GE 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. GE 2013 ANNUAL REPORT 83

DERIVATIVES. We use closing prices for derivatives included in

Level 1, which are traded either on exchanges or liquid over-the-

counter markets.

The majority of our derivatives are valued using internal mod-

els. The models maximize the use of market observable inputs

including interest rate curves and both forward and spot prices

for currencies and commodities. Derivative assets and liabilities

included in Level 2 primarily represent interest rate swaps, cross-

currency swaps and foreign currency and commodity forward

and option contracts.

Derivative assets and liabilities included in Level 3 primarily

represent equity derivatives and interest rate products that con-

tain embedded optionality or prepayment features.

Non-recurring Fair Value Measurements

Certain assets are measured at fair value on a non-recurring

basis. These assets are not measured at fair value on an ongoing

basis, but are subject to fair value adjustments only in certain

circumstances. These assets can include loans and long-lived

assets that have been reduced to fair value when they are held

for sale, impaired loans that have been reduced based on the

fair value of the underlying collateral, cost and equity method

investments and long-lived assets that are written down to fair

value when they are impaired and the remeasurement of retained

investments in formerly consolidated subsidiaries upon a change

in control that results in deconsolidation of a subsidiary, if we

sell a controlling interest and retain a noncontrolling stake in the

entity. Assets that are written down to fair value when impaired

and retained investments are not subsequently adjusted to fair

value unless further impairment occurs.

The following sections describe the valuation methodolo-

gies we use to measure fi nancial and non-fi nancial instruments

accounted for at fair value on a non-recurring basis and for cer-

tain assets within our pension plans and retiree benefi t plans at

each reporting period, as applicable.

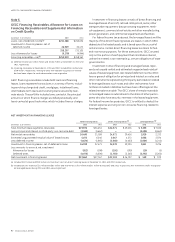

FINANCING RECEIVABLES AND LOANS HELD FOR SALE. When avail-

able, we use observable market data, including pricing on recent

closed market transactions, to value loans that are included in

Level 2. When this data is unobservable, we use valuation meth-

odologies using current market interest rate data adjusted for

inherent credit risk, and such loans are included in Level 3. When

appropriate, loans may be valued using collateral values (see

Long-Lived Assets, including Real Estate below).

COST AND EQUITY METHOD INVESTMENTS. Cost and equity

method investments are valued using market observable data

such as quoted prices when available. When market observable

data is unavailable, investments are valued using a discounted

cash fl ow model, comparative market multiples or a combination

of both approaches as appropriate and other third-party pricing

sources. These investments are generally included in Level 3.

Investments in private equity, real estate and collective funds

are valued using net asset values. The net asset values are deter-

mined based on the fair values of the underlying investments in

the funds. Investments in private equity and real estate funds are

generally included in Level 3 because they are not redeemable

at the measurement date. Investments in collective funds are

included in Level 2.

LONG-LIVED ASSETS, INCLUDING REAL ESTATE. Fair values of

long-lived assets, including aircraft and real estate, are primarily

derived internally and are based on observed sales transactions

for similar assets. In other instances, for example, collateral types

for which we do not have comparable observed sales transaction

data, collateral values are developed internally and corroborated

by external appraisal information. Adjustments to third-party

valuations may be performed in circumstances where market

comparables are not specifi c to the attributes of the specifi c col-

lateral or appraisal information may not be refl ective of current

market conditions due to the passage of time and the occur-

rence of market events since receipt of the information. For real

estate, fair values are based on discounted cash fl ow estimates

that refl ect current and projected lease profi les and available

industry information about capitalization rates and expected

trends in rents and occupancy and are corroborated by external

appraisals. These investments are generally included in Level 2 or

Level 3.

RETAINED INVESTMENTS IN FORMERLY CONSOLIDATED

SUBSIDIARIES. Upon a change in control that results in

deconsolidation of a subsidiary, the fair value measurement

of our retained noncontrolling stake is valued using market

observable data such as quoted prices when available, or if not

available, an income approach, a market approach, or a com-

bination of both approaches as appropriate. In applying these

methodologies, we rely on a number of factors, including actual

operating results, future business plans, economic projections,

market observable pricing multiples of similar businesses and

comparable transactions, and possible control premiums. These

investments are generally included in Level 1 or Level 3, as appro-

priate, determined at the time of the transaction.

Accounting Changes

On January 1, 2012, we adopted Financial Accounting Standards

Board (FASB) Accounting Standards Update (ASU) 2011-05, an

amendment to Accounting Standards Codifi cation (ASC) 220,

Comprehensive Income. ASU 2011-05 introduced a new state-

ment, the Consolidated Statement of Comprehensive Income.

The amendments affect only the display of those components of

equity categorized as other comprehensive income and do not

change existing recognition and measurement requirements that

determine net earnings.

On January 1, 2012, we adopted FASB ASU 2011-04, an

amendment to ASC 820, Fair Value Measurements. ASU 2011-04

clarifi es or changes the application of existing fair value measure-

ments, including: that the highest and best use valuation premise

in a fair value measurement is relevant only when measuring the

fair value of nonfi nancial assets; that a reporting entity should

measure the fair value of its own equity instrument from the