GE 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 GE 2013 ANNUAL REPORT

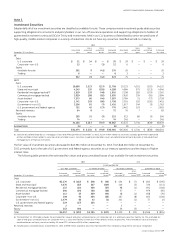

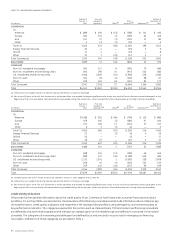

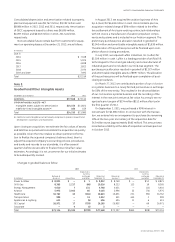

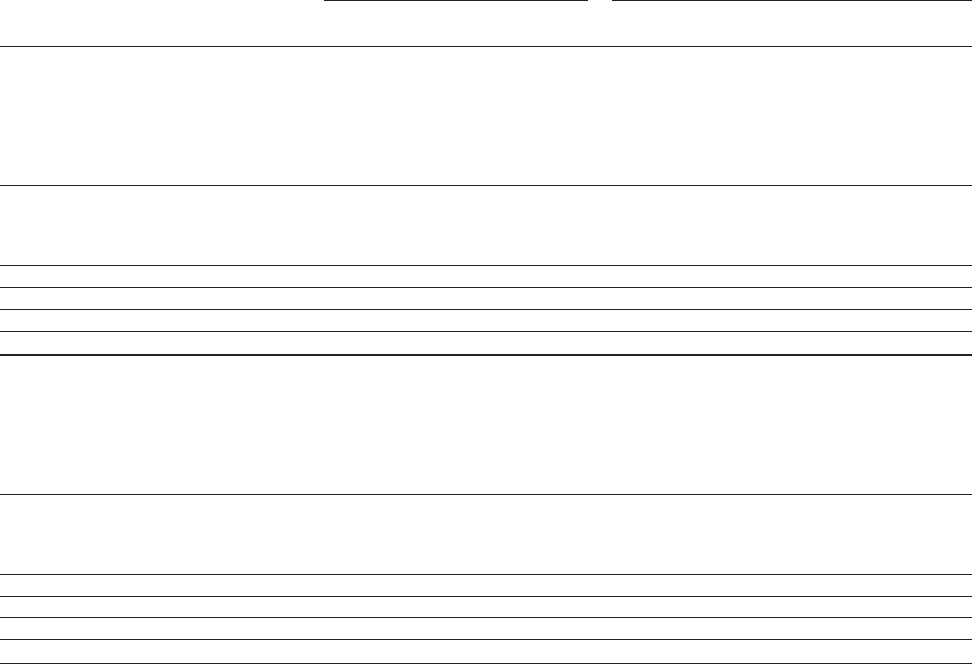

IMPAIRED LOANS

The following tables provide information about loans classifi ed as impaired and specifi c reserves related to Commercial, Real Estate

and Consumer.

With no specific allowance With a specific allowance

December 31 (In millions)

Recorded

investment

in loans

Unpaid

principal

balance

Average

investment

in loans

Recorded

investment

in loans

Unpaid

principal

balance

Associated

allowance

Average

investment

in loans

2013

COMMERCIAL

CLL

Americas $ 1,670 $ 2,187 $ 2,154 $ 417 $ 505 $ 96 $ 497

Europe 802 1,589 956 580 921 211 536

Asia 302 349 180 111 125 20 93

Other — — — — — — 12

Total CLL 2,774 4,125 3,290 1,108 1,551 327 1,138

Energy Financial Services — — — 4 4 1 2

GECAS — — — — — — 1

Other 2 3 9 4 4 — 5

Total Commercial (a) 2,776 4,128 3,299 1,116 1,559 328 1,146

REAL ESTATE (b) 2,615 3,036 3,058 1,245 1,507 74 1,688

CONSUMER (c) 109 153 98 2,879 2,948 567 3,058

Total $ 5,500 $ 7,317 $ 6,455 $ 5,240 $ 6,014 $ 969 $ 5,892

2012

COMMERCIAL

CLL

Americas $ 2,487 $ 2,927 $ 2,535 $ 557 $ 681 $ 178 $ 987

Europe 1,131 1,901 1,009 643 978 278 805

Asia 62 64 62 109 120 23 134

Other — — 43 52 68 6 16

Total CLL 3,680 4,892 3,649 1,361 1,847 485 1,942

Energy Financial Services — — 2 — — — 7

GECAS — — 17 3 3 — 5

Other 17 28 26 8 8 2 40

Total Commercial (a) 3,697 4,920 3,694 1,372 1,858 487 1,994

REAL ESTATE (b) 3,491 3,712 3,773 2,202 2,807 188 3,752

CONSUMER (c) 105 117 100 3,103 3,141 673 2,949

Total $ 7,293 $ 8,749 $ 7,567 $ 6,677 $ 7,806 $ 1,348 $ 8,695

(a) We recognized $218 million and $253 million of interest income, including $60 million and $92 million on a cash basis, for the years ended December 31, 2013 and 2012,

respectively, principally in our CLL Americas business. The total average investment in impaired loans for the years ended December 31, 2013 and 2012 was $4,445 million

and $5,688 million, respectively.

(b) We recognized $187 million and $329 million of interest income, including $135 million and $237 million on a cash basis, for the years ended December 31, 2013 and 2012,

respectively. The total average investment in impaired loans for the years ended December 31, 2013 and 2012 was $4,746 million and $7,525 million, respectively.

(c) We recognized $221 million and $168 million of interest income, including $3 million and $4 million on a cash basis, for the years ended December 31, 2013 and 2012,

respectively, principally in our Consumer-U.S. installment and revolving credit portfolios. The total average investment in impaired loans for the years ended December 31,

2013 and 2012 was $3,156 million and $3,049 million, respectively.