Family Dollar 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

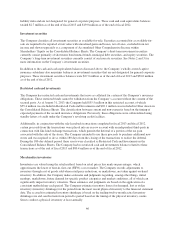

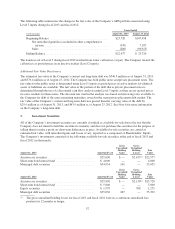

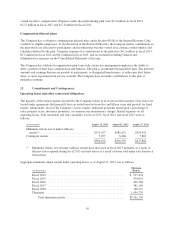

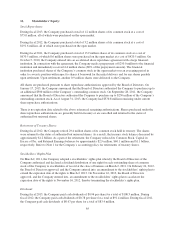

8. Accrued Liabilities:

Accrued liabilities consisted of the following at the end of fiscal 2013 and fiscal 2012:

(in thousands) August 31, 2013 August 25, 2012

Compensation ........................................... $101,199 $ 99,673

Taxes other than income taxes ............................... 95,825 91,207

Self-insurance liabilities ................................... 52,229 52,224

Other(1) ................................................. 86,601 85,294

$335,854 $328,398

(1) Other accrued liabilities consist primarily of certain store rental accruals, current portion of deferred

gain on sale-leaseback transactions, medical insurance accruals, accrued interest, and litigation

accruals.

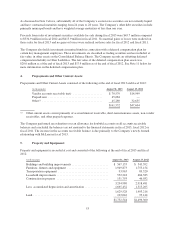

9. Other Liabilities:

Other liabilities consisted of the following at the end of fiscal 2013 and fiscal 2012:

(in thousands) August 31, 2013 August 25, 2012

Self-insurance liabilities ................................... $179,930 $184,638

Other(1) ................................................. 109,264 83,703

$289,194 $268,341

(1) Other liabilities consist primarily of deferred rent, income taxes and deferred compensation.

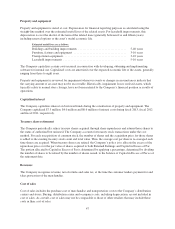

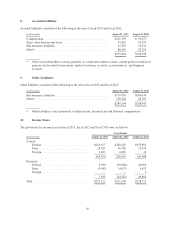

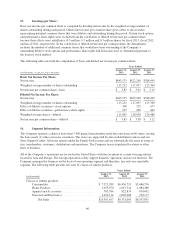

10. Income Taxes:

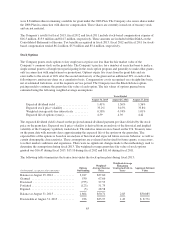

The provisions for income taxes in fiscal 2013, fiscal 2012 and fiscal 2011 were as follows:

Years Ended

(in thousands) August 31, 2013 August 25, 2012 August 27, 2011

Current:

Federal ............................... $216,077 $228,245 $155,893

State ................................. 24,927 36,709 25,974

Foreign ............................... 2,425 1,065 41

243,429 266,019 181,908

Deferred:

Federal ............................... 6,780 (19,648) 44,964

State ................................. (3,087) (4,673) 1,832

Foreign ............................... — — 9

3,693 (24,321) 46,805

Total ..................................... $247,122 $241,698 $228,713

56