Family Dollar 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

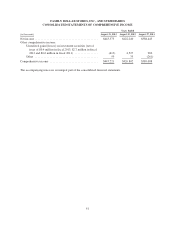

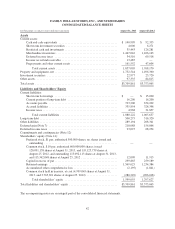

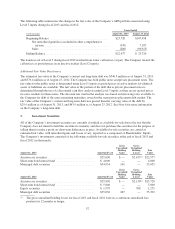

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share and share amounts) August 31, 2013 August 25,2012

Assets

Current assets:

Cash and cash equivalents ........................................ $ 140,999 $ 92,333

Short-term investment securities ................................... 4,000 6,271

Restricted cash and investments .................................... 35,443 126,281

Merchandise inventories .......................................... 1,467,016 1,426,163

Deferred income taxes ........................................... 34,510 69,518

Income tax refund receivable ...................................... 13,485 —

Prepayments and other current assets ................................ 161,552 47,604

Total current assets .......................................... 1,857,005 1,768,170

Property and equipment, net ........................................... 1,732,544 1,496,360

Investment securities ................................................ 22,977 23,720

Other assets ........................................................ 97,335 84,815

Total assets ........................................................ $3,709,861 $3,373,065

Liabilities and Shareholders’ Equity

Current liabilities:

Short-term borrowings ........................................... $ — $ 15,000

Current portion of long-term debt .................................. 16,200 16,200

Accounts payable ............................................... 723,200 674,202

Accrued liabilities ............................................... 335,854 328,398

Income taxes ................................................... 4,968 31,857

Total current liabilities ....................................... 1,080,222 1,065,657

Long-term debt ..................................................... 500,275 516,320

Other liabilities ..................................................... 289,194 268,341

Deferred gain (Note 7) ............................................... 218,088 156,866

Deferred income taxes ............................................... 23,027 68,254

Commitments and contingencies (Note 12)

Shareholders’ equity (Note 14):

Preferred stock, $1 par; authorized 500,000 shares; no shares issued and

outstanding .................................................. — —

Common stock, $.10 par; authorized 600,000,000 shares; issued

120,091,158 shares at August 31, 2013, and 119,125,739 shares at

August 25, 2012, and outstanding 115,092,113 shares at August 31, 2013,

and 115,362,048 shares at August 25, 2012 ......................... 12,009 11,913

Capital in excess of par ........................................... 299,865 259,189

Retained earnings ............................................... 1,569,625 1,234,384

Accumulated other comprehensive loss .............................. (2,195) (1,841)

Common stock held in treasury, at cost (4,999,045 shares at August 31,

2013, and 3,763,691 shares at August 25, 2012) ..................... (280,249) (206,018)

Total shareholders’ equity .................................... 1,599,055 1,297,627

Total liabilities and shareholders’ equity ................................. $3,709,861 $3,373,065

The accompanying notes are an integral part of the consolidated financial statements.

42