GE 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2013 ANNUAL REPORT 93

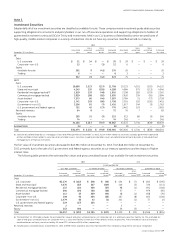

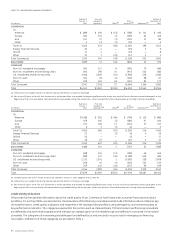

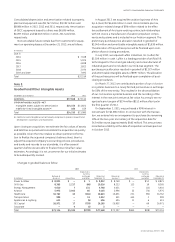

CONTRACTUAL MATURITIES

(In millions) Total loans

Net rentals

receivable

Due in

2014 $ 54,971 $ 8,184

2015 19,270 6,114

2016 19,619 4,209

2017 17,281 2,733

2018 14,714 1,798

2019 and later 43,121 3,452

168,976 26,490

Consumer revolving loans 62,292 —

Total $ 231,268 $ 26,490

We expect actual maturities to differ from contractual maturities.

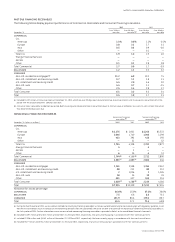

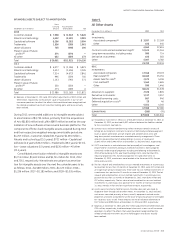

The following tables provide additional information about our

fi nancing receivables and related activity in the allowance for

losses for our Commercial, Real Estate and Consumer portfolios.

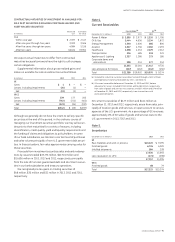

FINANCING RECEIVABLES — NET

December 31 (In millions) 2013 2012

COMMERCIAL

CLL

Americas $ 68,585 $ 72,517

Europe

(a) 37,962 37,037

Asia 9,469 11,401

Other

(a) 451 603

Total CLL 116,467 121,558

Energy Financial Services 3,107 4,851

GE Capital Aviation Services (GECAS) 9,377 10,915

Other 318 486

Total Commercial 129,269 137,810

REAL ESTATE 19,899 20,946

CONSUMER

Non-U.S. residential mortgages 30,501 33,350

Non-U.S. installment and revolving credit 13,677 17,816

U.S. installment and revolving credit 55,854 50,853

Non-U.S. auto 2,054 4,260

Other 6,953 8,070

Total Consumer 109,039 114,349

Total financing receivables 258,207 273,105

Less allowance for losses (5,178) (4,944)

Total financing receivables—net $ 253,029 $ 268,161

(a) During 2013, we transferred our European equipment services portfolio from CLL

Other to CLL Europe. Prior-period amounts were reclassified to conform to the

current period presentation.

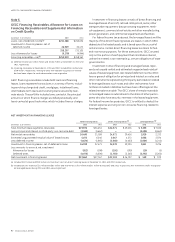

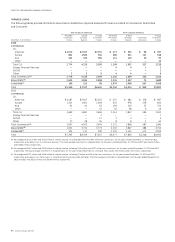

ALLOWANCE FOR LOSSES ON FINANCING RECEIVABLES

(In millions)

Balance at

January 1,

2013

Provision

charged to

operations Other

(a) Gross

write-offs

(b) Recoveries

(b)

Balance at

December 31,

2013

COMMERCIAL

CLL

Americas $ 490 $ 292 $ (1) $ (422) $ 114 $ 473

Europe 445 321 12 (441) 78 415

Asia 80 124 (11) (115) 12 90

Other 6 (3) — (3) — —

Total CLL 1,021 734 — (981) 204 978

Energy Financial Services 9 (1) — — — 8

GECAS 8 9 — — — 17

Other 3 (1) — (2) 2 2

Total Commercial 1,041 741 — (983) 206 1,005

REAL ESTATE 320 28 (4) (163) 11 192

CONSUMER

Non-U.S. residential mortgages 480 269 10 (458) 57 358

Non-U.S. installment and revolving credit 582 589 (93) (967) 483 594

U.S. installment and revolving credit 2,282 3,006 (51) (2,954) 540 2,823

Non-U.S. auto 67 58 (13) (126) 70 56

Other 172 127 11 (236) 76 150

Total Consumer 3,583 4,049 (136) (4,741) 1,226 3,981

Total $ 4,944 $ 4,818 $ (140) $ (5,887) $ 1,443 $ 5,178

(a) Other primarily included dispositions and the effects of currency exchange.

(b) Net write-offs (gross write-offs less recoveries) in certain portfolios may exceed the beginning allowance for losses as a result of losses that are incurred subsequent to the

beginning of the fiscal year due to information becoming available during the current year, which may identify further deterioration on existing financing receivables.