GE 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 GE 2013 ANNUAL REPORT

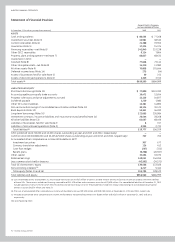

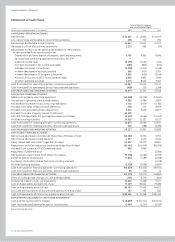

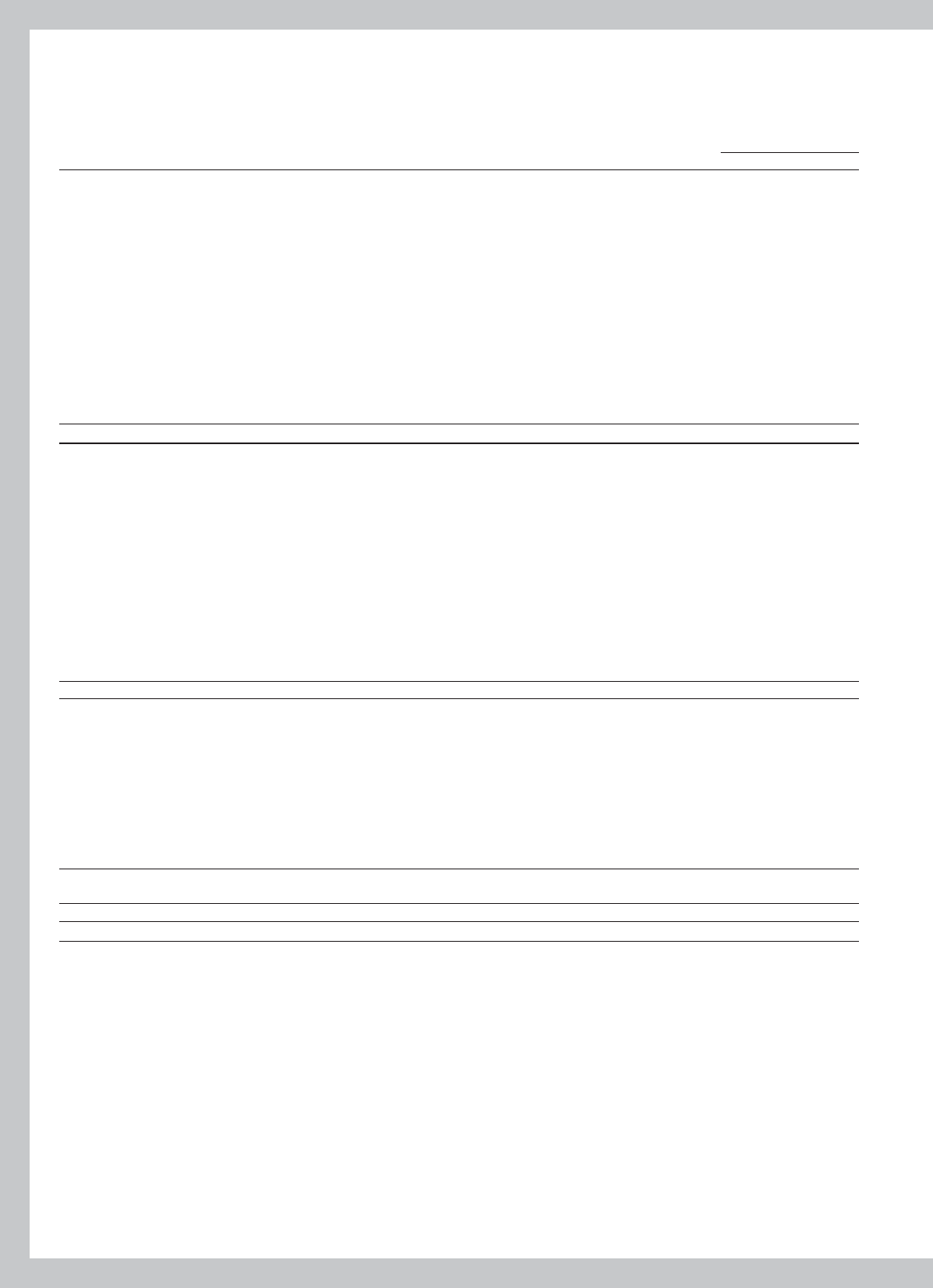

Statement of Financial Position

General Electric Company

and consolidated affiliates

At December 31 (In millions, except share amounts) 2013 2012

ASSETS

Cash and equivalents $ 88,555 $ 77,268

Investment securities (Note 3) 43,981 48,510

Current receivables (Note 4) 21,388 19,902

Inventories (Note 5) 17,325 15,374

Financing receivables—net (Note 6) 241,940 257,238

Other GECC receivables 9,114 7,864

Property, plant and equipment—net (Note 7) 68,827 68,633

Investment in GECC — —

Goodwill (Note 8) 77,648 73,114

Other intangible assets—net (Note 8) 14,310 11,980

All other assets (Note 9) 70,808 101,644

Deferred income taxes (Note 14) 275 (54)

Assets of businesses held for sale (Note 2) 50 211

Assets of discontinued operations (Note 2) 2,339 3,315

Total assets (a) $ 656,560 $ 684,999

LIABILITIES AND EQUITY

Short-term borrowings (Note 10) $ 77,890 $ 101,392

Accounts payable, principally trade accounts 16,471 15,654

Progress collections and price adjustments accrued 13,125 10,877

Dividends payable 2,220 1,980

Other GE current liabilities 13,381 14,895

Non-recourse borrowings of consolidated securitization entities (Note 10) 30,124 30,123

Bank deposits (Note 10) 53,361 46,200

Long-term borrowings (Note 10) 221,665 236,084

Investment contracts, insurance liabilities and insurance annuity benefits (Note 11) 26,544 28,268

All other liabilities (Note 13) 61,057 68,166

Liabilities of businesses held for sale (Note 2) 6 157

Liabilities of discontinued operations (Note 2) 3,933 2,733

Total liabilities (a) 519,777 556,529

GECC preferred stock (50,000 and 40,000 shares outstanding at year-end 2013 and 2012, respectively) — —

Common stock (10,060,881,000 and 10,405,625,000 shares outstanding at year-end 2013 and 2012, respectively) 702 702

Accumulated other comprehensive income attributable to GE (b)

Investment securities 307 677

Currency translation adjustments 126 412

Cash flow hedges (257) (722)

Benefit plans (9,296) (20,597)

Other capital 32,494 33,070

Retained earnings 149,051 144,055

Less common stock held in treasury (42,561) (34,571)

Total GE shareowners’ equity 130,566 123,026

Noncontrolling interests (c) 6,217 5,444

Total equity (Notes 15 and 16) 136,783 128,470

Total liabilities and equity $ 656,560 $ 684,999

(a) Our consolidated assets at December 31, 2013 include total assets of $47,367 million of certain variable interest entities (VIEs) that can only be used to settle the liabilities

of those VIEs. These assets include net financing receivables of $41,420 million and investment securities of $3,830 million. Our consolidated liabilities at December 31, 2013

include liabilities of certain VIEs for which the VIE creditors do not have recourse to GE. These liabilities include non-recourse borrowings of consolidated securitization

entities (CSEs) of $28,574 million. See Note 23.

(b) The sum of accumulated other comprehensive income attributable to GE was $(9,120) million and $(20,230) million at December 31, 2013 and 2012, respectively.

(c) Included accumulated other comprehensive income attributable to noncontrolling interests of $(180) million and $(155) million at December 31, 2013 and 2012,

respectively.

See accompanying notes.