GameStop 2007 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2007 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

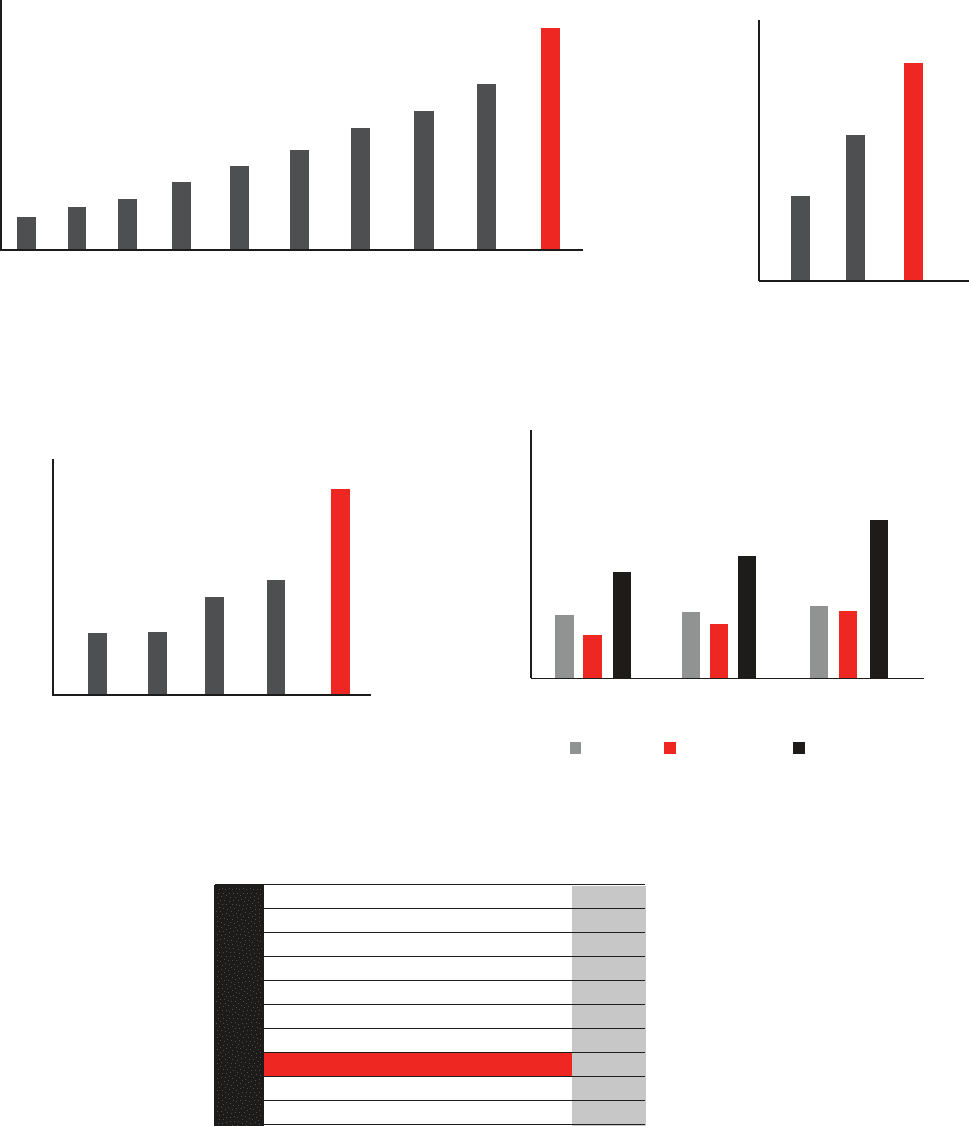

scorecard

GAMESTOP INTERNATIONAL STORE GROWTH

STORE COUNT

1,000

200

400

600

800

261

177

428

2005

267

219

493

2006

287

280

636

2007

CANADA AUSTRALIA/ NZ EUROPE

GAMESTOP OPERATING EARNINGS GROWTH

$100,000,000

$200,000,000

$300,000,000

$400,000,000

$500,000,000

$600,000,000

2005

192,700,000

2006

333,700,000

2007

501,400,000

FISCAL YEAR

1,036

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

1998

1,311

1999

1,560

2000

2,180

2001

3,167

2003

3,827

2004

4,394

2005

5,319

2006

7,094

20072002

2,662

FISCAL YEAR

ANNUAL REVENUE (IN MILLIONS)

GAMESTOP REVENUE GROWTH*

GAMESTOP EARNINGS PER SHARE GROWTH**

2003

$0.53

2004

$0.53

2005

$0.81

2006

$1.00

2007

$1.75

$2.00

$1.00

$0.50

$-

$1.50

* Pro forma revenues of GameStop and EB Games combined for 1998-2005.

** All per share data has been adjusted to reflect the 2-for-1 stock split and Class B share conversion.

*** May 5, 2008 edition of Fortune Magazine based on 2007 performance.

RANK COMPANY RETURN

1 MOSAIC 341.7%

2 AK STEEL HOLDING 173.6%

3 OWENS-ILLINOIS 168.3%

4 NATIONAL OILWELL VARCO 140.1%

5 AMAZON.COM 134.8%

6 JACOBS ENGINEERING GROUP 134.5%

7 APPLE 133.5%

8 GAMESTOP 125.4%

9 AGCO 119.7%

10 CUMMINS 117.5%

BEST INVESTMENTS AS REPORTED BY FORTUNE MAGAZINE***

2007 STOCK APPRECIATION