GE 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 GE 2013 ANNUAL REPORT

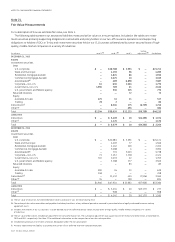

Note 21.

Fair Value Measurements

For a description of how we estimate fair value, see Note 1.

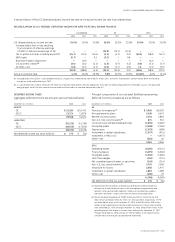

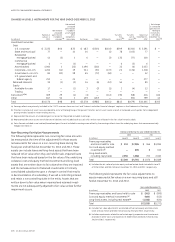

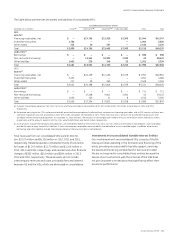

The following tables present our assets and liabilities measured at fair value on a recurring basis. Included in the tables are invest-

ment securities primarily supporting obligations to annuitants and policyholders in our run-off insurance operations and supporting

obligations to holders of GICs in Trinity and investment securities held in our CLL business collateralized by senior secured loans of high-

quality, middle-market companies in a variety of industries.

(In millions) Level 1 (a) Level 2 (a) Level 3

Netting

adjustment (b) Net balance

DECEMBER 31, 2013

ASSETS

Investment securities

Debt

U.S. corporate $ — $ 18,788 $ 2,953 $ — $ 21,741

State and municipal — 4,193 96 — 4,289

Residential mortgage-backed — 1,824 86 — 1,910

Commercial mortgage-backed — 3,025 10 — 3,035

Asset-backed

(c) — 489 6,898 — 7,387

Corporate—non-U.S. 61 645 1,064 — 1,770

Government—non-U.S. 1,590 789 31 — 2,410

U.S. government and federal agency — 545 225 — 770

Retained interests — — 72 — 72

Equity

Available-for-sale 475 31 11 — 517

Trading 78 2 — — 80

Derivatives (d) — 8,304 175 (6,739) 1,740

Other (e) — — 494 — 494

Total $ 2,204 $ 38,635 $ 12,115 $ (6,739) $ 46,215

LIABILITIES

Derivatives $ — $ 5,409 $ 20 $ (4,355) $ 1,074

Other (f) — 1,170 — — 1,170

Total $ — $ 6,579 $ 20 $ (4,355) $ 2,244

DECEMBER 31, 2012

ASSETS

Investment securities

Debt

U.S. corporate $ — $ 20,580 $ 3,591 $ — $ 24,171

State and municipal — 4,469 77 — 4,546

Residential mortgage-backed — 2,162 100 — 2,262

Commercial mortgage-backed — 3,088 6 — 3,094

Asset-backed

(c) — 715 5,023 — 5,738

Corporate—non-U.S. 71 1,132 1,218 — 2,421

Government—non-U.S. 702 1,019 42 — 1,763

U.S. government and federal agency — 3,288 277 — 3,565

Retained interests — — 83 — 83

Equity

Available-for-sale 590 16 13 — 619

Trading 248 — — — 248

Derivatives (d) — 11,432 434 (7,926) 3,940

Other (e) 35 — 799 — 834

Total $ 1,646 $ 47,901 $ 11,663 $ (7,926) $ 53,284

LIABILITIES

Derivatives $ — $ 3,434 $ 20 $ (3,177) $ 277

Other (f) — 908 — — 908

Total $ — $ 4,342 $ 20 $ (3,177) $ 1,185

(a) The fair value of securities transferred between Level 1 and Level 2 was $2 million during 2013.

(b) The netting of derivative receivables and payables (including the effects of any collateral posted or received) is permitted when a legally enforceable master netting

agreement exists.

(c) Includes investments in our CLL business in asset-backed securities collateralized by senior secured loans of high-quality, middle-market companies in a variety

of industries.

(d) The fair value of derivatives included an adjustment for non-performance risk. The cumulative adjustment was a gain (loss) of $(7) million and $(15) million at December 31,

2013 and 2012, respectively. See Note 22 for additional information on the composition of our derivative portfolio.

(e) Included private equity investments and loans designated under the fair value option.

(f) Primarily represented the liability associated with certain of our deferred incentive compensation plans.