GE 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2013 ANNUAL REPORT 125

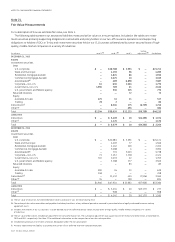

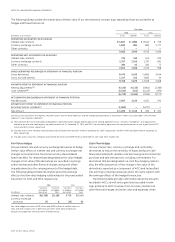

LEVEL 3 MEASUREMENTS

The following table presents information relating to the signifi cant unobservable inputs of our Level 3 recurring and non-

recurring measurements.

(Dollars in millions) Fair value Valuation technique Unobservable inputs Range (weighted average)

DECEMBER 31, 2013

RECURRING FAIR VALUE MEASUREMENTS

Investment securities

Debt

U.S. corporate $ 898 Income approach Discount rate (a) 1.5%–13.3% (6.5%)

Asset-backed 6,854 Income approach Discount rate (a) 1.2%–10.5% (3.7%)

Corporate—non-U.S. 819 Income approach Discount rate (a) 1.4%–46.0% (15.1%)

Other financial assets 381 Income approach,

Market comparables

Weighted average

cost of capital 9.3%–9.3% (9.3%)

EBITDA multiple 5.4X–12.5X (9.5X)

Discount rate (a) 5.2%–8.8% (5.3%)

Capitalization rate (b) 6.3%–7.5% (7.2%)

NON-RECURRING FAIR VALUE MEASUREMENTS

Financing receivables and loans held for sale $ 1,937 Income approach, Capitalization rate (b) 5.5%–16.7% (8.0%)

Business enterprise value EBITDA multiple 4.3X–5.5X (4.8X)

Discount rate (a) 6.6%–6.6% (6.6%)

Cost and equity method investments 102 Income approach, Discount rate (a) 5.7%–5.9% (5.8%)

Market comparables Capitalization rate (b) 8.5%–10.6% (10.0%)

Weighted average

cost of capital 9.3%–9.6% (9.4%)

EBITDA multiple 7.1X–14.5X (11.3X)

Revenue multiple 2.2X–12.6X (9.4X)

Long-lived assets, including real estate 694 Income approach Capitalization rate (b) 5.4%–14.5% (7.8%)

Discount rate (a) 4.0%–23.0% (9.0%)

DECEMBER 31, 2012

RECURRING FAIR VALUE MEASUREMENTS

Investment securities

Debt

U.S. corporate $ 1,652 Income approach Discount rate (a) 1.3%–29.9% (11.1%)

Asset-backed 4,977 Income approach Discount rate (a) 2.1%–13.1% (3.8%)

Corporate—non-U.S. 865 Income approach Discount rate (a) 1.5%–25.0% (13.2%)

Other financial assets 633 Income approach,

Market comparables

Weighted average

cost of capital 8.7%–10.2% (8.7%)

EBITDA multiple 4.9X–10.6X (7.9X)

NON-RECURRING FAIR VALUE MEASUREMENTS

Financing receivables and loans held for sale $ 2,835 Income approach, Capitalization rate (b) 3.8%–14.0% (8.0%)

Business enterprise value EBITDA multiple 2.0X–6.0X (4.8X)

Cost and equity method investments 72 Income approach Capitalization rate (b) 9.2%–12.8% (12.0%)

Long-lived assets, including real estate 985 Income approach Capitalization rate (b) 4.8%–14.6% (7.3%)

(a) Discount rates are determined based on inputs that market participants would use when pricing investments, including credit and liquidity risk. An increase in the discount

rate would result in a decrease in the fair value.

(b) Represents the rate of return on net operating income that is considered acceptable for an investor and is used to determine a property’s capitalized value. An increase in

the capitalization rate would result in a decrease in the fair value.

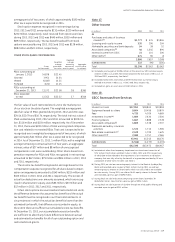

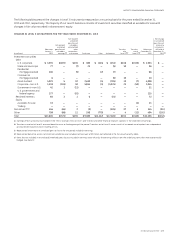

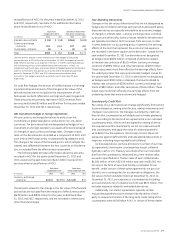

At December 31, 2013 and December 31, 2012, other Level 3

recurring fair value measurements of $2,816 million and

$3,146 million, respectively, and non-recurring measurements

of $1,460 million and $2,412 million, respectively, are valued

using non-binding broker quotes or other third-party sources.

For a description of our process to evaluate third-party pricing

servicers, see Note 1. At December 31, 2013 and December 31,

2012, other recurring fair value measurements of $327 million

and $370 million, respectively, and non-recurring fair value mea-

surements of $571 million and $285 million, respectively, were

individually insignifi cant and utilize a number of different unob-

servable inputs not subject to meaningful aggregation.