GE 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 GE 2013 ANNUAL REPORT

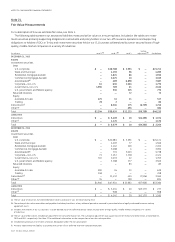

Note 16.

Other Stock-Related Information

We grant stock options, restricted stock units (RSUs) and

performance share units (PSUs) to employees under the 2007

Long-Term Incentive Plan (the Plan). This plan replaced the

1990 Long-Term Incentive Plan. In addition, we grant options

and RSUs in limited circumstances to consultants, advisors and

independent contractors under a plan approved by our Board

of Directors in 1997 (the Consultants’ Plan). Share requirements

for all plans may be met from either unissued or treasury shares.

Stock options expire 10 years from the date they are granted and

vest over service periods that range from one to fi ve years. RSUs

give the recipients the right to receive shares of our stock upon

the vesting of their related restrictions. Restrictions on RSUs vest

in various increments and at various dates, beginning after one

year from date of grant through grantee retirement. Although

the plan permits us to issue RSUs settleable in cash, we have only

issued RSUs settleable in shares of our stock. PSUs give recipients

the right to receive shares of our stock upon the achievement of

certain performance targets.

All grants of GE options under all plans must be approved by

the Management Development and Compensation Committee,

which consists entirely of independent directors.

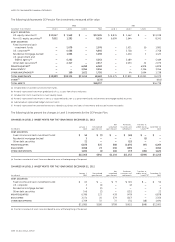

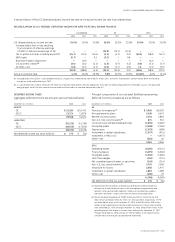

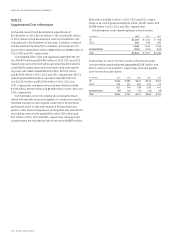

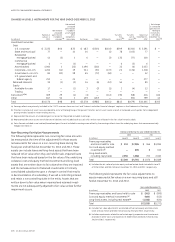

STOCK COMPENSATION PLANS

December 31, 2013 (Shares in thousands)

Securities

to be

issued

upon

exercise

Weighted

average

exercise

price

Securities

available

for future

issuance

APPROVED BY SHAREOWNERS

Options 473,247 $ 20.02 (a)

RSUs 13,572 (b) (a)

PSUs 950 (b) (a)

NOT APPROVED BY SHAREOWNERS

(CONSULTANTS’ PLAN)

Options 364 25.32 (c)

RSUs — (b) (c)

Total 488,133 $ 20.02 404,574

(a) In 2007, the Board of Directors approved the 2007 Long-Term Incentive Plan,

which replaced the 1990 Long-Term Incentive Plan. During 2012, an amendment

was approved to increase the number of shares authorized for issuance under

the Plan from 500 million shares to 925 million shares. No more than 230 million

of the total number of authorized shares may be available for awards granted in

any form provided under the Plan other than options or stock appreciation

rights. Total shares available for future issuance under the Plan amounted to

376.4 million shares at December 31, 2013.

(b) Not applicable.

(c) Total shares available for future issuance under the Consultants’ Plan amount to

28.2 million shares.

Outstanding options expire on various dates through

December 13, 2023.

The following table summarizes information about stock

options outstanding at December 31, 2013.

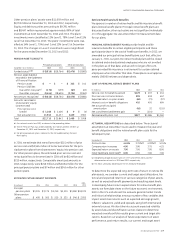

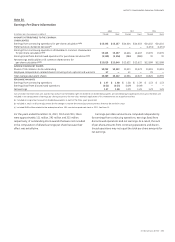

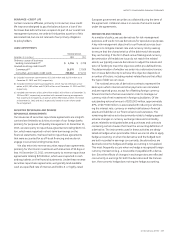

STOCK OPTIONS OUTSTANDING

(Shares in thousands) Outstanding Exercisable

Exercise price range Shares

Average

life (a)

Average

exercise

price Shares

Average

exercise

price

Under $10.00 34,973 4.9 $ 9.57 26,995 $ 9.57

10.01–15.00 56,571 5.1 11.98 45,821 11.98

15.01–20.00 172,157 6.8 17.46 91,007 17.24

20.01–25.00 139,740 9.1 22.55 20,533 21.57

25.01–30.00 20,638 4.3 28.19 20,115 28.23

30.01–35.00 35,993 1.6 33.54 35,993 33.54

Over $35.00 13,539 3.3 38.67 13,539 38.67

Total 473,611 6.5 $ 20.02 254,003 $ 20.15

(a) Average contractual life remaining in years.

At year-end 2012, options with a weighted average exercise price

of $20.85 were exercisable on 214 million shares.

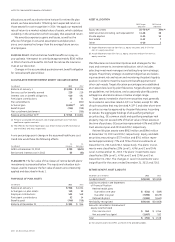

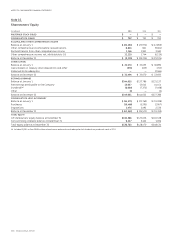

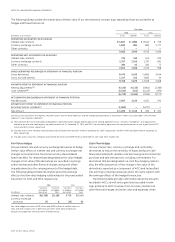

STOCK OPTION ACTIVITY

Shares

(In thousands)

Weighted

average

exercise price

Weighted

average

remaining

contractual

term (In years)

Aggregate

intrinsic value

(In millions)

Outstanding at

January 1, 2013 467,837 $ 19.27

Granted 62,762 23.80

Exercised (36,191) 13.65

Forfeited (9,688) 18.95

Expired (11,109) 31.60

Outstanding at

December 31, 2013 473,611 $ 20.02 6.5 $ 4,140

Exercisable at

December 31, 2013 254,003 $ 20.15 5.1 $ 2,348

Options expected

to vest 200,909 $ 19.79 8.0 $ 1,656

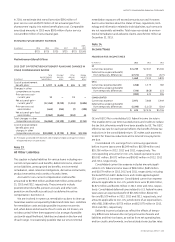

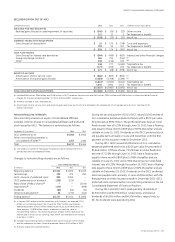

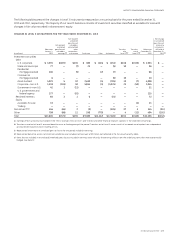

We measure the fair value of each stock option grant at the

date of grant using a Black-Scholes option pricing model. The

weighted average grant-date fair value of options granted during

2013, 2012 and 2011 was $4.52, $3.80 and $4.00, respectively.

The following assumptions were used in arriving at the fair value

of options granted during 2013, 2012 and 2011, respectively:

risk-free interest rates of 2.5%, 1.3% and 2.6%; dividend yields of

4.0%, 4.0% and 3.9%; expected volatility of 28%, 29% and 30%;

and expected lives of 7.5 years, 7.8 years and 7.7 years. Risk-free

interest rates refl ect the yield on zero-coupon U.S. Treasury

securities. Expected dividend yields presume a set dividend

rate and we used a historical fi ve-year average for the dividend

yield. Expected volatilities are based on implied volatilities from

traded options and historical volatility of our stock. The expected

option lives are based on our historical experience of employee

exercise behavior.

The total intrinsic value of options exercised during 2013, 2012

and 2011 amounted to $392 million, $265 million and $65 million,

respectively. As of December 31, 2013, there was $663 million

of total unrecognized compensation cost related to nonvested

options. That cost is expected to be recognized over a weighted