GE 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2013 ANNUAL REPORT 117

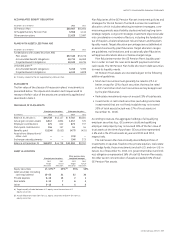

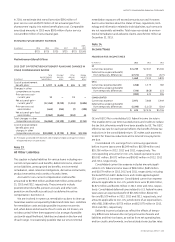

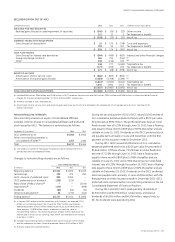

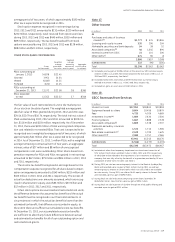

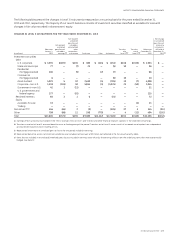

RECLASSIFICATION OUT OF AOCI

Components of AOCI 2013 2012 2011 Statement of Earnings Caption

AVAILABLE-FOR-SALE SECURITIES

Realized gains (losses) on sale/impairment of securities $ (540) $ (35) $ (32) Other income

222 13 1 Tax (expense) or benefit

$ (318) $ (22) $ (31) Net of tax

CURRENCY TRANSLATION ADJUSTMENTS

Gains (losses) on dispositions $ 25 $ 120 $ (738) Costs and expenses

793 54 357 Tax (expense) or benefit

$ 818 $ 174 $ (381) Net of tax

CASH FLOW HEDGES

Gains (losses) on interest rate derivatives $ (364) $ (499) $ (820) Interest and other financial charges

Foreign exchange contracts 564 792 (510) (a)

Other 248 (116) 150 (b)

448 177 (1,180) Total before tax

(177) (245) 202 Tax (expense) or benefit

$ 271 $ (68) $ (978) Net of tax

BENEFIT PLAN ITEMS

Amortization of prior service costs $ (664) $ (823) $ (855) (c)

Amortization of actuarial gains (losses) (3,983) (3,768) (2,389) (c)

(4,647) (4,591) (3,244) Total before tax

1,610 1,604 1,152 Tax (expense) or benefit

$ (3,037) $ (2,987) $ (2,092) Net of tax

TOTAL RECLASSIFICATION ADJUSTMENTS $ (2,266) $ (2,903) $ (3,482) Net of tax

(a) Includes $608 million, $894 million and $(310) million in GECC revenues from services and $(44) million, $(102) million and $(200) million in interest and other financial

charges for the years ended December 31, 2013, 2012 and 2011, respectively.

(b) Primarily included in costs and expenses.

(c) Amortization of prior service costs and actuarial gains and losses out of AOCI are included in the computation of net periodic pension costs. See Note 12 for

further information.

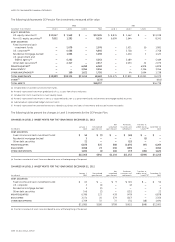

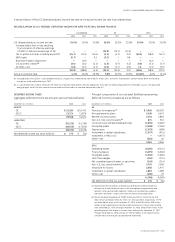

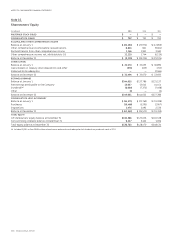

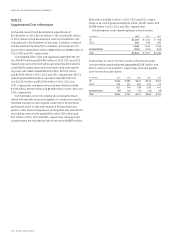

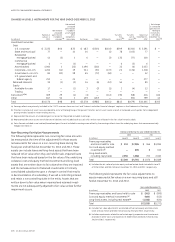

NONCONTROLLING INTERESTS

Noncontrolling interests in equity of consolidated affi liates

includes common shares in consolidated affi liates and preferred

stock issued by GECC. The balance is summarized as follows.

December 31 (In millions) 2013 2012

GECC preferred stock $ 4,950 $ 3,960

Other noncontrolling interests in

consolidated affiliates (a) 1,267 1,484

Total $ 6,217 $ 5,444

(a) Consisted of a number of individually insignificant noncontrolling interests in

partnerships and consolidated affiliates.

Changes to noncontrolling interests are as follows.

Years ended December 31

(In millions) 2013 2012 2011

Beginning balance $ 5,444 $ 1,696 $ 5,262

Net earnings 298 223 292

GECC issuance of preferred stock 990 3,960 —

GECC preferred stock dividend (298) (123) —

Repurchase of NBCU shares (a) — — (3,070)

Dispositions (b) (175) — (609)

Dividends (80) (42) (34)

Other (including AOCI) (c) 38 (270) (145)

Ending balance $ 6,217 $ 5,444 $ 1,696

(a) In January 2011 and prior to the transaction with Comcast, we acquired 12.3%

of NBCU’s outstanding shares from Vivendi for $3,673 million and made an

additional payment of $222 million related to previously purchased shares. Of

these amounts, $3,070 million reflects a reduction in carrying value of

noncontrolling interests. The remaining amount of $825 million represents the

amount paid in excess of our carrying value, which was recorded as an increase

in our basis in NBCU.

(b) Includes noncontrolling interests related to the sale of GE SeaCo of $311 million

and the redemption of Heller Financial preferred stock of $275 million in 2011.

(c) Primarily acquisitions and eliminations.

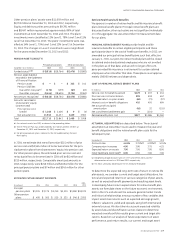

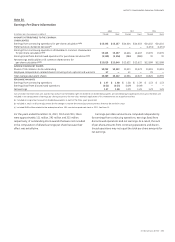

During the second quarter of 2013, GECC issued 10,000 shares of

non-cumulative perpetual preferred stock with a $0.01 par value

for proceeds of $990 million. The preferred shares bear an initial

fi xed interest rate of 5.25% through June 15, 2023, bear a fl oating

rate equal to three-month LIBOR plus 2.967% thereafter and are

callable on June 15, 2023. Dividends on the GECC preferred stock

are payable semi-annually, in June and December, with the fi rst

payment on this issuance made in December 2013.

During 2012, GECC issued 40,000 shares of non-cumulative

perpetual preferred stock with a $0.01 par value for proceeds of

$3,960 million. Of these shares, 22,500 bear an initial fi xed inter-

est rate of 7.125% through June 15, 2022, bear a fl oating rate

equal to three-month LIBOR plus 5.296% thereafter and are

callable on June 15, 2022, and 17,500 shares bear an initial fi xed

interest rate of 6.25% through December 15, 2022, bear a fl oating

rate equal to three-month LIBOR plus 4.704% thereafter and are

callable on December 15, 2022. Dividends on the GECC preferred

stock are payable semi-annually, in June and December, with the

fi rst payment on these issuances made in December 2012. GECC

preferred stock is presented as noncontrolling interests in the GE

Consolidated Statement of Financial Position.

During 2013 and 2012, GECC paid quarterly dividends of

$1,930 million and $1,926 million, respectively, and special

dividends of $4,055 million and $4,500 million, respectively, to

GE. No dividends were paid during 2011.