Family Dollar 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The total intrinsic value of stock options exercised was $30.2 million during fiscal 2013, $28.7 million during

fiscal 2012 and $11.2 million during fiscal 2011. As of August 31, 2013, there was approximately $10.3 million

of unrecognized compensation cost related to outstanding stock options. The unrecognized compensation cost

will be recognized over a weighted-average period of 2.6 years.

Performance Share Rights

The Company grants performance share rights to key employees on an annual basis and in connection with

employment or promotion. Performance share rights give employees the right to receive shares of the Company’s

common stock at a future date based on the Company’s performance relative to a peer group. Performance is

measured based on two pre-tax metrics: Return on Equity and Income Growth. The Leadership Development and

Compensation Committee of the Board of Directors establishes the peer group and performance metrics. The

performance share rights vest at the end of the performance period (generally three years) and the shares are

issued shortly thereafter. The actual number of shares issued can range from 0% to 200% of the employee’s

target award depending on the Company’s performance relative to the peer group.

The Company’s performance share rights have a service condition and performance condition. The service

condition is an explicit requisite service period that is known at grant date and is generally three years. The

performance condition is the Company’s performance against its peer group. In accordance with ASC 718, the

Company values the performance share rights at the grant date based on the most probable outcome of payout

and the most probable outcome is re-evaluated in each reporting period. As a result, the Company adjusts

compensation cost throughout the term of the award to reflect its estimate of the most probable payout of shares.

Upon vesting, the appropriate number of shares are issued and compensation cost reflects the total grant date fair

value of those shares.

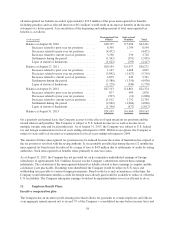

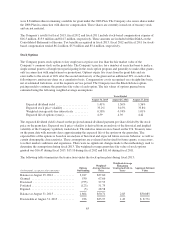

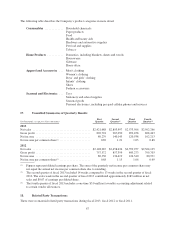

The following table summarizes the transactions under the performance share rights program during fiscal 2013:

(in thousands, except per share amounts)

Performance

Share Rights

Outstanding

Weighted

Average

Grant-Date

Fair Value

Nonvested—August 25, 2012 .................................... 447 $42.85

Granted ..................................................... 175 64.34

Vested ...................................................... (239) 29.92

Cancellations ................................................. (37) 51.81

Performance adjustment ........................................ 75 N/A

Nonvested—August 31, 2013 .................................... 421 $54.26

The grant-date fair value of the performance share rights is based on the stock price on the grant date. The weighted-

average grant-date fair value of performance share rights granted was $64.34 during fiscal 2013, $52.42 during

fiscal 2012 and $46.38 during fiscal 2011. Compensation cost is recognized on a straight-line basis, net of estimated

forfeitures, over the requisite service period and adjusted quarterly to reflect the ultimate number of shares expected

to be issued. The performance adjustments of performance share rights outstanding in the table above represent the

performance adjustment for shares vested during the period. The total fair value of performance share rights vested

was $16.4 million during fiscal 2013, $22.4 million during fiscal 2012 and $15.0 million during fiscal 2011. As of

August 31, 2013, there was approximately $15.9 million of unrecognized compensation cost related to outstanding

performance share rights, based on the Company’s most recent performance analysis. The unrecognized

compensation cost will be recognized over a weighted-average period of 1.7 years.

64