GE 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

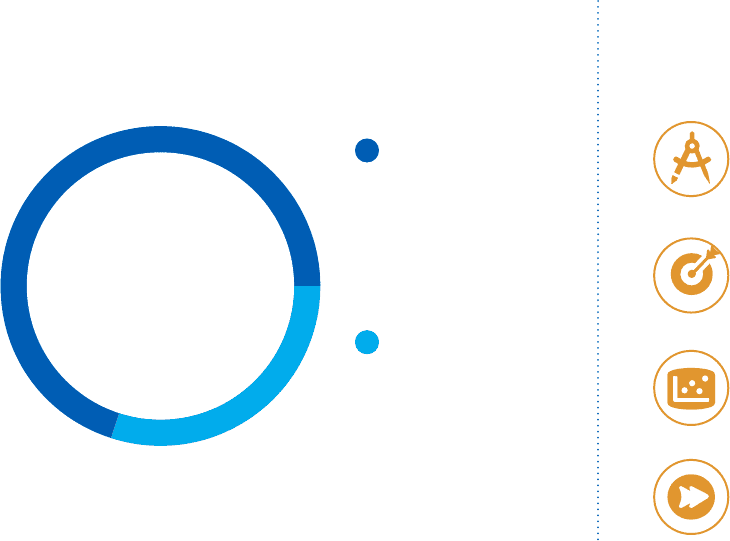

70%

PREMIER

INFRASTRUCTURE

COMPANY

30%

VALUABLE

SPECIALTY

FINANCE

GE PORTFOLIO GOALS ENTERPRISE

ADVANTAGES

Technical

leadership

& scale

Growth market

capabilities:

breadth & depth

Services driving

customer outcomes

through analytics

Culture of

simplifi cation:

low cost + speed

2014. We have a solid franchise in the

private label credit card business, but

it is a step removed from GE Capital’s

strength of lending to industrial

middle-market companies. By 2015, we

expect fi nancial services should be

30% of our earnings.

GE Capital is a valuable middle-market

franchise that builds on GE strengths

and our domain expertise. We have

strong leadership franchises in areas

like equipment and inventory fi nance,

and a portion of our assets are around

GE’s installed base. This gives us

unique capability in aviation, energy

and healthcare. We link our Capital

customers to GE through a program

called “Access GE,” through which we

share our best practices to help them

run their businesses better. GE Capital

has never been stronger or safer,

and we are making substantial invest-

ments to meet the standards expected

from a Federal Reserve regulated

fi nancial institution.

GE’s portfolio sets our potential.

We have completed substantial work

over the past decade. We have

repositioned GE Capital as a smaller

and safer specialty fi nance leader

with less leverage and more liquidity.

We have redeployed capital from

businesses outside the GE core — like

insurance and media — to platforms

that can leverage our strengths like

Oil & Gas and Life Sciences. We expect

this portfolio to deliver valuable growth

and trade at a premium in the future.

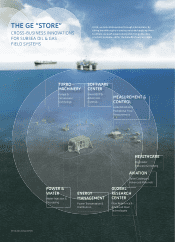

Leading in Productivity

We are consistently innovating inside

GE. In an “effi ciency-starved” world,

our innovations are focused on

productivity. We are investing in three

initiatives that can deliver big gains in

productivity for our customers and GE.

We will lead as the industrial and

analytical worlds collide. We believe

that every industrial company will

become a software company; that

ultimately deep domain knowledge

is tougher to come by than writing

code. In this sense, GE seeks to link

the “iron and the data.” Our assets

have sensors that produce a custom-

ized stream of performance data.

We can harness this data to optimize

performance. We know that smart

machines, guided by domain-based

analytics, in a distributed setting,

will drive new levels of productivity.

We call this the Industrial Internet.

Our customers want our assets to

operate with no unplanned down-

time and optimal performance. Small

improvements in asset performance

could impact $20 billion of benefi ts

for our customers. We are delivering

software and analytical solutions

that can take data from our installed

base and turn it into productive

outcomes for our customers. We call

our data solutions “Predictivity,” and

so far, we have launched 24 offerings

generating $800 million of incremental

revenue. We expect Predictivity reve-

nues to exceed $1 billion in 2014.

Our systems can analyze the perfor-

mance of individual engines in the

Aviation installed base; this allows us

to differentiate repairs, saving money

and time for our customers. Through

GE’s Healthcare Asset Management,

radiologists can keep “images in the

cloud.” This improves clinician produc-

tivity, expands networks of care and

LETTER TO SHAREOWNERS

6 GE 2013 ANNUAL REPORT