GE 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2013 ANNUAL REPORT 101

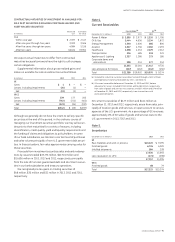

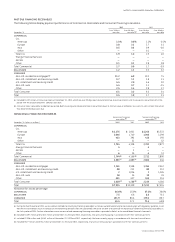

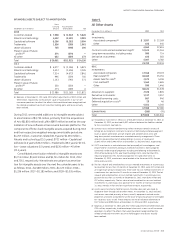

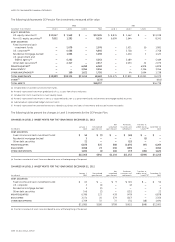

Consolidated depreciation and amortization related to property,

plant and equipment was $9,762 million, $9,192 million and

$8,986 million in 2013, 2012 and 2011, respectively. Amortization

of GECC equipment leased to others was $6,696 million,

$6,097 million and $6,063 million in 2013, 2012 and 2011,

respectively.

Noncancellable future rentals due from customers for equip-

ment on operating leases at December 31, 2013, are as follows:

(In millions)

Due in

2014 $ 7,168

2015 5,925

2016 4,838

2017 3,823

2018 3,070

2019 and later 7,695

Total $ 32,519

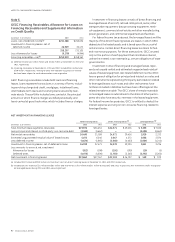

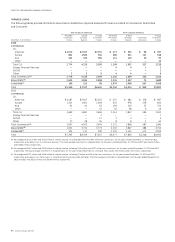

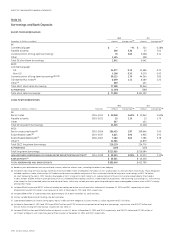

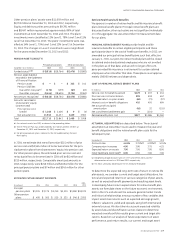

Note 8.

Goodwill and Other Intangible Assets

December 31 (In millions) 2013 2012

GOODWILL $ 77,648 $ 73,114

OTHER INTANGIBLE ASSETS—NET

Intangible assets subject to amortization $ 14,150 $ 11,821

Indefinite-lived intangible assets (a) 160 159

Total $ 14,310 $ 11,980

(a) Indefinite-lived intangible assets principally comprised in-process research and

development, trademarks and tradenames.

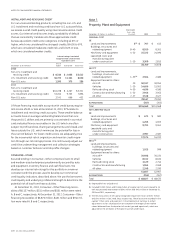

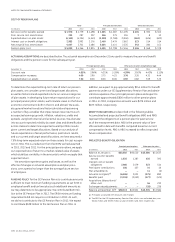

Upon closing an acquisition, we estimate the fair values of assets

and liabilities acquired and consolidate the acquisition as quickly

as possible. Given the time it takes to obtain pertinent informa-

tion to fi nalize the acquired company’s balance sheet, then to

adjust the acquired company’s accounting policies, procedures,

and books and records to our standards, it is often several

quarters before we are able to fi nalize those initial fair value

estimates. Accordingly, it is not uncommon for our initial estimates

to be subsequently revised.

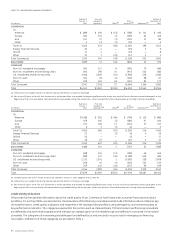

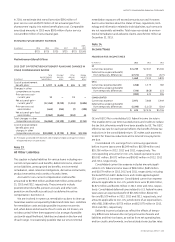

In August 2013, we acquired the aviation business of Avio

S.p.A. (Avio) for $4,449 million in cash. We recorded a pre-tax,

acquisition-related charge of $96 million related to the effec-

tive settlement of Avio’s pre-existing contractual relationships

with GE. Avio is a manufacturer of aviation propulsion compo-

nents and systems and is included in our Aviation segment. The

preliminary purchase price allocation resulted in goodwill of

$3,043 million and amortizable intangible assets of $1,830 million.

The allocation of the purchase price will be fi nalized upon com-

pletion of post-closing procedures.

In July 2013, we acquired Lufkin Industries, Inc. (Lufkin) for

$3,309 million in cash. Lufkin is a leading provider of artifi cial lift

technologies for the oil and gas industry and a manufacturer of

industrial gears and is included in our Oil & Gas segment. The

purchase price allocation resulted in goodwill of $2,027 million

and amortizable intangible assets of $997 million. The allocation

of the purchase price will be fi nalized upon completion of post-

closing procedures.

On March 27, 2012, we contributed a portion of our civil avion-

ics systems business to a newly formed joint venture in exchange

for 50% of the new entity. This resulted in the deconsolidation

of our civil avionics systems business and the recording of the

interest in the new joint venture at fair value. As a result, we rec-

ognized a pre-tax gain of $274 million ($152 million after tax) in

the fi rst quarter of 2012.

On September 2, 2011, we purchased a 90% interest in

Converteam for $3,586 million. In connection with the transac-

tion, we entered into an arrangement to purchase the remaining

10% at the two-year anniversary of the acquisition date for

343 million euros (approximately $465 million). This amount was

recorded as a liability at the date of acquisition and was paid out

in October 2013.

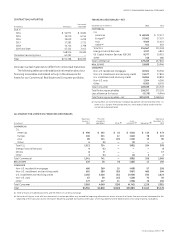

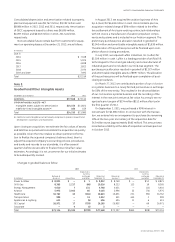

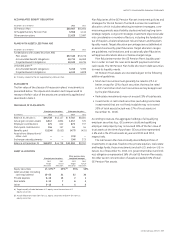

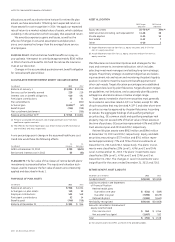

Changes in goodwill balances follow.

2013 2012

(In millions)

Balance at

January 1 Acquisitions

Dispositions,

currency

exchange

and other

Balance at

December 31

Balance at

January 1 Acquisitions

Dispositions,

currency

exchange

and other

Balance at

December 31

Power & Water $ 8,821 $ — $ 1 $ 8,822 $ 8,769 $ — $ 52 $ 8,821

Oil & Gas 8,365 2,217 (66) 10,516 8,233 113 19 8,365

Energy Management 4,610 7 131 4,748 4,621 — (11) 4,610

Aviation 5,975 3,043 85 9,103 5,996 55 (76) 5,975

Healthcare 16,762 45 (164) 16,643 16,631 221 (90) 16,762

Transportation 999 — 13 1,012 551 445 3 999

Appliances & Lighting 611 — (5) 606 594 11 6 611

GE Capital 26,971 17 (793) 26,195 26,902 — 69 26,971

Corporate — 4 (1) 3 — — — —

Total $ 73,114 $ 5,333 $ (799) $ 77,648 $ 72,297 $ 845 $ (28) $ 73,114