GE 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140 GE 2013 ANNUAL REPORT

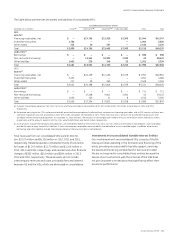

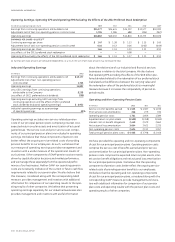

Operating Earnings, Operating EPS and Operating EPS Excluding the Effects of the 2011 Preferred Stock Redemption

(In millions; except earnings per share) 2013 2012 2011 2010 2009

Earnings from continuing operations attributable to GE $ 15,177 $ 14,624 $ 14,122 $ 12,577 $ 10,993

Adjustment (net of tax): non-operating pension costs (income) 1,705 1,386 688 (204) (967)

Operating earnings $ 16,882 $ 16,010 $ 14,810 $ 12,373 $ 10,026

EARNINGS PER SHARE—DILUTED (a)

Continuing earnings per share $ 1.47 $ 1.38 $ 1.23 $ 1.15 $ 1.00

Adjustment (net of tax): non-operating pension costs (income) 0.16 0.13 0.06 (0.02) (0.09)

Operating earnings per share 1.64 1.51 1.30 1.13 0.91

Less effects of the 2011 preferred stock redemption — — 0.08 — —

Operating EPS excluding the effects of the 2011 preferred stock redemption $ 1.64 $ 1.51 $ 1.37 $ 1.13 $ 0.91

(a) Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total.

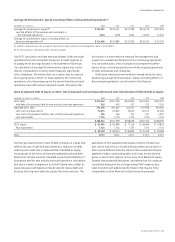

Industrial Operating Earnings

(In millions) 2013

Earnings from continuing operations attributable to GE $ 15,177

Adjustments (net of tax): non-operating pension

costs (income) 1,705

Operating earnings 16,882

Less GECC earnings from continuing operations

attributable to the Company 8,258

Less effect of GECC preferred stock dividends (298)

Operating earnings excluding GECC earnings from

continuing operations and the effect of GECC preferred

stock dividends (Industrial operating earnings) $ 8,922

Industrial operating earnings as a percentage

of operating earnings 53%

Operating earnings excludes non-service-related pension

costs of our principal pension plans comprising interest cost,

expected return on plan assets and amortization of actuarial

gains/losses. The service cost and prior service cost compo-

nents of our principal pension plans are included in operating

earnings. We believe that these components of pension cost

better refl ect the ongoing service-related costs of providing

pension benefi ts to our employees. As such, we believe that

our measure of operating earnings provides management and

investors with a useful measure of the operational results of

our business. Other components of GAAP pension cost are mainly

driven by capital allocation decisions and market performance,

and we manage these separately from the operational perfor-

mance of our businesses. Neither GAAP nor operating pension

costs are necessarily indicative of the current or future cash fl ow

requirements related to our pension plan. We also believe that

this measure, considered along with the corresponding GAAP

measure, provides management and investors with additional

information for comparison of our operating results to the oper-

ating results of other companies. We believe that presenting

operating earnings separately for our industrial businesses also

provides management and investors with useful information

about the relative size of our industrial and fi nancial services

businesses in relation to the total company. We also believe

that operating EPS excluding the effects of the $0.8 billion pre-

ferred dividend related to the redemption of our preferred stock

(calculated as the difference between the carry ing value and

the redemption value of the preferred stock) is a meaningful

measure because it increases the comparability of period-to-

period results.

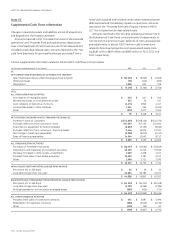

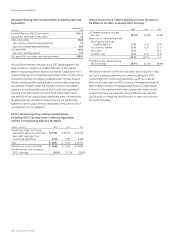

Operating and Non-Operating Pension Costs

(In millions) 2013 2012 2011

Service cost for benefits earned $ 1,535 $ 1,387 $ 1,195

Prior service cost amortization 246 279 194

Operating pension costs 1,781 1,666 1,389

Expected return on plan assets (3,500) (3,768) (3,940)

Interest cost on benefit obligations 2,460 2,479 2,662

Net actuarial loss amortization 3,664 3,421 2,335

Non-operating pension costs 2,624 2,132 1,057

Total principal pension plans costs $ 4,405 $ 3,798 $ 2,446

We have provided the operating and non-operating components

of cost for our principal pension plans. Operating pension costs

comprise the service cost of benefi ts earned and prior service

cost amortization for our principal pension plans. Non-operating

pension costs comprise the expected return on plan assets, inter-

est cost on benefi t obligations and net actuarial loss amortization

for our principal pension plans. We believe that the operating

components of pension costs better refl ect the ongoing service-

related costs of providing pension benefi ts to our employees.

We believe that the operating and non-operating components

of cost for our principal pension plans, considered along with the

corresponding GAAP measure, provide management and inves-

tors with additional information for comparison of our pension

plan costs and operating results with the pension plan costs and

operating results of other companies.