GE 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

GE 2013 ANNUAL REPORT 51

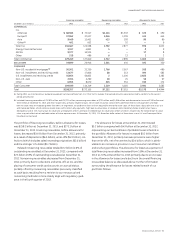

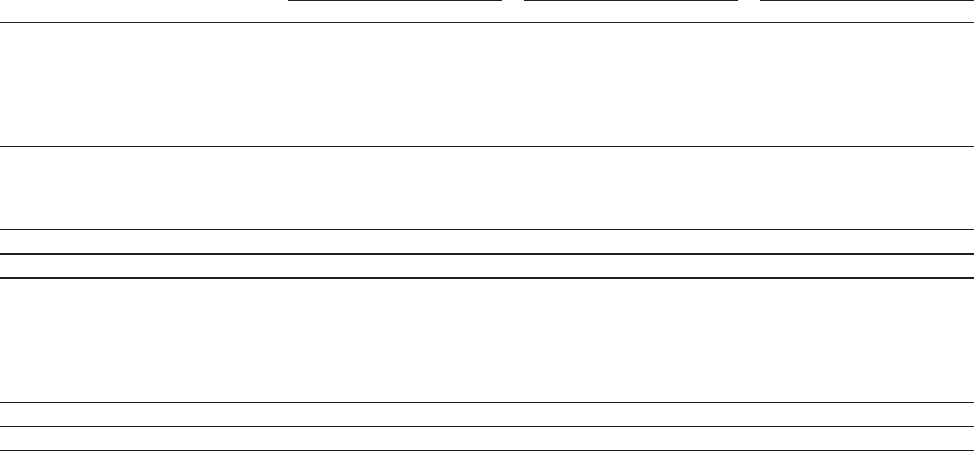

Financing receivables Nonearning receivables Allowance for losses

December 31 (In millions) 2013 2012 2013 2012 2013 2012

COMMERCIAL

CLL

Americas $ 68,585 $ 72,517 $ 1,243 $ 1,333 $ 473 $ 490

Europe

(a) 37,962 37,037 1,046 1,299 415 445

Asia 9,469 11,401 413 193 90 80

Other

(a) 451 603 — 52 — 6

Total CLL 116,467 121,558 2,702 2,877 978 1,021

Energy Financial Services 3,107 4,851 4 — 8 9

GECAS 9,377 10,915 — — 17 8

Other 318 486 6 13 2 3

Total Commercial 129,269 137,810 2,712 2,890 1,005 1,041

REAL ESTATE 19,899 20,946 2,301 444 192 320

CONSUMER

Non-U.S. residential mortgages (b) 30,501 33,350 1,766 2,567 358 480

Non-U.S. installment and revolving credit 13,677 17,816 88 213 594 582

U.S. installment and revolving credit 55,854 50,853 2 1,026 2,823 2,282

Non-U.S. auto 2,054 4,260 18 24 56 67

Other 6,953 8,070 345 351 150 172

Total Consumer 109,039 114,349 2,219 4,181 3,981 3,583

Total $ 258,207 $ 273,105 $ 7,232 $ 7,515 $ 5,178 $ 4,944

(a) During 2013, we transferred our European equipment services portfolio from CLL Other to CLL Europe. Prior-period amounts were reclassified to conform to the current

period presentation.

(b) Included financing receivables of $12,025 million and $12,221 million, nonearning receivables of $751 million and $1,036 million and allowance for losses of $139 million and

$142 million at December 31, 2013 and 2012, respectively, primarily related to loans, net of credit insurance, whose terms permitted interest-only payments and high

loan-to-value ratios at inception (greater than 90%). At origination, we underwrite loans with an adjustable rate to the reset value. Of these loans, about 85% are in our U.K.

and France portfolios, which comprise mainly loans with interest-only payments, high loan-to-value ratios at inception and introductory below market rates, have a

delinquency rate of 14%, have a loan-to-value ratio at origination of 82% and have re-indexed loan-to-value ratios of 84% and 64%, respectively. Re-indexed loan-to-value

ratios may not reflect actual realizable values of future repossessions. At December 31, 2013, 11% (based on dollar values) of these loans in our U.K. and France portfolios

have been restructured.

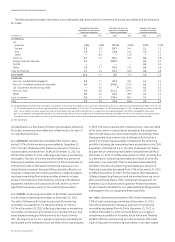

The portfolio of fi nancing receivables, before allowance for losses,

was $258.2 billion at December 31, 2013, and $273.1 billion at

December 31, 2012. Financing receivables, before allowance for

losses, decreased $14.9 billion from December 31, 2012, primarily

as a result of dispositions ($6.5 billion), write-offs ($5.9 billion), col-

lections (which includes sales) exceeding originations ($3.6 billion)

and the stronger U.S. dollar ($1.7 billion).

Related nonearning receivables totaled $7.2 billion (2.8% of

outstanding receivables) at December 31, 2013, compared with

$7.5 billion (2.8% of outstanding receivables) at December 31,

2012. Nonearning receivables decreased from December 31,

2012, primarily due to collections and write-offs at CLL and the

placing of consumer credit card accounts on accrual status,

partially offset by nonearning receivables previously classifi ed

as cash basis resulting from a revision to our nonaccrual and

nonearning methods to more closely align with regulatory guid-

ance in the fourth quarter of 2013.

The allowance for losses at December 31, 2013 totaled

$5.2 billion compared with $4.9 billion at December 31, 2012,

representing our best estimate of probable losses inherent in

the portfolio. Allowance for losses increased $0.2 billion from

December 31, 2012, primarily because provisions were higher

than write-offs, net of recoveries by $0.4 billion, which is attrib-

utable to an increase in provision in our Consumer installment

and revolving portfolios. The allowance for losses as a percent of

total fi nancing receivables increased from 1.8% at December 31,

2012 to 2.0% at December 31, 2013 primarily due to an increase

in the allowance for losses and a decline in the overall fi nancing

receivables balance as discussed above. Further information

surrounding the allowance for losses related to each of our

portfolios follows.