GameStop 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

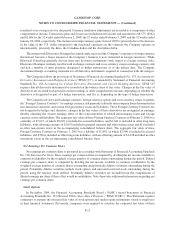

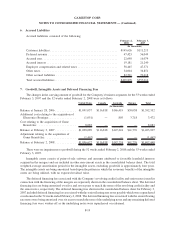

The changes in the carrying amount of deferred financing fees and intangible assets for the 53 weeks ended

February 3, 2007 and the 52 weeks ended February 2, 2008 were as follows:

Deferred

Financing Fees

Intangible

Assets

(In thousands)

Balance at January 28, 2006 .................................. $18,561 $19,519

Addition for the exchange offer in May 2006 .................... 409 —

Write-off of deferred financing fees remaining on repurchased senior

notes and senior floating rate notes (see Note 8) ................ (1,445) —

Amortization for the 53 weeks ended February 3, 2007 ............ (3,150) (4,974)

Balance at February 3, 2007 .................................. 14,375 14,545

Addition for revolving credit facility renewal and extension in 2007 . . . 263 —

Write-off of deferred financing fees remaining on repurchased senior

notes and senior floating rate notes (see Note 8) ................ (3,416) —

Amortization for the 52 weeks ended February 2, 2008 ............ (2,259) (4,646)

Balance at February 2, 2008 .................................. $ 8,963 $ 9,899

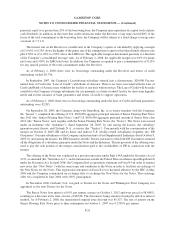

The gross carrying value and accumulated amortization of deferred financing fees as of February 2, 2008 were

$20,318 and $11,355, respectively.

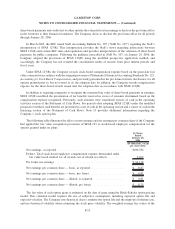

The estimated aggregate amortization expenses for deferred financing fees and other intangible assets for the

next five fiscal years are approximately:

Year Ended

Amortization

of Deferred

Financing Fees

Amortization of

Intangible

Assets

(In thousands)

January 2009 .......................................... $1,957 $3,599

January 2010 .......................................... 1,948 2,705

January 2011 .......................................... 1,946 1,891

January 2012 .......................................... 1,946 832

January 2013 .......................................... 894 396

$8,691 $9,423

8. Debt

In October 2005, in connection with the merger with EB, the Company entered into a five-year, $400,000

Credit Agreement (the “Revolver”), including a $50,000 letter of credit sub-limit, secured by the assets of the

Company and its U.S. subsidiaries. The Revolver places certain restrictions on the Company and its U.S. subsid-

iaries, including limitations on asset sales, additional liens and the incurrence of additional indebtedness.

In April 2007, the Company amended the Revolver to extend the maturity date from October 11, 2010 to

April 25, 2012, reduce the LIBO interest rate margin, reduce and fix the rate of the unused commitment fee and

modify or delete certain other covenants.

The availability under the Revolver is limited to a borrowing base which allows the Company to borrow up to

the lesser of (x) approximately 70% of eligible inventory and (y) 90% of the appraisal value of the inventory, in each

case plus 85% of eligible credit card receivables, net of certain reserves. Letters of credit reduce the amount

available to borrow by their face value. The Company’s ability to pay cash dividends, redeem options and

repurchase shares is generally prohibited, except that if availability under the Revolver is, or will be after any such

F-20

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)