GE 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

GE 2013 ANNUAL REPORT 63

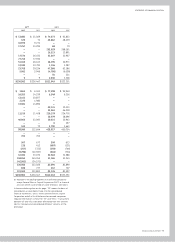

of $5.2 billion, partially offset by increases in other liabilities of

$1.8 billion and accounts payable of $1.0 billion.

Cash from operating activities increased $1.1 billion during

2012 compared with 2011, primarily due to increases in net cash

collateral held from counterparties on derivative contracts of

$1.7 billion, partially offset by decreases in accounts payable of

$0.9 billion.

Consistent with our plan to reduce GECC asset levels, cash

from investing activities was $23.4 billion, $14.7 billion and

$29.8 billion in 2013, 2012 and 2011, respectively. GECC cash

from investing activities increased $8.7 billion during 2013

compared with 2012, primarily due to higher proceeds from

sales of real estate properties of $7.3 billion; the acquisition of

MetLife Bank, N.A. in 2013, resulting in net cash provided from

the acquisition of $6.4 billion; lower net purchases of ELTO of

$1.6 billion; partially offset by lower net loan repayments from

our equity method investments of $4.9 billion and lower collec-

tions (which includes sales) exceeding originations of fi nancing

receivables of $1.9 billion.

GECC cash from investing activities decreased $15.1 billion

during 2012 compared with 2011, primarily due to lower

collections (which includes sales) exceeding originations of

fi nancing receivables of $9.0 billion and lower proceeds from

sales of discontinued operations of $8.7 billion, and higher

net purchases of ELTO of $1.7 billion. These decreases were

partially offset by higher net dispositions and maturities of

investment securities of $2.6 billion and a decrease in all other

assets—investments of $1.7 billion driven by net activity of our

equity method investments.

GECC cash used for fi nancing activities was $29.4 billion,

$52.5 billion and $33.2 billion in 2013, 2012 and 2011, respectively.

GECC cash used for fi nancing activities decreased $23.0 billion

during 2013 compared with 2012, primarily due to lower net

repayments of borrowings of $24.0 billion, consisting primarily of

net reductions in long-term borrowings and commercial paper,

and lower redemptions of guaranteed investment contracts of

$2.3 billion, partially offset by lower proceeds from the issuance

of preferred stock of $3.0 billion.

GECC cash used for fi nancing activities increased $19.3 billion

during 2012 compared with 2011, primarily due to a reduction in

total borrowings of $11.7 billion, consisting primarily of net reduc-

tions in long-term borrowings and commercial paper; $6.5 billion

of dividends paid to shareowners in 2012 (including $0.1 billion

paid to preferred shareowners); a reduction in bank deposits

of $4.2 billion and $1.0 billion of redemptions of guaranteed

investment contracts at Trinity, partially offset by $4.0 billion of

proceeds from the issuance of preferred stock.

GECC pays dividends to GE through a distribution of its

retained earnings, including special dividends from proceeds of

certain business sales. Beginning in the second quarter of 2012,

GECC restarted its dividend to GE. During 2013 and 2012, GECC

paid quarterly dividends of $1.9 billion in both years and special

dividends of $4.1 billion and $4.5 billion, respectively, to GE. No

dividends were paid to GE in 2011.

Intercompany Eliminations

Effects of transactions between related companies are made

on an arms-length basis, are eliminated and consist primarily of

GECC dividends to GE; GE customer receivables sold to GECC;

GECC services for trade receivables management and material

procurement; buildings and equipment (including automobiles)

leased between GE and GECC; information technology (IT) and

other services sold to GECC by GE; aircraft engines manufactured

by GE that are installed on aircraft purchased by GECC from third-

party producers for lease to others; and various investments,

loans and allocations of GE corporate overhead costs. For further

information related to intercompany eliminations, see Note 26.

Contractual Obligations

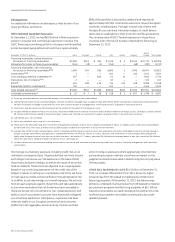

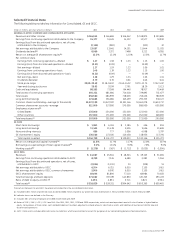

As defi ned by reporting regulations, our contractual obligations for future payments as of December 31, 2013, follow.

Payments due by period

(In billions) Total 2014 2015–2016 2017–2018

2019 and

thereafter

Borrowings and bank deposits (Note 10) $ 383.0 $ 116.7 $ 103.4 $ 59.4 $ 103.5

Interest on borrowings and bank deposits 91.4 9.6 14.0 10.7 57.1

Purchase obligations (a) (b) 67.5 34.2 10.0 9.9 13.4

Insurance liabilities (Note 11) (c) 13.5 1.8 2.1 1.7 7.9

Operating lease obligations (Note 19) 4.3 0.9 1.4 1.0 1.0

Other liabilities (d) 86.7 22.1 9.7 6.4 48.5

Contractual obligations of discontinued operations (e) 3.3 3.3 — — —

(a) Included all take-or-pay arrangements, capital expenditures, contractual commitments to purchase equipment that will be leased to others, contractual commitments

related to factoring agreements, software acquisition/license commitments, contractual minimum programming commitments and any contractually required cash

payments for acquisitions.

(b) Excluded funding commitments entered into in the ordinary course of business by our financial services businesses. Further information on these commitments and other

guarantees is provided in Note 24.

(c) Included contracts with reasonably determinable cash flows such as structured settlements, guaranteed investment contracts, and certain property and casualty

contracts, and excluded long-term care, variable annuity and other life insurance contracts.

(d) Included an estimate of future expected funding requirements related to our pension and postretirement benefit plans and included liabilities for unrecognized tax

benefits. Because their future cash outflows are uncertain, the following non-current liabilities are excluded from the table above: deferred taxes, derivatives, deferred

revenue and other sundry items. For further information on certain of these items, see Notes 14 and 22.

(e) Included payments for other liabilities.