GE 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2013 ANNUAL REPORT 139

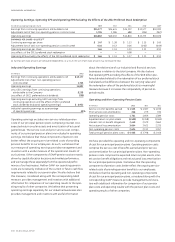

Financial Measures that Supplement Generally

Accepted Accounting Principles

We sometimes use information derived from consolidated

fi nancial information but not presented in our fi nancial state-

ments prepared in accordance with U.S. generally accepted

accounting principles (GAAP). Certain of these data are consid-

ered “non-GAAP fi nancial measures” under U.S. Securities and

Exchange Commission rules. Specifi cally, we have referred, in

various sections of this Annual Report, to:

• Industrial cash fl ows from operating activities (Industrial CFOA)

and GE CFOA excluding the effects of NBCU deal-related taxes

• Operating earnings, operating EPS, operating EPS exclud-

ing the effects of the 2011 preferred stock redemption and

Industrial operating earnings

• Operating and non-operating pension costs

• Average GE shareowners’ equity, excluding effects of

discontinued operations

• Ratio of adjusted debt to equity at GECC, net of adjusted

cash and equivalents and with classifi cation of hybrid debt

as equity

• GE Capital ending net investment (ENI), excluding cash

and equivalents

• GE pre-tax earnings from continuing operations, excluding

GECC earnings from continuing operations, the correspond-

ing effective tax rates and the reconciliation of the U.S. federal

statutory income tax rate to GE effective tax rate, excluding

GECC earnings

The reasons we use these non-GAAP fi nancial measures and the

reconciliations to their most directly comparable GAAP fi nancial

measures follow.

Industrial Cash Flows from Operating Activities (Industrial

CFOA) and GE CFOA Excluding the Effects of NBCU Deal-

Related Taxes

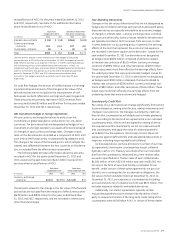

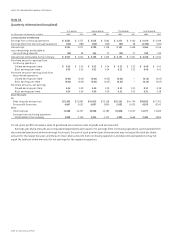

(In millions) 2013 2012 2011 2010 2009

Cash from GE’s

operating activities,

as reported $ 14,255 $ 17,826 $ 12,057 $ 14,746 $ 16,405

Less dividends from

GECC 5,985 6,426 — — —

Cash from GE’s

operating activities,

excluding

dividends from

GECC (Industrial

CFOA) $ 8,270 $ 11,400 $ 12,057 $ 14,746 $ 16,405

Cash from GE’s

operating activities,

as reported $ 14,255

Adjustment: effects

of NBCU deal-

related taxes 3,184

GE CFOA excluding

effects of NBCU

deal-related taxes $ 17,439

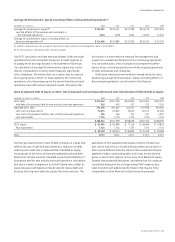

We refer to cash generated by our industrial businesses as

“Industrial CFOA,” which we defi ne as GE’s cash from continuing

operating activities less the amount of dividends received by GE

from GECC. This includes the effects of intercompany transac-

tions, including GE customer receivables sold to GECC; GECC

services for trade receivables management and material procure-

ment; buildings and equipment (including automobiles) leased

between GE and GECC; information technology (IT) and other

services sold to GECC by GE; aircraft engines manufactured by GE

that are installed on aircraft purchased by GECC from third-party

producers for lease to others; and various investments, loans

and allocations of GE corporate overhead costs. We believe that

investors may fi nd it useful to compare GE’s operating cash fl ows

without the effect of GECC dividends, since these dividends are

not representative of the operating cash fl ows of our industrial

businesses and can vary from period-to-period based upon

the results of the fi nancial services businesses. We also believe

that investors may fi nd it useful to compare Industrial CFOA

excluding the effects of taxes paid related to the NBCU transac-

tion. Management recognizes that these measures may not be

comparable to cash fl ow results of companies that contain both

industrial and fi nancial services businesses, but believes that this

comparison is aided by the provision of additional information

about the amounts of dividends paid by our fi nancial services

business and the separate presentation in our fi nancial state-

ments of the Financial Services (GECC) cash fl ows. We believe

that our measures of Industrial CFOA and CFOA excluding NBCU

deal-related taxes provide management and investors with

useful measures to compare the capacity of our industrial opera-

tions to generate operating cash fl ows with the operating cash

fl ows of other non-fi nancial businesses and companies and as

such provide useful measures to supplement the reported GAAP

CFOA measure.