Family Dollar 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

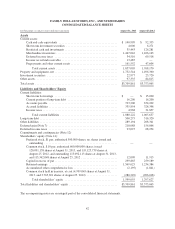

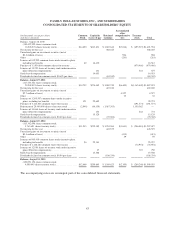

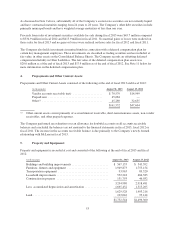

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands, except per share

and share amounts)

Common

Stock

Capital in

excess of par

Retained

earnings

Accumulated

other

comprehensive

loss

Treasury

stock Total

Balance, August 28, 2010

(130,452,959 shares common stock;

16,043,278 shares treasury stock) ................. $14,650 $243,831 $ 1,665,646 $(7,046) $ (495,527) $1,421,554

Net income for the year ............................ 388,445 388,445

Unrealized gains on investment securities (net of

$0.6 million of taxes) ............................ 904 904

Other ........................................... (261) (261)

Issuance of 819,995 common shares under incentive plans,

including tax benefits ............................ 82 16,430 16,512

Purchase of 13,934,868 common shares for treasury ...... (670,466) (670,466)

Issuance of 15,255 shares of treasury stock under incentive

plans (Director compensation) ..................... 131 544 675

Stock-based compensation .......................... 14,053 14,053

Dividends declared on common stock, $0.695 per share . . . (84,342) (84,342)

Balance, August 27, 2011

(117,353,341 shares common stock;

29,962,891 shares treasury stock) ................. $14,732 $274,445 $ 1,969,749 $(6,403) $(1,165,449) $1,087,074

Net income for the year ............................ 422,240 422,240

Unrealized gains on investment securities (net of

$2.7 million of taxes) ............................ 4,527 4,527

Other ........................................... 35 35

Issuance of 1,209,507 common shares under incentive

plans, including tax benefits ....................... 121 29,602 29,723

Purchase of 3,214,866 common shares for treasury ....... (191,573) (191,573)

Retirement of 29,400,000 shares of treasury stock ........ (2,940) (60,139) (1,087,303) 1,150,382 —

Issuance of 14,066 shares of treasury stock under incentive

plans (Director compensation) ..................... 152 622 774

Stock-based compensation .......................... 15,129 15,129

Dividends declared on common stock, $0.60 per share .... (70,302) (70,302)

Balance, August 25, 2012

(115,362,048 shares common stock;

3,763,691 shares treasury stock) .................. $11,913 $259,189 $ 1,234,384 $(1,841) $ (206,018) $1,297,627

Net income for the year ............................ 443,575 443,575

Unrealized gains on investment securities (net of

$0.4 million of taxes) ............................ (413) (413)

Other ........................................... 59 59

Issuance of 965,419 common shares under incentive plans,

including tax benefits ............................ 96 25,141 25,237

Purchase of 1,248,284 common shares for treasury ....... (74,954) (74,954)

Issuance of 12,930 shares of treasury stock under incentive

plans (Director compensation) ..................... 27 723 750

Stock-based compensation .......................... 15,508 15,508

Dividends declared on common stock, $0.94 per share .... (108,334) (108,334)

Balance, August 31, 2013

(120,091,158 shares common stock;

4,999,045 shares treasury stock) .................. $12,009 $299,865 $ 1,569,625 $(2,195) $ (280,249) $1,599,055

The accompanying notes are an integral part of the consolidated financial statements.

43