GE 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 GE 2013 ANNUAL REPORT

expected to be in effect when taxes are actually paid or recov-

ered. Deferred income tax assets represent amounts available to

reduce income taxes payable on taxable income in future years.

We evaluate the recoverability of these future tax deductions and

credits by assessing the adequacy of future expected taxable

income from all sources, including reversal of taxable temporary

differences, forecasted operating earnings and available tax plan-

ning strategies. To the extent we do not consider it more likely

than not that a deferred tax asset will be recovered, a valuation

allowance is established.

Our businesses are subject to regulation under a wide variety

of U.S. federal, state and foreign tax laws, regulations and policies.

Changes to these laws or regulations may affect our tax liability,

return on investments and business operations. For example,

GE’s effective tax rate is reduced because active business income

earned and indefi nitely reinvested outside the United States is

taxed at less than the U.S. rate. A signifi cant portion of this reduc-

tion depends upon a provision of U.S. tax law that defers the

imposition of U.S. tax on certain active fi nancial services income

until that income is repatriated to the United States as a dividend.

This provision is consistent with international tax norms and

permits U.S. fi nancial services companies to compete more effec-

tively with foreign banks and other foreign fi nancial institutions

in global markets. This provision, which had expired at the end of

2011, was reinstated in January 2013 retroactively for two years

through the end of 2013. The provision had been scheduled to

expire and had been extended by Congress on six previous occa-

sions, but there can be no assurance that it will continue to be

extended. In the event the provision is not extended after 2013,

the current U.S. tax imposed on active fi nancial services income

earned outside the United States would increase, making it more

diffi cult for U.S. fi nancial services companies to compete in global

markets. If this provision is not extended, we expect our effective

tax rate to increase signifi cantly after 2014.

We have not provided U.S. deferred taxes on cumulative earn-

ings of non-U.S. affi liates and associated companies that have

been reinvested indefi nitely. These earnings relate to ongoing

operations and, at December 31, 2013 and December 31, 2012,

were approximately $110 billion and $108 billion, respectively.

Most of these earnings have been reinvested in active non-U.S.

business operations and we do not intend to repatriate these

earnings to fund U.S. operations. Because of the availability of

U.S. foreign tax credits, it is not practicable to determine the U.S.

federal income tax liability that would be payable if such earnings

were not reinvested indefi nitely. Deferred taxes are provided for

earnings of non-U.S. affi liates and associated companies when

we plan to remit those earnings.

Annually, we fi le over 5,800 income tax returns in over 250

global taxing jurisdictions. We are under examination or engaged

in tax litigation in many of these jurisdictions. During 2013, the

Internal Revenue Service (IRS) completed the audit of our con-

solidated U.S. income tax returns for 2008–2009, except for

certain issues that remain under examination. During 2011, the

IRS completed the audit of our consolidated U.S. income tax

returns for 2006–2007, except for certain issues that remained

under examination. At December 31, 2013, the IRS was auditing

our consolidated U.S. income tax returns for 2010–2011. In addi-

tion, certain other U.S. tax defi ciency issues and refund claims for

previous years were unresolved. The IRS has disallowed the tax

loss on our 2003 disposition of ERC Life Reinsurance Corporation.

We have contested the disallowance of this loss. It is reasonably

possible that the unresolved items could be resolved during the

next 12 months, which could result in a decrease in our balance

of “unrecognized tax benefi ts”—that is, the aggregate tax effect

of differences between tax return positions and the benefi ts rec-

ognized in our fi nancial statements. We believe that there are no

other jurisdictions in which the outcome of unresolved issues or

claims is likely to be material to our results of operations, fi nan-

cial position or cash fl ows. We further believe that we have made

adequate provision for all income tax uncertainties. Resolution

of audit matters, including the IRS audit of our consolidated U.S.

income tax returns for 2008–2009, reduced our 2013 consoli-

dated income tax rate by 2.8 percentage points. Resolution of

audit matters, including the IRS audit of our consolidated U.S.

income tax returns for 2006–2007, reduced our 2011 consolidated

effective tax rate by 2.4 percentage points.

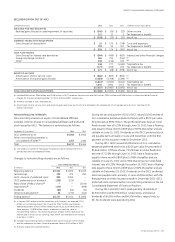

The balance of unrecognized tax benefi ts, the amount of

related interest and penalties we have provided and what we

believe to be the range of reasonably possible changes in the

next 12 months were:

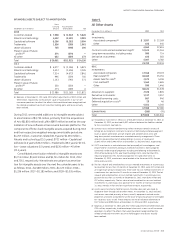

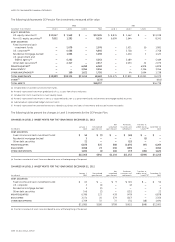

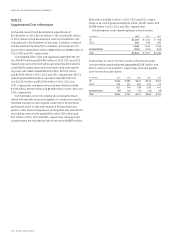

December 31 (In millions) 2013 2012

Unrecognized tax benefits $ 5,816 $ 5,445

Portion that, if recognized, would reduce

tax expense and effective tax rate (a) 4,307 4,032

Accrued interest on unrecognized tax benefits 975 961

Accrued penalties on unrecognized tax benefits 164 173

Reasonably possible reduction to the balance

of unrecognized tax benefits in succeeding

12 months 0–900 0–800

Portion that, if recognized, would reduce

tax expense and effective tax rate (a) 0–350 0–700

(a) Some portion of such reduction might be reported as discontinued operations.

A reconciliation of the beginning and ending amounts of unrec-

ognized tax benefi ts is as follows:

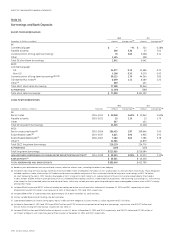

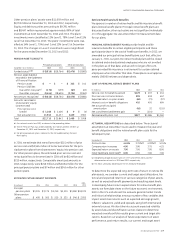

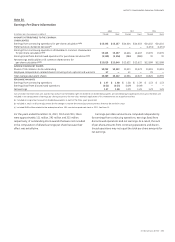

(In millions) 2013 2012

Balance at January 1 $ 5,445 $ 5,230

Additions for tax positions of the current year 771 293

Additions for tax positions of prior years 872 882

Reductions for tax positions of prior years (1,140) (723)

Settlements with tax authorities (98) (191)

Expiration of the statute of limitations (34) (46)

Balance at December 31 $ 5,816 $ 5,445

We classify interest on tax defi ciencies as interest expense; we

classify income tax penalties as provision for income taxes. For

the years ended December 31, 2013, 2012 and 2011, $22 mil-

lion, $(45) million and $(197) million of interest expense (income),

respectively, and $0 million, $33 million and $10 million of tax

expense (income) related to penalties, respectively, were recog-

nized in the Statement of Earnings.