Family Dollar 2013 Annual Report Download - page 55

Download and view the complete annual report

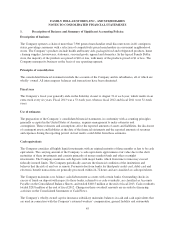

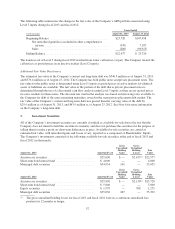

Please find page 55 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Level 2 Inputs

All of the assets classified as Level 2 are valued by a third-party pricing service which uses matrix pricing to

value the assets. The Company believes that while a majority of the assets valued using Level 2 inputs currently

trade in active markets and prices could be obtained for identical assets, the classification of these investments as

Level 2 is more appropriate when matrix pricing is used.

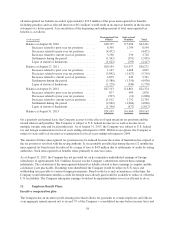

Auction Rate Securities

The Company’s auction rate securities (“ARS”) are tax-exempt bonds that are collateralized by federally

guaranteed student loans and are valued using Level 3 inputs. While the underlying securities generally have

long-term nominal maturities that exceed one year, the interest rates reset periodically in scheduled auctions

(generally every 7-35 days). Due to the continued issues in the global credit and capital markets, specifically as it

relates to the ARS market, the Company’s ARS portfolio experienced sustained failed auctions. A failed auction

typically occurs when the number of securities submitted for sale in the auction exceeds the number of purchase

bids. As of August 31, 2013, all of the Company’s $25.7 million par value investments were subject to failed

auctions. As a result of the failed auctions, the interest rates on the investments reset to the established rates per

the applicable investment offering statements. The Company will not be able to liquidate the investments until a

successful auction occurs, a buyer is found outside the auction process, the securities are called or refinanced by

the issuer, or the underlying securities mature.

The Company does not currently expect to liquidate any ARSs going forward through the normal auction

process. However, the Company does expect to be able to liquidate substantially all of its remaining ARS

portfolio at par through issuer calls, refinancings, or upon maturity. During fiscal 2013, the Company liquidated

$0.2 million of auction rate securities at par as a result of issuer calls. As of August 31, 2013, all of the

Company’s ARS portfolio was subject to failed auctions and was classified as long-term assets due to the

continued failure of the auction process and the continued uncertainty regarding the timing of future liquidity.

The Company had a temporary gross unrealized loss of $2.7 million ($1.7 million, net of taxes) with respect to its

ARS portfolio as of August 31, 2013. Changes in the unrealized loss are included in Accumulated Other

Comprehensive Loss within Shareholders’ Equity on the Consolidated Balance Sheets. Because there is no active

market for the Company’s ARS portfolio, the fair value of each security was determined through the use of a

discounted cash flow analysis using Level 3 inputs. The two most significant unobservable inputs used in the

analysis are the weighted average expected term to liquidate the securities and the illiquidity factor applied to the

discount rate. The weighted average expected term assumption used in the analysis is based on the Company’s

estimate of the timing of future liquidity, which assumes that the securities will be called or refinanced by the

issuer or repurchased by the broker dealers prior to maturity. The discount rates used in the analysis are based on

market rates for similar liquid tax-exempt securities with comparable ratings and maturities. Due to the

uncertainty surrounding the timing of future liquidity, a factor was applied to the discount rates to reflect the

illiquidity of the investments. These inputs used in Company’s analysis are sensitive to market conditions and the

Company’s valuation of its ARS portfolio can change significantly based on the assumptions used. As of

August 31, 2013, a 100 basis point increase or decrease in the illiquidity factor along with a 12-month increase or

decrease in the weighted average term could result in a gross unrealized loss ranging from $1.6 million to

$4.7 million.

The Company also evaluated each of its ARS for other-than-temporary impairment. The Company’s evaluation

was based on an analysis of the credit rating and parity ratio of each security. The parity ratio is the ratio of trust

assets available for distribution to creditors to the trust obligations to those creditors. The credit quality of the

Company’s ARS portfolio remains high and the securities had a weighted average parity ratio of 122.9% as of

August 31, 2013. Based on these factors, the Company concluded that there was no other-than-temporary

impairment as of August 31, 2013.

51