Family Dollar 2013 Annual Report Download - page 49

Download and view the complete annual report

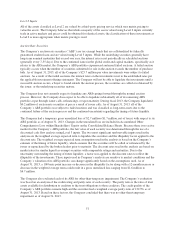

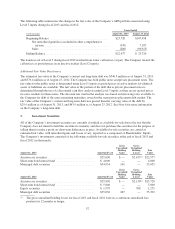

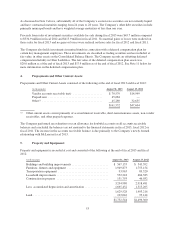

Please find page 49 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Description of Business and Summary of Significant Accounting Policies:

Description of business

The Company operates a chain of more than 7,900 general merchandise retail discount stores in 46 contiguous

states, providing consumers with a selection of competitively priced merchandise in convenient neighborhood

stores. The Company’s products include health and beauty aids, packaged food and refrigerated products, home

cleaning supplies, housewares, stationery, seasonal goods, apparel and domestics. In the typical Family Dollar

store, the majority of the products are priced at $10 or less, with many of the products priced at $1 or less. The

Company manages its business on the basis of one operating segment.

Principles of consolidation

The consolidated financial statements include the accounts of the Company and its subsidiaries, all of which are

wholly- owned. All intercompany balances and transactions have been eliminated.

Fiscal year

The Company’s fiscal year generally ends on the Saturday closest to August 31 of each year, which results in an

extra week every six years. Fiscal 2013 was a 53-week year, whereas fiscal 2012 and fiscal 2011 were 52-week

years.

Use of estimates

The preparation of the Company’s consolidated financial statements, in conformity with accounting principles

generally accepted in the United States of America, requires management to make estimates and

assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues

and expenses during the reporting period. Actual results could differ from these estimates.

Cash equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash

equivalents. The carrying amount of the Company’s cash equivalents approximates fair value due to the short

maturities of these investments and consists primarily of money market funds and other overnight

investments. The Company maintains cash deposits with major banks, which from time to time may exceed

federally insured limits. The Company periodically assesses the financial condition of the institutions and

believes that the risk of any loss is remote. Payments due from banks for third-party credit card, debit card and

electronic benefit transactions are generally processed within 24-72 hours and are classified as cash equivalents.

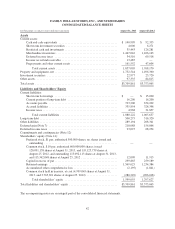

The Company maintains zero balance cash disbursement accounts with certain banks. Outstanding checks in

excess of funds on deposit with respect to these banks, referred to as cash overdrafts, are classified as Accounts

Payable on the Consolidated Balance Sheets, and totaled $100.5 million at the end of fiscal 2013. Cash overdrafts

totaled $28.8 million at the end of fiscal 2012. Changes in these overdraft amounts are recorded as financing

activities on the Consolidated Statements of Cash Flows.

The Company’s wholly-owned captive insurance subsidiary maintains balances in cash and cash equivalents that

are used in connection with the Company’s retained workers’ compensation, general liability and automobile

45