GE 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. GE 2013 ANNUAL REPORT 79

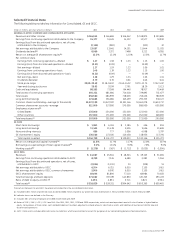

Beginning in the fourth quarter of 2013, we revised our

methods for classifying fi nancing receivables as nonaccrual

and nonearning to more closely align with regulatory guidance.

Under the revised methods, we continue to accrue interest on

consumer credit cards until the accounts are written off in the

period the account becomes 180 days past due. Previously, we

stopped accruing interest on consumer credit cards when the

account became 90 days past due. In addition, the revised meth-

ods limit the use of the cash basis of accounting for nonaccrual

fi nancing receivables.

As a result of these revisions, consumer credit card receiv-

ables of $1,051 million that were previously classifi ed as both

nonaccrual and nonearning were returned to accrual status in the

fourth quarter of 2013. In addition, $1,524 million of Real Estate

and Commercial Lending and Leasing (CLL) fi nancing receiv-

ables previously classifi ed as nonaccrual, paying in accordance

with contractual terms and accounted for on the cash basis,

were returned to accrual status, while $2,174 million of fi nancing

receivables previously classifi ed as nonaccrual and accounted for

on the cash basis (primarily in Real Estate and CLL) were placed

into the nonearning category based on our assessment of the

short-term outlook for resolution through payoff or refi nance.

Given that the revised methods result in nonaccrual and

nonearning amounts that are substantially the same, we plan to

discontinue the reporting of nonearning fi nancing receivables,

one of our internal performance metrics, and report selected

ratios related to nonaccrual fi nancing receivables, in the fi rst

quarter of 2014.

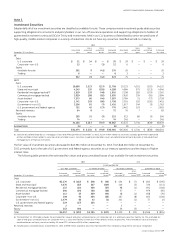

“Delinquent” receivables are those that are 30 days or more

past due based on their contractual terms.

The same fi nancing receivable may meet more than one of the

defi nitions above. Accordingly, these categories are not mutually

exclusive and it is possible for a particular loan to meet the defi -

nitions of a TDR, impaired loan, nonaccrual loan and nonearning

loan and be included in each of these categories. The categoriza-

tion of a particular loan also may not be indicative of the potential

for loss.

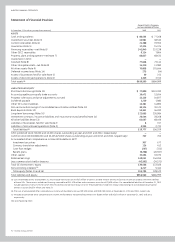

Our consumer loan portfolio consists of smaller-balance,

homogeneous loans, including credit card receivables, install-

ment loans, auto loans and leases and residential mortgages. We

collectively evaluate each portfolio for impairment quarterly. The

allowance for losses on these receivables is established through

a process that estimates the probable losses inherent in the

portfolio based upon statistical analyses of portfolio data. These

analyses include migration analysis, in which historical delin-

quency and credit loss experience is applied to the current aging

of the portfolio, together with other analyses that refl ect current

trends and conditions. We also consider our historical loss experi-

ence to date based on actual defaulted loans and overall portfolio

indicators including nonearning loans, trends in loan volume and

lending terms, credit policies and other observable environmen-

tal factors such as unemployment rates and home price indices.

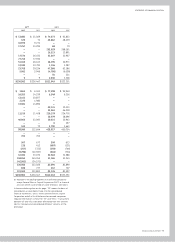

Our commercial loan and lease portfolio consists of a variety

of loans and leases, including both larger-balance, non-homo-

geneous loans and leases and smaller-balance homogeneous

loans and leases. Losses on such loans and leases are recorded

when probable and estimable. We routinely evaluate our entire

portfolio for potential specifi c credit or collection issues that

might indicate an impairment.

For larger-balance, non-homogeneous loans and leases,

we consider the fi nancial status, payment history, collateral

value, industry conditions and guarantor support related to

specifi c customers. Any delinquencies or bankruptcies are indi-

cations of potential impairment requiring further assessment

of collectibility. We routinely receive fi nancial as well as rating

agency reports on our customers, and we elevate for further

attention those customers whose operations we judge to be

marginal or deteriorating. We also elevate customers for further

attention when we observe a decline in collateral values for asset-

based loans. While collateral values are not always available,

when we observe such a decline, we evaluate relevant markets to

assess recovery alternatives—for example, for real estate loans,

relevant markets are local; for commercial aircraft loans, relevant

markets are global.

Measurement of the loss on our impaired commercial loans

is based on the present value of expected future cash fl ows dis-

counted at the loan’s effective interest rate or the fair value of

collateral, net of expected selling costs, if the loan is determined

to be collateral dependent. We determine whether a loan is col-

lateral dependent if the repayment of the loan is expected to be

provided solely by the underlying collateral. Our review process

can often result in reserves being established in advance of a

modifi cation of terms or designation as a TDR. After providing

for specifi c incurred losses, we then determine an allowance for

losses that have been incurred in the balance of the portfolio but

cannot yet be identifi ed to a specifi c loan or lease. This estimate is

based upon various statistical analyses considering historical and

projected default rates and loss severity and aging, as well as our

view on current market and economic conditions. It is prepared

by each respective line of business. For Real Estate, this includes

assessing the probability of default and the loss given default

based on loss history of our portfolio for loans with similar loan

metrics and attributes.

We consider multiple factors in evaluating the adequacy of

our allowance for losses on Real Estate fi nancing receivables,

including loan-to-value ratios, collateral values at the individual

loan level, debt service coverage ratios, delinquency status, and

economic factors including interest rate and real estate market

forecasts. In addition to these factors, we evaluate a Real Estate

loan for impairment classifi cation if its projected loan-to-value

ratio at maturity is in excess of 100%, even if the loan is currently

paying in accordance with its contractual terms. Substantially all

of the loans in the Real Estate portfolio are considered collateral

dependent and are measured for impairment based on the fair

value of collateral. If foreclosure is deemed probable or if repay-

ment is dependent solely on the sale of collateral, we also include

estimated selling costs in our reserve. Collateral values for our

Real Estate loans are determined based upon internal cash fl ow

estimates discounted at an appropriate rate and corroborated

by external appraisals, as appropriate. Collateral valuations are

routinely monitored and updated annually, or more frequently for

changes in collateral, market and economic conditions. Further

discussion on determination of fair value is in the Fair Value

Measurements section that follows.