GE 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

GE 2013 ANNUAL REPORT 43

were partially offset by the effects of the stronger U.S. dollar

($0.1 billion).

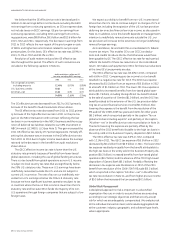

Oil & Gas orders increased 8% to $19.7 billion in 2013. Total

Oil & Gas backlog increased 27% to $18.8 billion at December 31,

2013, composed of equipment backlog of $13.0 billion and ser-

vices backlog of $5.8 billion. Comparable December 31, 2012

equipment and service order backlogs were $10.2 billion and

$4.5 billion, respectively.

ENERGY MANAGEMENT revenues of $7.6 billion increased $0.2 bil-

lion, or 2%, in 2013 as higher volume ($0.2 billion) was partially

offset by the effects of the stronger U.S. dollar ($0.1 billion).

Segment profi t of $0.1 billion decreased 16% in 2013 as a

result of lower productivity ($0.1 billion).

Energy Management revenues of $7.4 billion increased

$1.0 billion (including $1.0 billion from acquisitions), or 15%, in

2012 as higher volume ($1.1 billion), primarily driven by acqui-

sitions, higher prices ($0.1 billion) and increased other income

($0.1 billion) were partially offset by the effects of the stronger

U.S. dollar ($0.2 billion).

Segment profi t of $0.1 billion increased $0.1 billion, or 68%, in

2012 as a result of higher prices ($0.1 billion) and increased other

income ($0.1 billion).

Energy Management orders increased 12% to $8.8 billion

in 2013. Total Energy Management backlog increased 20% to

$4.6 billion at December 31, 2013, composed of equipment back-

log of $3.6 billion and services backlog of $1.0 billion. Comparable

December 31, 2012 equipment and service order backlogs were

$3.2 billion and $0.6 billion, respectively.

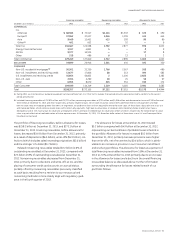

AVIATION revenues of $21.9 billion increased $1.9 billion (including

$0.5 billion from acquisitions), or 10%, in 2013 due primarily to

higher volume ($1.4 billion) and higher prices ($0.6 billion). Higher

volume and higher prices were driven by increased services

revenues ($0.7 billion) and equipment ($1.2 billion). The increase in

services revenue was primarily due to higher commercial spares

sales, while the increase in equipment revenue was primarily due

to increased commercial engine shipments.

Segment profi t of $4.3 billion increased $0.6 billion, or 16%,

in 2013 as higher prices ($0.6 billion), higher volume ($0.2 billion)

and increased other income ($0.1 billion) were partially offset

by the effects of infl ation ($0.2 billion) and lower productivity

($0.1 billion).

Aviation revenues of $20.0 billion increased $1.1 billion, or

6%, in 2012 due primarily to higher prices ($0.8 billion) and higher

volume ($0.4 billion), which were driven by increased commercial

and military engine sales.

Segment profi t of $3.7 billion increased $0.2 billion, or 7%, in

2012 as higher prices ($0.8 billion) and higher volume ($0.1 billion)

were partially offset by higher infl ation ($0.3 billion) and lower

productivity ($0.3 billion).

Aviation orders increased 16% to $27.2 billion in 2013. Total

Aviation backlog increased 22% to $125.1 billion at December 31,

2013, composed of equipment backlog of $28.4 billion and

services backlog of $96.7 billion. Comparable December 31, 2012

equipment and service order backlogs were $22.9 billion and

$79.5 billion, respectively.

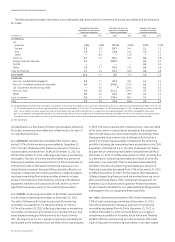

HEALTHCARE revenues of $18.2 billion decreased $0.1 billion

in 2013. Revenues decreased as lower prices ($0.3 billion), the

effects of the stronger U.S. dollar ($0.2 billion) and lower other

income were partially offset by higher volume ($0.5 billion).

Segment profi t of $3.0 billion increased $0.1 billion, or 4%,

in 2013 as higher productivity ($0.6 billion), driven by SG&A cost

reductions, and higher volume ($0.1 billion) were partially offset

by lower prices ($0.3 billion), the effects of infl ation ($0.2 billion),

the stronger U.S. dollar ($0.1 billion) and lower other income.

Healthcare revenues of $18.3 billion increased $0.2 billion,

or 1%, in 2012 as higher volume ($0.8 billion) and other income

($0.1 billion) were partially offset by the stronger U.S. dollar

($0.4 billion) and lower prices ($0.3 billion). The revenue increase,

driven by higher equipment sales, is attributable to international

markets, with the strongest growth in emerging markets.

Segment profi t of $2.9 billion increased $0.1 billion, or 4%,

in 2012 as increased productivity ($0.4 billion), higher volume

($0.1 billion) and other income ($0.1 billion) were partially offset by

lower prices ($0.3 billion) and higher infl ation ($0.2 billion), primar-

ily non-material related.

Healthcare orders increased 1% to $19.2 billion in 2013. Total

Healthcare backlog increased 5% to $16.1 billion at December 31,

2013, composed of equipment backlog of $5.0 billion and ser-

vices backlog of $11.1 billion. Comparable December 31, 2012

equipment and service order backlogs were $4.5 billion and

$10.9 billion, respectively.

TRANSPORTATION revenues of $5.9 billion increased $0.3 billion,

or 5%, in 2013 due to higher volume ($0.3 billion) primarily

from acquisitions.

Segment profi t of $1.2 billion increased $0.1 billion, or 13%, in

2013 as a result of effects of material defl ation ($0.1 billion) and

higher volume and productivity.

Transportation revenues of $5.6 billion increased $0.7 billion,

or 15%, in 2012 due to higher volume ($0.6 billion) and higher

prices ($0.1 billion). The revenue increase was split between

equipment sales ($0.4 billion) and services ($0.3 billion). The

increase in equipment revenue was primarily driven by an

increase in U.S. locomotive sales and growth in our global mining

equipment business. The increase in service revenue was due to

higher overhauls and increased service productivity.

Segment profi t of $1.0 billion increased $0.3 billion, or 36%,

in 2012 as a result of higher volume ($0.1 billion), higher prices

($0.1 billion) and increased productivity ($0.1 billion), refl ecting

improved service margins.

Transportation orders decreased 8% to $5.1 billion in 2013.

Total Transportation backlog increased 3% to $14.9 billion

at December 31, 2013, composed of equipment backlog of

$2.5 billion and services backlog of $12.4 billion. Comparable

December 31, 2012 equipment and service order backlogs were

$3.3 billion and $11.1 billion, respectively.