GameStop 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. Acquisitions

On October 8, 2005, Historical GameStop and EB completed their previously announced mergers pursuant to

the Agreement and Plan of Merger, dated as of April 17, 2005 (the “Merger Agreement”). Upon the consummation

of the mergers, Historical GameStop and EB became wholly-owned subsidiaries of the Company. Both manage-

ment and the respective boards of directors of EB and Historical Gamestop believed that the merger of the

companies would create significant synergies in operations when the companies were integrated and would enable

the Company to increase profitability as a result of combined market share.

Under the terms of the Merger Agreement, Historical GameStop’s stockholders received one share of the

Company’s common stock for each share of Historical GameStop’s common stock owned. Approximately

104,135 shares of the Company’s common stock were issued in exchange for all outstanding common stock of

Historical GameStop based on the one-for-one ratio. EB stockholders received $19.08 in cash and .39398 of a share

of the Company’s common stock for each EB share owned. In aggregate, 40,458 shares of the Company’s Class A

common stock were issued to EB stockholders at a value of approximately $437,144 (based on the closing price of

$10.81 per share of Historical GameStop’s Class A common stock on April 15, 2005, the last trading day before the

date the merger was announced). In addition, approximately $993,254 in cash was paid in consideration for (i) all

outstanding common stock of EB, and (ii) all outstanding stock options of EB. Including transaction costs of

$13,558 incurred by Historical GameStop, the total consideration paid was approximately $1,443,956.

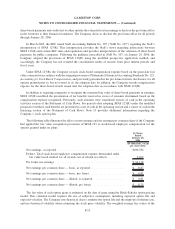

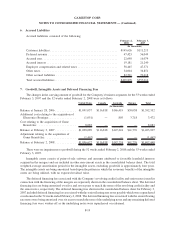

The following table summarizes unaudited pro forma financial information assuming the mergers had

occurred on the first day of the period presented. The unaudited pro forma financial information does not

necessarily represent what would have occurred if the transaction had taken place on the date presented and should

not be taken as representative of the Company’s future consolidated results of operations. At the time of the mergers,

management expected to realize operating synergies from reduced costs in logistics, marketing, and administration.

The unaudited pro forma information does not reflect these potential synergies or expenses associated with the

mergers or integration activities:

52 Weeks

Ended

January 28,

2006

(In thousands, except

per share data)

Sales......................................................... $4,393,890

Cost of sales ................................................... 3,154,928

Gross profit .................................................. 1,238,962

Selling, general and administrative expenses ........................... 930,767

Depreciation and amortization ...................................... 94,288

Operating earnings............................................. 213,907

Interest income ................................................. (6,717)

Interest expense ................................................ 85,056

Earnings before income tax expense ................................ 135,568

Income tax expense .............................................. 49,482

Net earnings ................................................. $ 86,086

Net earnings per common share — basic .............................. $ 0.60

Weighted average shares of common stock — basic ...................... 143,850

Net earnings per common share — diluted ............................. $ 0.56

Weighted average shares of common stock — diluted ..................... 152,982

F-16

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)