GE 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

60 GE 2013 ANNUAL REPORT

we assumed that, on January 1, 2014, interest rates decreased

by 100 basis points across the yield curve (a “parallel shift” in

that curve) and further assumed that the decrease remained

in place for 2014. We estimated, based on the year-end 2013

portfolio and holding all other assumptions constant, that our

2014 consolidated net earnings would decline by less than

$0.1 billion as a result of this parallel shift in the yield curve.

• It is our policy to minimize currency exposures and to con-

duct operations either within functional currencies or using

the protection of hedge strategies. We analyzed year-end

2013 consolidated currency exposures, including derivatives

designated and effective as hedges, to identify assets and

liabilities denominated in other than their relevant functional

currencies. For such assets and liabilities, we then evaluated

the effects of a 10% shift in exchange rates between those

currencies and the U.S. dollar, holding all other assumptions

constant. This analysis indicated that our 2014 consolidated

net earnings would decline by less than $0.1 billion as a result

of such a shift in exchange rates.

Debt and Derivative Instruments, Guarantees and Covenants

CREDIT RATINGS

On April 3, 2012, Moody’s Investors Service (Moody’s) announced

that it had downgraded the senior unsecured debt rating of GE by

one notch from Aa2 to Aa3 and the senior unsecured debt rating

of GECC by two notches from Aa2 to A1. The ratings downgrade

did not affect GE’s and GECC’s short-term funding ratings of P-1,

which were affi rmed by Moody’s. Moody’s ratings outlook for GE

and GECC is stable. We did not experience any material opera-

tional, funding or liquidity impacts from this ratings downgrade.

As of December 31, 2013, GE’s and GECC’s long-term unsecured

debt ratings from Standard and Poor’s Ratings Service (S&P) were

AA+ with a stable outlook and their short-term funding ratings

from S&P were A-1+. We are disclosing these ratings to enhance

understanding of our sources of liquidity and the effects of our

ratings on our costs of funds. Although we currently do not

expect a downgrade in the credit ratings, our ratings may be sub-

ject to a revision or withdrawal at any time by the assigning rating

organization, and each rating should be evaluated independently

of any other rating.

Substantially all GICs were affected by the downgrade and

are more fully discussed in the Principal Debt and Derivative

Conditions section.

PRINCIPAL DEBT AND DERIVATIVE CONDITIONS

Certain of our derivative instruments can be terminated if spec-

ifi ed credit ratings are not maintained and certain debt and

derivative agreements of other consolidated entities have provi-

sions that are affected by these credit ratings.

Fair values of our derivatives can change signifi cantly from

period to period based on, among other factors, market move-

ments and changes in our positions. We manage counterparty

credit risk (the risk that counterparties will default and not make

payments to us according to the terms of our standard master

agreements) on an individual counterparty basis. Where we have

agreed to netting of derivative exposures with a counterparty,

we offset our exposures with that counterparty and apply the

value of collateral posted to us to determine the net exposure.

We actively monitor these net exposures against defi ned limits

and take appropriate actions in response, including requiring

additional collateral.

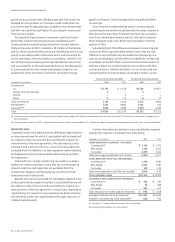

Swap, forward and option contracts are executed under

standard master agreements that typically contain mutual down-

grade provisions that provide the ability of the counterparty to

require termination if the long-term credit ratings of the applica-

ble GE entity were to fall below A-/A3. In certain of these master

agreements, the counterparty also has the ability to require

termination if the short-term ratings of the applicable GE entity

were to fall below A-1/P-1. The net derivative liability after consid-

eration of netting arrangements, outstanding interest payments

and collateral posted by us under these master agreements was

estimated to be $1.2 billion at December 31, 2013. See Note 22.

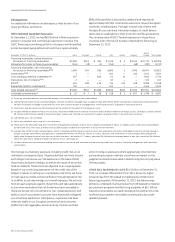

Other debt and derivative agreements of consolidated entities

include Trinity, which comprises two entities that hold investment

securities, the majority of which are investment grade, and were

funded by the issuance of GICs. These GICs included conditions

under which certain holders could require immediate repayment

of their investment should the long-term credit ratings of GECC

fall below AA-/Aa3 or the short-term credit ratings fall below

A-1+/P-1, and are reported in investment contracts, insurance

liabilities and insurance annuity benefi ts. The Trinity assets and

liabilities are disclosed in note (a) in our Statement of Financial

Position. Another consolidated entity also had issued GICs where

proceeds are loaned to GECC. These GICs included conditions

under which certain holders could require immediate repayment

of their investment should the long-term credit ratings of GECC

fall below AA-/Aa3. These obligations are included in long-term

borrowings in our Statement of Financial Position. These three

consolidated entities ceased issuing GICs in 2010.

Following the April 3, 2012 Moody’s downgrade of GECC’s

long-term credit rating to A1, substantially all of these GICs

became redeemable by their holders. In 2012, holders of $2.4 bil-

lion in principal amount of GICs redeemed their holdings and

GECC made related cash payments. The remaining outstanding

GICs will continue to be subject to their scheduled maturities

and individual terms, which may include provisions permitting

redemption upon a downgrade of one or more of GECC’s ratings,

among other things.

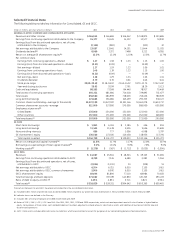

RATIO OF EARNINGS TO FIXED CHARGES, INCOME MAINTENANCE

AGREEMENT AND SUBORDINATED DEBENTURES

GE provides implicit and explicit support to GECC through com-

mitments, capital contributions and operating support. For

example, and as discussed below, GE has committed to keep

GECC’s ratio of earnings to fi xed charges above a minimum level.

GECC’s credit rating is higher than it would be on a stand-alone