Family Dollar 2013 Annual Report Download - page 53

Download and view the complete annual report

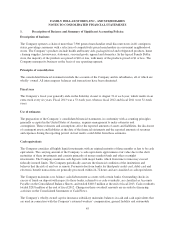

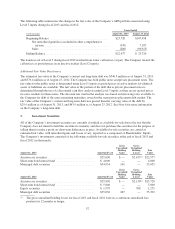

Please find page 53 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company estimates contingent income tax liabilities based on an assessment of the probability of the

income-tax-related exposures and settlements related to uncertain tax positions. The Company intends to reinvest

undistributed earnings of foreign subsidiaries indefinitely and anticipates earnings would not be repatriated

unless it was tax efficient to do so. If earnings were distributed, the Company would be subject to U.S. taxes and

withholding taxes payable to various foreign governments. See Note 10 for more information on the Company’s

income taxes.

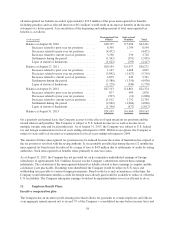

Stock-based compensation

The Company recognizes compensation expense related to its stock-based awards based on the fair value of the

awards on the grant date. The Company utilizes the Black-Scholes option-pricing model to estimate the grant-

date fair value of its stock option awards. The grant-date fair value of the Company’s performance share rights

awards is based on the stock price on the grant date. Compensation expense for the Company’s stock-based

awards is recognized on a straight-line basis, net of estimated forfeitures, over the service period of each

award. See Note 13 for more information on the Company’s stock-based compensation plans.

Other Income

The Company classifies income earned on non-merchandise transactions, which primarily includes fees charged

to customers when receiving cash back on debit card transactions, in a line item captioned Other Income below

Operating Profit. These amounts were previously classified in Selling, General and Administrative Expenses.

Reclassifications

Certain reclassifications of the amounts on the Consolidated Statements of Income and the Consolidated

Statements of Cash Flows in fiscal 2012 and fiscal 2011 have been made to conform with the presentation of

fiscal 2013. These reclassifications are not material.

New accounting pronouncements

In February 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

2013-02 “Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income” (“ASU

2013-02”). ASU 2013-02 requires an entity to provide information about the amounts reclassified out of

accumulated other comprehensive income by component. The ASU is effective for annual periods and interim

periods within those periods beginning after December 15, 2012. The ASU will be effective for the Company

beginning in the first quarter of fiscal 2014 and is not expected to have a material impact on the Company’s

Consolidated Financial Statements.

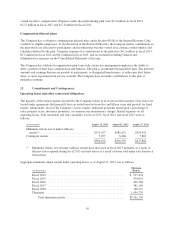

2. Fair Value Measurements:

Fair value accounting standards define fair value as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date. The following

fair value hierarchy prioritizes the inputs used to measure fair value into three levels, giving the highest priority

to Level 1 inputs and the lowest priority to Level 3 inputs.

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly, such as quoted prices for similar assets or liabilities in active

markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs

49