GameStop 2007 Annual Report Download - page 42

Download and view the complete annual report

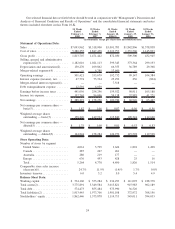

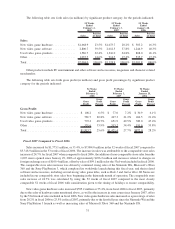

Please find page 42 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.related software and accessories will increase in the future. The Company’s gross margin in fiscal 2007 and fiscal

2006 was adversely impacted by the recent launches of these new products and subsequent manufacturer-funded

retail price decreases for some of these products.

Critical Accounting Policies

The Company believes that the following are its most significant accounting policies which are important in

determining the reporting of transactions and events:

Use of Estimates. The preparation of financial statements in conformity with GAAP requires man-

agement to make estimates and assumptions that affect the reported amounts of assets and liabilities, the

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. In preparing these financial statements, management has

made its best estimates and judgments of certain amounts included in the financial statements, giving due

consideration to materiality. Changes in the estimates and assumptions used by management could have

significant impact on the Company’s financial results. Actual results could differ from those estimates.

Revenue Recognition. Revenue from the sales of the Company’s products is recognized at the time of

sale. The sales of used video game products are recorded at the retail price charged to the customer. Sales

returns (which are not significant) are recognized at the time returns are made. Subscription and advertising

revenues are recorded upon release of magazines for sale to consumers and are stated net of sales discounts.

Magazine subscription revenue is recognized on a straight-line basis over the subscription period. Revenue

from the sales of product replacement plans is recognized on a straight-line basis over the coverage period. Gift

cards sold to customers are recognized as a liability on the balance sheet until redeemed.

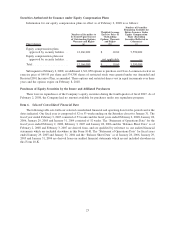

Stock-Based Compensation. In December 2004, the Financial Accounting Standards Board (“FASB”)

issued Statement of Financial Accounting Standards No. 123 (Revised 2004), Share-Based Payment,

(“SFAS 123(R)”). This Statement requires companies to expense the estimated fair value of stock options

and similar equity instruments issued to employees in its financial statements. The Company adopted the

provisions of SFAS 123(R) using the modified prospective application method beginning on the first day of

fiscal 2006. Under SFAS 123(R), the Company records stock-based compensation expense based on the grant-

date fair value estimated in accordance with the original provisions of Statement of Financial Accounting

Standards No. 123, Accounting for Stock-Based Compensation, and previously presented in the pro forma

footnote disclosures, for all options granted prior to, but not vested as of, the adoption date. In addition, the

Company records compensation expense for the share-based awards issued after the adoption date in

accordance with SFAS 123(R). As of February 2, 2008, the unrecognized compensation expense related

to the unvested portion of our stock options and restricted stock was $13.7 million and $18.8 million,

respectively, which is expected to be recognized over a weighted average period of 0.8 and 1.9 years,

respectively. Note 1 of “Notes to Consolidated Financial Statements” provides additional information on

stock-based compensation.

Merchandise Inventories. Our merchandise inventories are carried at the lower of cost or market using

the average cost method. Under the average cost method, as new product is received from vendors, its current

cost is added to the existing cost of product on-hand and this amount is re-averaged over the cumulative units.

Used video game products traded in by customers are recorded as inventory at the amount of the store credit

given to the customer.

In valuing inventory, management is required to make assumptions regarding the necessity of reserves

required to value potentially obsolete or over-valued items at the lower of cost or market. Management

considers quantities on hand, recent sales, potential price protections and returns to vendors, among other

factors, when making these assumptions. Our ability to gauge these factors is dependent upon our ability to

forecast customer demand and to provide a well-balanced merchandise assortment. Any inability to forecast

customer demand properly could lead to increased costs associated with inventory markdowns. We also adjust

inventory based on anticipated physical inventory losses or shrinkage. Physical inventory counts are taken on a

regular basis to ensure the reported inventory is accurate. During interim periods, estimates of shrinkage are

recorded based on historical losses in the context of current period circumstances.

27