GameStop 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

share-based payments and could elect to either include the estimated cost in earnings or disclose the pro forma effect

in the footnotes to their financial statements. The Company chose to disclose the pro forma effect for all periods

through January 28, 2006.

In March 2005, the SEC issued Staff Accounting Bulletin No. 107 (“SAB No. 107”) regarding the Staff’s

interpretation of SFAS 123(R). This interpretation provides the Staff’s views regarding interactions between

SFAS 123(R) and certain SEC rules and regulations and provides interpretations of the valuation of share-based

payments for public companies. Following the guidance prescribed in SAB No. 107, on January 29, 2006, the

Company adopted the provisions of SFAS 123(R) using the modified prospective application method, and

accordingly, the Company has not restated the consolidated results of income from prior interim periods and

fiscal years.

Under SFAS 123(R), the Company records stock-based compensation expense based on the grant-date fair

value estimated in accordance with the original provisions of Statement of Financial Accounting Standards No. 123,

Accounting for Stock-Based Compensation, and previously presented in the pro forma footnote disclosures, for all

options granted prior to, but not vested as of, the adoption date. In addition, the Company records compensation

expense for the share-based awards issued after the adoption date in accordance with SFAS 123(R).

In addition to requiring companies to recognize the estimated fair value of share-based payments in earnings,

SFAS 123(R) modified the presentation of tax benefits received in excess of amounts determined based on the

compensation expense recognized. Previously, such amounts were considered sources of cash in the operating

activities section of the Statement of Cash Flows. For periods after adopting SFAS 123(R) under the modified

prospective method, such benefits are presented as a use of cash in the operating section and a source of cash in the

financing section of the Statement of Cash Flows. Note 13 provides additional information regarding the

Company’s stock option plan.

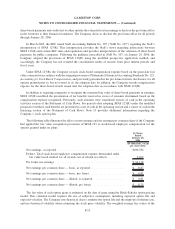

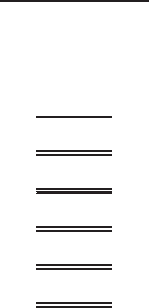

The following table illustrates the effect on net earnings and net earnings per common share if the Company

had applied the fair value recognition provisions of SFAS 123 to stock-based employee compensation for the

options granted under its plans:

52 Weeks

Ended

January 28,

2006

(In thousands, except

per share data)

Net earnings, as reported .......................................... $100,784

Deduct: Total stock-based employee compensation expense determined under

fair value based method for all awards, net of related tax effects ........... 6,666

Pro forma net earnings ........................................... $ 94,118

Net earnings per common share — basic, as reported ..................... $ 0.87

Net earnings per common share — basic, pro forma ...................... $ 0.81

Net earnings per common share — diluted, as reported .................... $ 0.81

Net earnings per common share — diluted, pro forma .................... $ 0.75

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

model. This valuation model requires the use of subjective assumptions, including expected option life and

expected volatility. The Company uses historical data to estimate the option life and the employee forfeiture rate,

and uses historical volatility when estimating the stock price volatility. The weighted-average fair values of the

F-13

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)