GE 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 GE 2013 ANNUAL REPORT

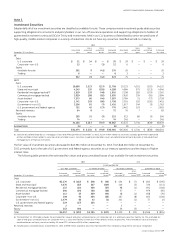

Note 6.

GECC Financing Receivables, Allowance for Losses on

Financing Receivables and Supplemental Information

on Credit Quality

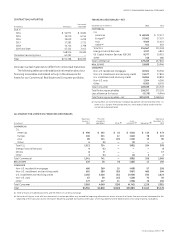

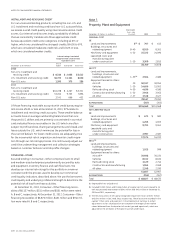

December 31 (In millions) 2013 2012

Loans, net of deferred income (a) $ 231,268 $ 240,634

Investment in financing leases, net of

deferred income 26,939 32,471

258,207 273,105

Less allowance for losses (5,178) (4,944)

Financing receivables—net (b) $ 253,029 $ 268,161

(a) Deferred income was $2,013 million and $2,184 million at December 31, 2013 and

2012, respectively.

(b) Financing receivables at December 31, 2013 and 2012 included $544 million and

$750 million, respectively, relating to loans that had been acquired in a transfer

but have been subject to credit deterioration since origination.

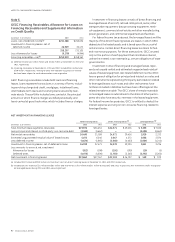

GECC fi nancing receivables include both loans and fi nancing

leases. Loans represent transactions in a variety of forms, includ-

ing revolving charge and credit, mortgages, installment loans,

intermediate-term loans and revolving loans secured by busi-

ness assets. The portfolio includes loans carried at the principal

amount on which fi nance charges are billed periodically, and

loans carried at gross book value, which includes fi nance charges.

Investment in fi nancing leases consists of direct fi nancing and

leveraged leases of aircraft, railroad rolling stock, autos, other

transportation equipment, data processing equipment, medi-

cal equipment, commercial real estate and other manufacturing,

power generation, and commercial equipment and facilities.

For federal income tax purposes, the leveraged leases and the

majority of the direct fi nancing leases are leases in which GECC

depreciates the leased assets and is taxed upon the accrual of

rental income. Certain direct fi nancing leases are loans for fed-

eral income tax purposes. For these transactions, GECC is taxed

only on the portion of each payment that constitutes interest,

unless the interest is tax-exempt (e.g., certain obligations of state

governments).

Investment in direct fi nancing and leveraged leases repre-

sents net unpaid rentals and estimated unguaranteed residual

values of leased equipment, less related deferred income. GECC

has no general obligation for principal and interest on notes and

other instruments representing third-party participation related

to leveraged leases; such notes and other instruments have

not been included in liabilities but have been offset against the

related rentals receivable. The GECC share of rentals receivable

on leveraged leases is subordinate to the share of other partici-

pants who also have security interests in the leased equipment.

For federal income tax purposes, GECC is entitled to deduct the

interest expense accruing on non-recourse fi nancing related to

leveraged leases.

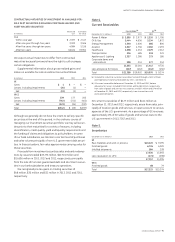

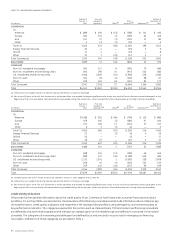

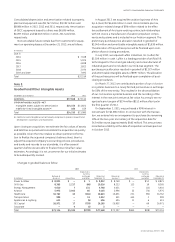

NET INVESTMENT IN FINANCING LEASES

Total financing leases Direct financing leases (a) Leveraged leases (b)

December 31 (In millions) 2013 2012 2013 2012 2013 2012

Total minimum lease payments receivable $ 29,970 $ 36,451 $ 24,571 $ 29,416 $ 5,399 $ 7,035

Less principal and interest on third-party non-recourse debt (3,480) (4,662) — — (3,480) (4,662)

Net rentals receivables 26,490 31,789 24,571 29,416 1,919 2,373

Estimated unguaranteed residual value of leased assets 5,073 6,346 3,067 4,272 2,006 2,074

Less deferred income (4,624) (5,664) (3,560) (4,453) (1,064) (1,211)

Investment in financing leases, net of deferred income 26,939 32,471 24,078 29,235 2,861 3,236

Less amounts to arrive at net investment

Allowance for losses (202) (198) (192) (193) (10) (5)

Deferred taxes (4,075) (4,506) (1,783) (2,245) (2,292) (2,261)

Net investment in financing leases $ 22,662 $ 27,767 $ 22,103 $ 26,797 $ 559 $ 970

(a) Included $317 million and $330 million of initial direct costs on direct financing leases at December 31, 2013 and 2012, respectively.

(b) Included pre-tax income of $31 million and $81 million and income tax of $11 million and $32 million during 2013 and 2012, respectively. Net investment credits recognized

on leveraged leases during 2013 and 2012 were insignificant.