purchase of Game Brands Inc. in January 2007. Goodwill

represents the excess purchase price over tangible net assets and identifiable intangible assets acquired.

The Company accounts for goodwill according to the provisions of Statement of Financial Accounting

Standards No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). SFAS 142 requires, among other things,

that companies evaluate goodwill for impairment on at least an annual basis. Subsequent to the mergers, the

Company determined that it has four reporting units, the United States, Australia, Canada and Europe, based on a

combination of geographic areas, the methods in which the Company analyzes performance and division of

management responsibility. The Company employed the services of an independent valuation specialist to assist in

the allocation of goodwill resulting from the mergers to the four reporting units as of October 8, 2005, the merger

date. Additionally, in accordance with the requirements of SFAS 142, the Company completed its annual

impairment test of goodwill on the first day of the fourth quarter of fiscal 2005, fiscal 2006 and fiscal 2007

and concluded that none of its goodwill was impaired. Note 7 provides additional information concerning goodwill.

Revenue Recognition

Revenue from the sales of the Company’s products is recognized at the time of sale. The sales of used video

game products are recorded at the retail price charged to the customer. Sales returns (which are not significant) are

recognized at the time returns are made. Subscription and advertising revenues are recorded upon release of

magazines for sale to consumers and are stated net of sales discounts. Magazine subscription revenue is recognized

on a straight-line basis over the subscription period. Revenue from the sales of product replacement plans is

recognized on a straight-line basis over the coverage period. The deferred revenues for magazine subscriptions and

deferred financing plans are included in accrued liabilities (see Note 6).

Revenues do not include sales or other taxes collected from customers.

Cost of Sales and Selling, General and Administrative Expenses Classification

The classification of cost of sales and selling, general and administrative expenses varies across the retail

industry. The Company includes purchasing, receiving and distribution costs in selling, general and administrative

expenses, rather than cost of goods sold, in the statement of operations. For the 52 weeks ended February 2, 2008,

the 53 weeks ended February 3, 2007 and the 52 weeks ended January 28, 2006, these purchasing, receiving and

distribution costs amounted to $43,928, $35,903 and $20,826, respectively.

The Company includes processing fees associated with purchases made by check and credit cards in cost of

sales, rather than selling, general and administrative expenses, in the statement of operations. For the 52 weeks

ended February 2, 2008, the 53 weeks ended February 3, 2007 and the 52 weeks ended January 28, 2006, these

processing fees amounted to $55,215, $40,877 and $20,905, respectively.

Customer Liabilities

The Company establishes a liability upon the issuance of merchandise credits and the sale of gift cards.

Revenue is subsequently recognized when the credits and gift cards are redeemed. In addition, income (“breakage”)

is recognized quarterly on unused customer liabilities older than three years to the extent that the Company believes

the likelihood of redemption by the customer is remote, based on historical redemption patterns. Breakage has

historically been immaterial. To the extent that future redemption patterns differ from those historically experi-

enced, there will be variations in the recorded breakage.

F-10

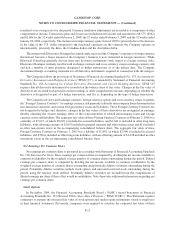

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)