GE 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

62 GE 2013 ANNUAL REPORT

We evaluate our cash fl ow performance by reviewing our

industrial (non-fi nancial services) businesses and fi nancial ser-

vices businesses separately. Cash from operating activities (CFOA)

is the principal source of cash generation for our industrial busi-

nesses. The industrial businesses also have liquidity available via

the public capital markets. Our fi nancial services businesses use

a variety of fi nancial resources to meet our capital needs. Cash

for fi nancial services businesses is primarily provided from the

issuance of term debt and commercial paper in the public and

private markets and deposits, as well as fi nancing receivables col-

lections, sales and securitizations.

GE Cash Flows

GE cash and equivalents were $13.7 billion at December 31, 2013

compared with $15.5 billion at December 31, 2012. GE CFOA

totaled $14.3 billion, $17.8 billion and $12.1 billion in 2013, 2012

and 2011, respectively. With respect to GE CFOA, we believe that

it is useful to supplement our GE Statement of Cash Flows and to

examine in a broader context the business activities that provide

and require cash.

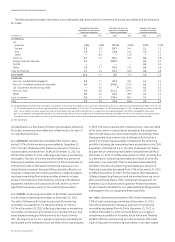

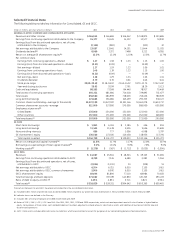

For the years ended December 31 (In billions) 2013 2012 2011

Operating cash collections (a) $ 104.8 $ 105.4 $ 93.6

Operating cash payments (96.5) (94.0) (81.5)

Cash dividends from GECC 6.0 6.4 —

GE cash from operating activities

(GE CFOA) (a) $ 14.3 $ 17.8 $ 12.1

(a) GE sells customer receivables to GECC in part to fund the growth of our

industrial businesses. These transactions can result in cash generation or cash

use. During any given period, GE receives cash from the sale of receivables to

GECC. It also foregoes collection of cash on receivables sold. The incremental

amount of cash received from sale of receivables in excess of the cash GE would

have otherwise collected had those receivables not been sold, represents the

cash generated or used in the period relating to this activity. The incremental

cash generated in GE CFOA from selling these receivables to GECC increased

GE’s CFOA by $0.1 billion, $1.9 billion and $1.2 billion in 2013, 2012 and 2011,

respectively. See Note 26 for additional information about the elimination of

intercompany transactions between GE and GECC.

The most signifi cant source of cash in GE CFOA is customer-

related activities, the largest of which is collecting cash resulting

from product or services sales. GE operating cash collections

decreased by $0.6 billion in 2013 compared with an increase of

$11.8 billion in 2012. In 2013, these changes are consistent with a

decrease in collections on long-term contracts and increases in

current receivables, partially offset by increased progress collec-

tions and improved segment revenues, including the impact of

acquisitions, primarily at Aviation and Oil & Gas. In 2012, these

changes are consistent with the changes in comparable GE

segment revenues, including the impact of acquisitions, primarily

at Oil & Gas and Energy Management. Analyses of segment

revenues discussed in the preceding Segment Operations section

provide additional information regarding our CFOA.

The most signifi cant operating use of cash is to pay our sup-

pliers, employees, tax authorities and others for a wide range of

material and services. GE operating cash payments increased

by $2.5 billion and $12.5 billion in 2013 and 2012, respectively.

In 2013, these changes are consistent with NBCU deal-related

tax payments and payouts under our long-term incentive plan,

partially offset by the non-recurrence of principal pension plan

funding. In 2012, these changes are consistent with the changes

in GE total costs and expenses, including the impact of acquisi-

tions, primarily at Oil & Gas and Energy Management.

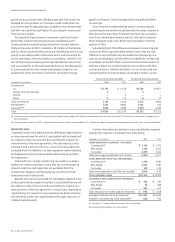

Dividends from GECC, including special dividends, represent

the distribution of a portion of GECC retained earnings, and are

distinct from cash from continuing operating activities within the

fi nancial services businesses. The amounts we show in GE CFOA

are the total dividends, including special dividends from excess

capital. Beginning in the second quarter of 2012, GECC restarted

its dividend to GE. GECC paid quarterly dividends of $1.9 billion in

both 2013 and 2012. In addition, GECC paid special dividends of

$4.1 billion and $4.5 billion in 2013 and 2012, respectively, to GE.

There were no dividends received from GECC in 2011.

GE cash from investing activities was $4.8 billion for 2013

compared with cash used of $5.4 billion and $8.2 billion for 2012

and 2011, respectively. GE cash fl ows from investing activities

increased $10.2 billion during 2013 compared with 2012, pri-

marily due to proceeds of $16.7 billion from the 2013 sale of our

remaining 49% common equity interest in NBCU LLC to Comcast,

partially offset by the 2013 acquisitions of Avio for $4.4 billion and

Lufkin for $3.3 billion.

GE cash used for investing activities decreased by $2.8 bil-

lion during 2012 compared with 2011 primarily due to decreased

business acquisition activity of $9.7 billion driven by 2011 acqui-

sitions of Converteam, the Well Support division of John Wood

Group PLC, Dresser, Inc., Wellstream PLC and Lineage Power

Holdings, Inc. This was offset by decreased business disposition

activity of $5.7 billion driven by cash received in 2011 related to

the formation of NBCU LLC ($6.2 billion) and an increase in addi-

tions to property, plant and equipment of $1.0 billion in 2012.

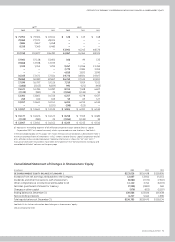

GE cash used for fi nancing activities was $20.9 billion, $5.3 bil-

lion and $14.6 billion for 2013, 2012 and 2011, respectively.

Cash used for fi nancing activities increased $15.6 billion com-

pared with 2012, primarily as a result of our 2013 repayment of

$5.0 billion of GE unsecured notes compared with an issuance

of $7.0 billion of notes in 2012. Additionally, increases in cash

used in 2013 were a result of increased repurchases of GE shares

for treasury in accordance with our share repurchase program

of $5.2 billion and increased dividends paid to shareowners of

$0.6 billion in 2013.

GE cash used for fi nancing activities decreased $9.3 billion

compared with 2011 primarily due to an issuance of $7.0 billion of

notes in 2012 and non-recurrence of two transactions from 2011.

In 2011, prior to the formation of NBCU LLC, GE purchased the

remaining shares of Vivendi S.A.’s 12.3% interest in NBC Universal

for $3.9 billion. Additionally, GE redeemed preferred shares from

Berkshire Hathaway Inc. at a redemption price of $3.3 billion.

The impacts of these 2011 transactions were partially offset by

increased repurchases of GE shares for treasury in accordance

with our share repurchase program of $2.9 billion and increased

dividends paid to shareowners of $0.7 billion in 2012.

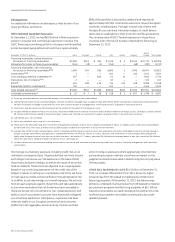

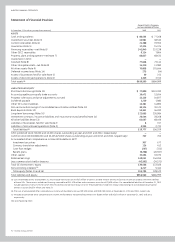

GECC Cash Flows

GECC cash from operating activities totaled $19.9 billion,

$21.7 billion and $20.6 billion in 2013, 2012 and 2011, respectively.

Cash from operating activities decreased $1.9 billion during

2013 compared with 2012, primarily due to decreases in net

cash collateral held from counterparties on derivative contracts