Family Dollar 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

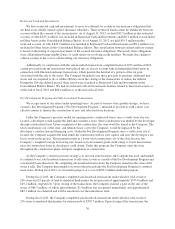

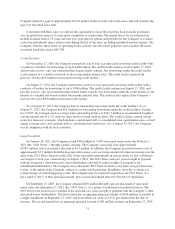

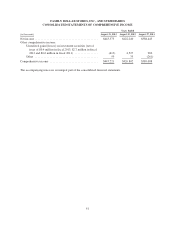

Contractual Obligations and Other Commercial Commitments

The following table shows our obligations and commitments to make future payments under contractual

obligations at the end of fiscal 2013.

Payments Due During

(in thousands)

Contractual Obligations Total

Fiscal

2014

Fiscal

2015

Fiscal

2016

Fiscal

2017

Fiscal

2018 Thereafter

Long-term debt ......... $ 517,600 $ 16,200 $ 16,200 $185,200 $ — $ — $ 300,000

Interest ............... 139,177 26,265 25,416 19,996 15,000 15,000 37,500

Merchandise letters of

credit ............... 75,589 75,589 ———— —

Operating leases ........ 3,561,136 515,254 474,601 426,788 381,196 328,527 1,434,770

Construction

obligations .......... 38,135 38,135 ———— —

Minimum royalties(1) .... 3,500 2,800 700 — — — —

Total ................. $4,335,137 $674,243 $516,917 $631,984 $396,196 $343,527 $1,772,270

(1) Minimum royalty payments related to an exclusive agreement to sell certain branded merchandise.

As of August 31, 2013, we had $30.2 million in liabilities related to our uncertain tax positions. At this time,

we cannot reasonably determine the timing of any payments related to these liabilities, except for $4.8 million,

which were classified as current liabilities and may become payable within the next 12 months. See Note 10 to

the Consolidated Financial Statements included in this Report for more information on our tax liabilities.

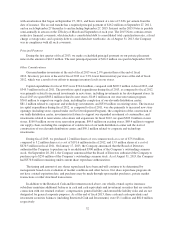

The following table shows our other commercial commitments at the end of fiscal 2013.

Other Commercial Commitments (in thousands)

Total Amounts

Committed

Standby letters of credit .......................................... $48,767

Surety bonds ................................................... 37,036

Total ..................................................... $85,803

A substantial portion of the outstanding amount of standby letters of credit (which are primarily renewed on

an annual basis) is used as surety for future premium and deductible payments to our workers’ compensation and

general liability insurance carrier. We accrue for these future payment liabilities as described in the “Critical

Accounting Policies” section of this discussion.

We issue inventory purchase orders in the normal course of business, which represent purchase

authorizations that can be canceled. We do not consider purchase orders to be firm inventory commitments;

therefore, they are excluded from the table above. If we choose to cancel a purchase order, we may be obligated

to reimburse the vendor for unrecoverable outlays incurred prior to cancellation.

Off Balance Sheet Arrangements

The Company does not have any material off balance sheet arrangements other than the operating leases

included in the “Contractual Obligations and Other Commercial Commitments” section above.

Recent Accounting Pronouncements

In February 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards

Update 2013-02 “Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income”

34