Family Dollar 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

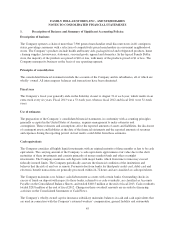

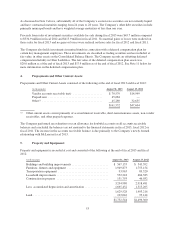

Property and equipment

Property and equipment is stated at cost. Depreciation for financial reporting purposes is calculated using the

straight-line method over the estimated useful lives of the related assets. For leasehold improvements, this

depreciation is over the shorter of the term of the related lease (generally between five and fifteen years)

including renewal options or the asset’s useful economic life.

Estimated useful lives are as follows:

Buildings and building improvements ................................. 5-40 years

Furniture, fixtures and equipment .................................... 3-10 years

Transportation equipment ........................................... 3-10 years

Leasehold improvements ........................................... 5-10 years

The Company capitalizes certain costs incurred in connection with developing, obtaining and implementing

software for internal use. Capitalized costs are amortized over the expected economic life of the assets, generally

ranging from three to eight years.

Property and equipment is reviewed for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable. Historically, impairment losses on fixed assets, which

typically relate to normal store closings, have not been material to the Company’s financial position or results of

operations.

Capitalized interest

The Company capitalizes interest on borrowed funds during the construction of property and equipment. The

Company capitalized $7.3 million, $4.0 million and $0.6 million of interest costs during fiscal 2013, fiscal 2012

and fiscal 2011, respectively.

Treasury share retirement

The Company periodically retires treasury shares acquired through share repurchases and returns those shares to

the status of authorized but unissued. The Company accounts for treasury stock transactions under the cost

method. For each reacquisition of common stock, the number of shares and the acquisition price for those shares

is added to the existing treasury stock count and total value. Thus, the average cost per share is re-averaged each

time shares are acquired. When treasury shares are retired, the Company’s policy is to allocate the excess of the

repurchase price over the par value of shares acquired to both Retained Earnings and Capital in Excess of Par.

The portion allocated to Capital in Excess of Par is determined by applying a percentage, determined by dividing

the number of shares to be retired by the number of shares issued, to the balance of Capital in Excess of Par as of

the retirement date.

Revenues

The Company recognizes revenue, net of returns and sales tax, at the time the customer tenders payment for and

takes possession of the merchandise.

Cost of sales

Cost of sales includes the purchase cost of merchandise and transportation costs to the Company’s distribution

centers and stores. Buying, distribution center and occupancy costs, including depreciation, are not included in

cost of sales. As a result, cost of sales may not be comparable to those of other retailers that may include these

costs in their cost of sales.

47