GE 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. GE 2013 ANNUAL REPORT 87

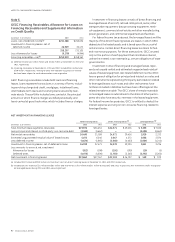

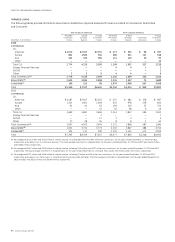

The dismissal of a lawsuit subsequent to December 31, 2013

decreased the pending claims amount by $123 million and the

Litigation Claims amount by $318 million. These claims refl ect the

purchase price or unpaid principal balances of the loans at the

time of purchase and do not give effect to pay downs, accrued

interest or fees, or potential recoveries based upon the underly-

ing collateral. As noted above, WMC believes that the Litigation

Claims confl ict with the governing agreements and applicable

law. As a result, WMC has not included the Litigation Claims in

its pending claims or in its estimates of future loan repurchase

requests and holds no related reserve as of December 31, 2013.

At this point, WMC is unable to develop a meaningful esti-

mate of reasonably possible loss in connection with the Litigation

Claims described above due to a number of factors, including the

extent to which courts will agree with the theories supporting

the Litigation Claims. The case law on these issues is unsettled,

and while several courts have supported some of the theories

underlying WMC’s legal defenses, other courts have rejected

them. There are a number of pending cases, including WMC

cases, which, in the coming months, could provide more certainty

regarding the legal status of these claims. An adverse court deci-

sion on any of the theories supporting the Litigation Claims could

increase WMC’s exposure in some or all of the 14 lawsuits, result

in a reclassifi cation of some or all of the Litigation Claims to pend-

ing claims and provoke new claims and lawsuits on additional

loans. However, WMC continues to believe that it has defenses

to all the claims asserted in litigation, including, for example,

causation and materiality requirements, limitations on remedies

for breach of representations and warranties, and the appli-

cable statutes of limitations. To the extent WMC is required to

repurchase loans, WMC’s loss also would be affected by several

factors, including pay downs, accrued interest and fees, and the

value of the underlying collateral. It is not possible to predict the

outcome or impact of these defenses and other factors, any one

of which could materially affect the amount of any loss ultimately

incurred by WMC on these claims.

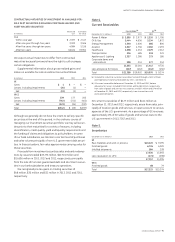

WMC has received claims on approximately $2,200 million

of mortgage loans after the expiration of the statute of limita-

tions as of December 31, 2013, $1,700 million of which are also

included as Litigation Claims. WMC has also received unspeci-

fi ed indemnifi cation demands from depositors/underwriters/

sponsors of residential mortgage-backed securities (RMBS) in

connection with lawsuits brought by RMBS investors concerning

alleged misrepresentations in the securitization offering docu-

ments to which WMC is not a party. WMC believes that it has

defenses to these demands.

The reserve estimates refl ect judgment, based on currently

available information, and a number of assumptions, including

economic conditions, claim activity, pending and threatened liti-

gation, indemnifi cation demands, estimated repurchase rates,

and other activity in the mortgage industry. Actual losses arising

from claims against WMC could exceed the reserve amount and

additional claims and lawsuits could result if actual claim rates,

governmental actions, litigation and indemnifi cation activity,

adverse court decisions, settlement activity, actual repurchase

rates or losses WMC incurs on repurchased loans differ from its

assumptions. It is diffi cult to develop a meaningful estimate of

aggregate possible claims exposure because of uncertainties

surrounding economic conditions, the ability and propensity

of mortgage loan holders to present and resolve valid claims,

governmental actions, mortgage industry activity and litiga-

tion, court decisions affecting WMC’s defenses, and pending and

threatened litigation and indemnifi cation demands against WMC.

WMC revenues and other income (loss) from discontinued

operations were $(346) million, $(500) million and $(42) million

in 2013, 2012 and 2011, respectively. In total, WMC’s earnings

(loss) from discontinued operations, net of taxes, were $(232)

million, $(337) million and $(34) million in 2013, 2012 and 2011,

respectively.

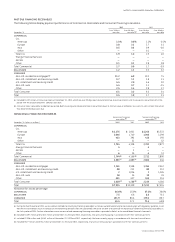

OTHER FINANCIAL SERVICES

In the fourth quarter of 2013, we announced the planned dis-

position of Consumer Russia and classifi ed the business as

discontinued operations. Consumer Russia revenues and other

income (loss) from discontinued operations were $260 million,

$276 million and $280 million in 2013, 2012 and 2011, respec-

tively. Consumer Russia earnings (loss) from discontinued

operations, net of taxes, were $(193) million (including a $170 mil-

lion loss on the planned disposal), $33 million and $87 million in

2013, 2012 and 2011, respectively.

In the fi rst quarter of 2013, we announced the planned dis-

position of CLL Trailer Services and classifi ed the business as

discontinued operations. We completed the sale in the fourth

quarter of 2013 for proceeds of $528 million. CLL Trailer Services

revenues and other income (loss) from discontinued operations

were $271 million, $399 million and $464 million in 2013, 2012 and

2011, respectively. CLL Trailer Services earnings (loss) from dis-

continued operations, net of taxes, were $(2) million (including an

$18 million gain on disposal), $22 million and $17 million in 2013,

2012 and 2011, respectively.

In the fi rst quarter of 2012, we announced the planned dis-

position of Consumer Ireland and classifi ed the business as

discontinued operations. We completed the sale in the third

quarter of 2012 for proceeds of $227 million. Consumer Ireland

revenues and other income (loss) from discontinued operations

were an insignifi cant amount, $7 million and $13 million in 2013,

2012 and 2011, respectively. Consumer Ireland earnings (loss)

from discontinued operations, net of taxes, were $6 million, $(195)

million (including a $121 million loss on disposal) and $(153) mil-

lion in 2013, 2012 and 2011, respectively.